LLMs

17 min read

—

Feb 5, 2025

Content Creator

Two guys meet in a pub:

A: Have you heard? AI is going to "revolutionize" finance. Just ask ChatGPT—it’ll go on and on about how generative AI is going to completely “transform” financial services.

B: Oh, I’ve heard. Good luck revolutionizing an industry that runs on decade-old, half-broken Excel spreadsheets.

A: Hey! If it works, it works! Nobody in the company knows how that Frankenstein spreadsheet operates, but it worked when I joined, and it works today.

B: True. And let’s not forget the software that fondly remembers the good ol' days of Windows 95.

A: Well, you know—the bigger the company, the older the tech.

The financial sector is a world of contrasts. The biggest challenge isn’t the AI technology itself—it’s the messy reality of how institutions and firms actually operate. Now, to be fair, turning chaos and unstructured data into something usable is one of the promises of the latest generative AI platforms for finance.

But can they actually deliver?

In this article, we’ll explore:

Where AI actually works in finance (and where it doesn’t)

How different financial sectors and roles use generative AI

Real challenges and limitations you need to know

Practical steps for implementation

Before diving into specific use cases, let’s examine the technologies driving this AI transformation—and, more importantly, where they hit the wall of reality in financial operations.

Here begins A Tale of Two AIs.

Background: Machine learning vs. generative AI for finance

Machine learning (ML), artificial intelligence (AI), and generative AI (GenAI)—these terms are sometimes used interchangeably. While there is overlap, it’s important to establish what generative AI is and how it differs from traditional approaches.

Machine learning is not a new technology in finance. Historically, it has been used for pattern recognition and forecasting in a very calculation-driven way. You feed an algorithm structured inputs, like numbers, and based on those inputs, it calculates the outputs. Long story short—ML learns to detect patterns and predict outcomes. It’s a great technology for financial modeling and similar tasks.

The problem, however, was that you needed specialized, technical skills to use it. From preprocessing and labeling training data, to tuning your own models and iterating on the results—the technology was hard to make use of. For many nuanced tasks, this is still the standard approach. For example, computer vision models used in surgeries require detailed video annotations with manual input from human experts and surgeons.

Until quite recently, you couldn’t just tell a computer what you wanted to do and explain what you expected. Now you can—and that’s the key difference between traditional machine learning and generative AI. Instead of coding solutions from scratch you can write a single prompt or use prompt engineering to solve complex problems.

With the release of tools like ChatGPT and other large language models (LLMs), AI can now do much more than crunch numbers and make predictions. It can understand text, extract key information, and even perform basic reasoning.

Therefore, when we talk about AI, we should distinguish between custom-trained machine learning solutions focused on specific tasks, like Mastercard Decision Intelligence for flagging suspicious transactions, and generative AI implementations, which mimic human behavior.

For example, generative AI can use a GPT model to summarize documents, answer customer questions, or extract insights from compliance reports. You can think of LLMs as “generalists,” trained on the entirety of human text-based knowledge available online, while traditional AI models are typically trained on hand-picked data and designed for more specialized tasks.

You can view the table above as illustrating two routes to innovation. These routes are not mutually exclusive and sometimes address different use cases and challenges.

The first option is extremely costly, complex, and requires a team of engineers and months—if not years—of development. Additionally, traditional machine learning methods have become highly commoditized. For instance, in the case of OCR, most companies find it impractical to compete with specialized models offered by major providers like Azure AI Vision by Microsoft.

The second option—using generative AI—thanks to companies like OpenAI and Anthropic, became available to everyone almost overnight, limited only by creativity.

The result?

If there’s an AI revolution happening in finance, it isn’t Goldman Sachs or JP Morgan leading the charge. Sure, they have the resources to build custom AI systems from scratch (and they do) to address specific pain points like flagging suspicious transaction patterns for fraud detection. But the most interesting innovations are happening in mid-sized firms using off-the-shelf AI platforms in creative ways.

Generative AI, on its own, may not always excel at addressing unique or specialized challenges. However, its true strength lies in its ability to seamlessly integrate and leverage diverse technologies. Think of it as the "secret sauce" or glue that unites various tools and capabilities to create versatile, powerful solutions that are greater than the sum of their parts.

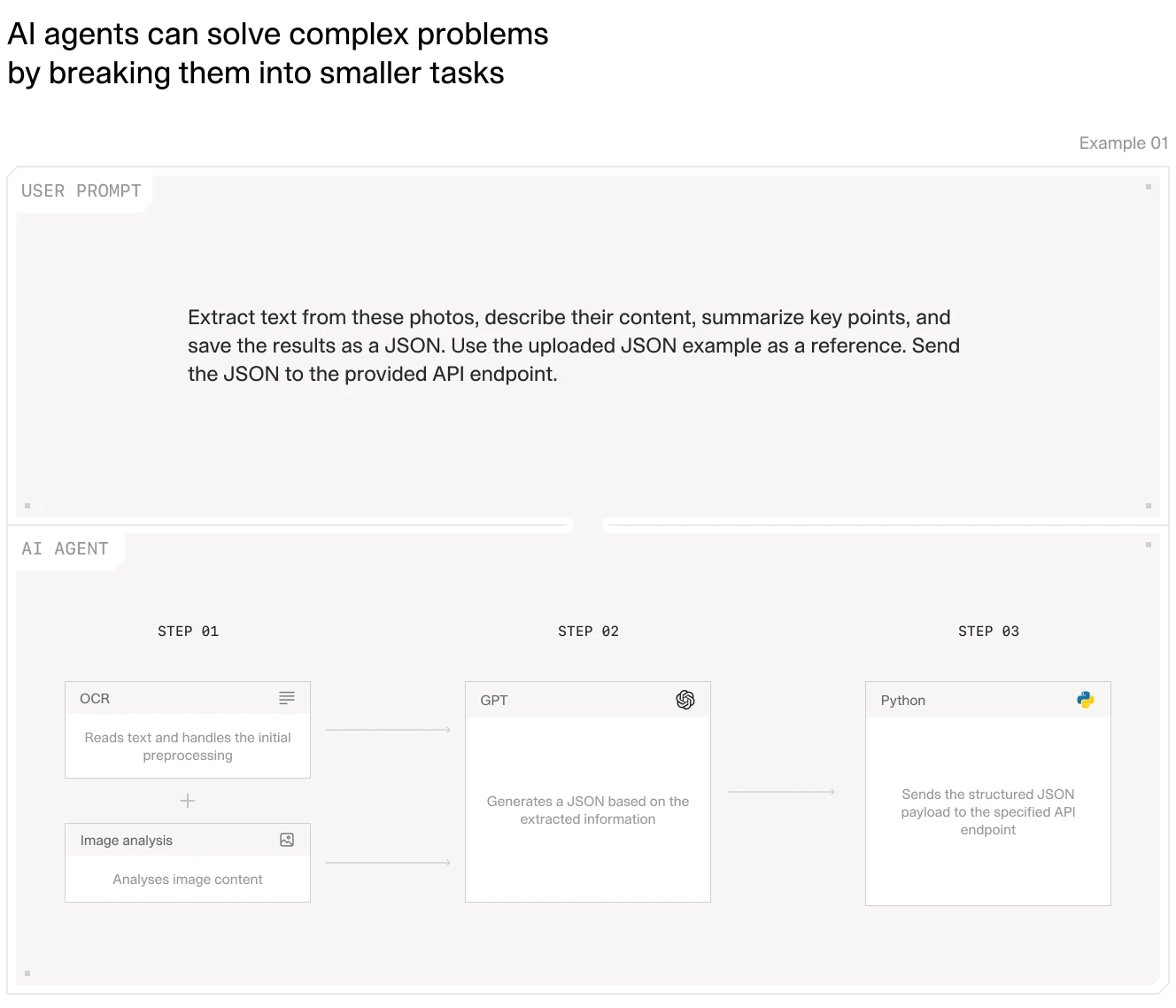

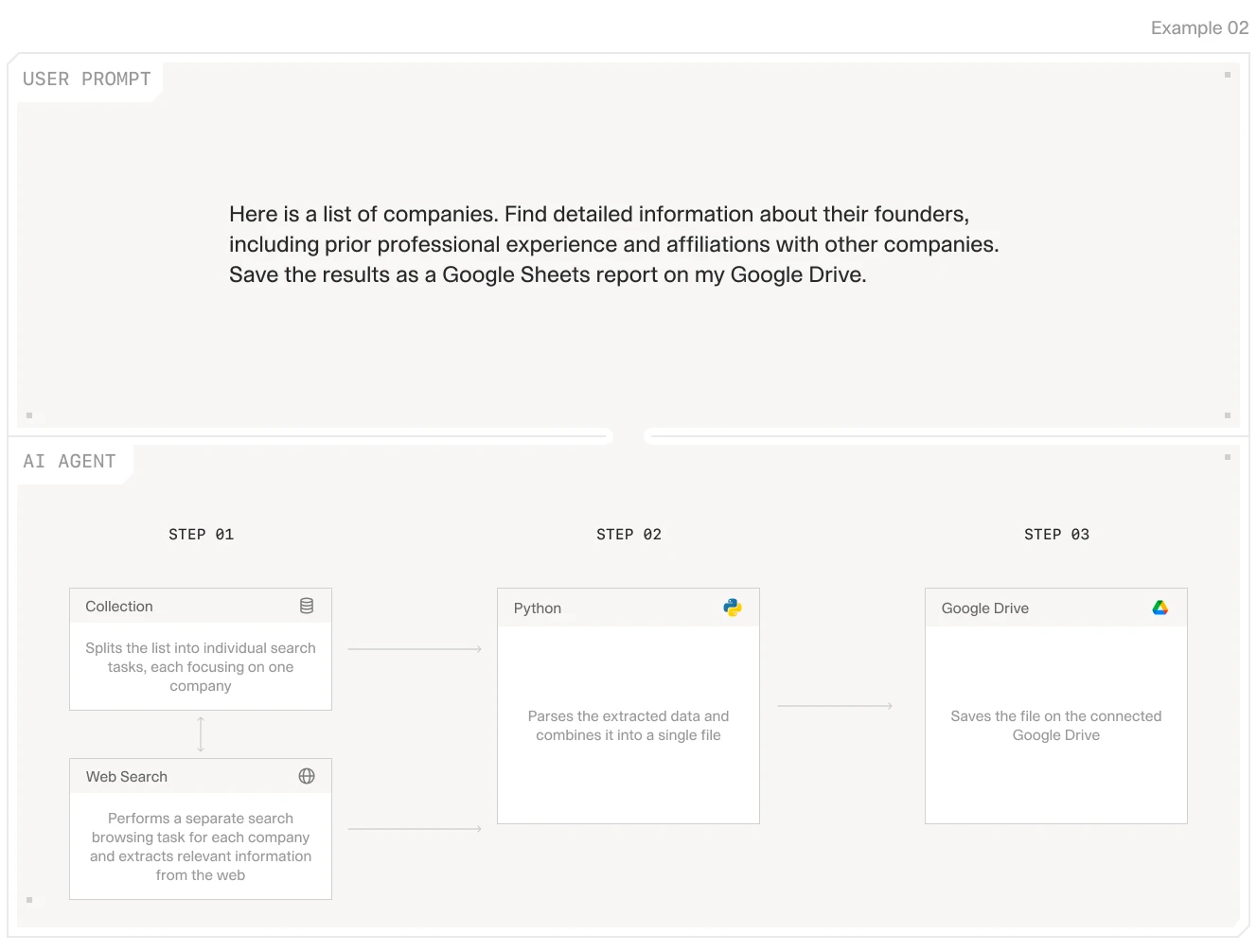

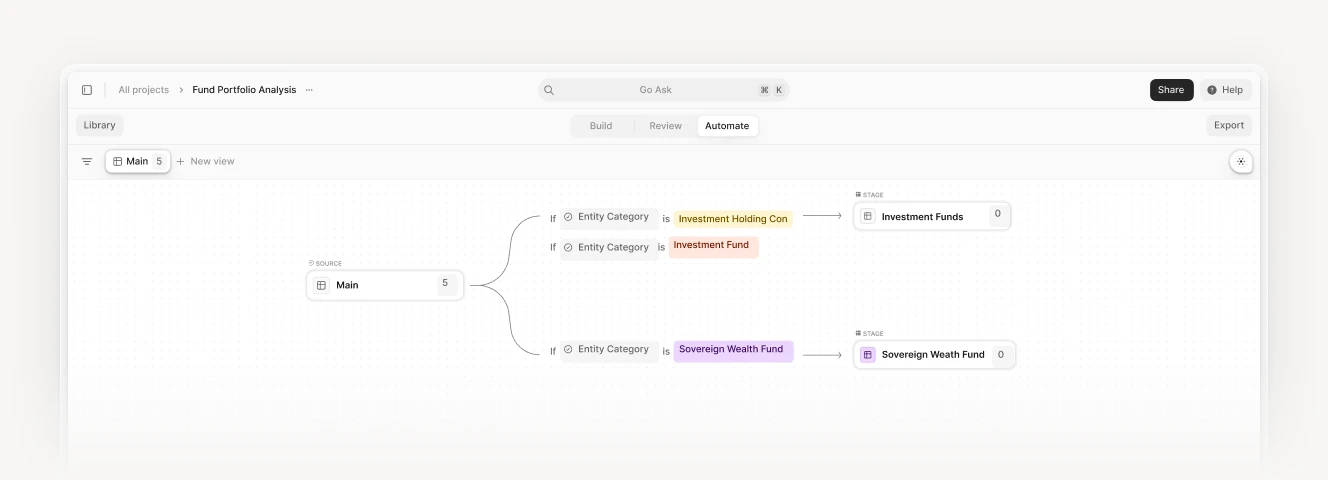

The key challenge now is breaking down complex problems into smaller parts that can already be automated by publicly available AI models like GPT4, Claude 3.5, or Gemini 2.0. The answer lies in AI workflows and AI agents, which can iterate on tasks and determine what to do at each step.

Interestingly, some AI solutions can already break tasks into smaller pieces automatically and apply the best technology to each step to complete the job.

Imagine getting a cloning machine for unlimited junior assistants (or, for some use cases, even more competent and capable)—how would you use them and what tasks would you assign to them to streamline your financial operations? Would it be back-office processes? Or maybe triple-checking and cross-referencing some data points, transactions, or reports?

Myth #1: AI will replace financial professionals. Fact: AI augments human expertise and allows professionals to focus on high-value activities like strategy and relationship building.

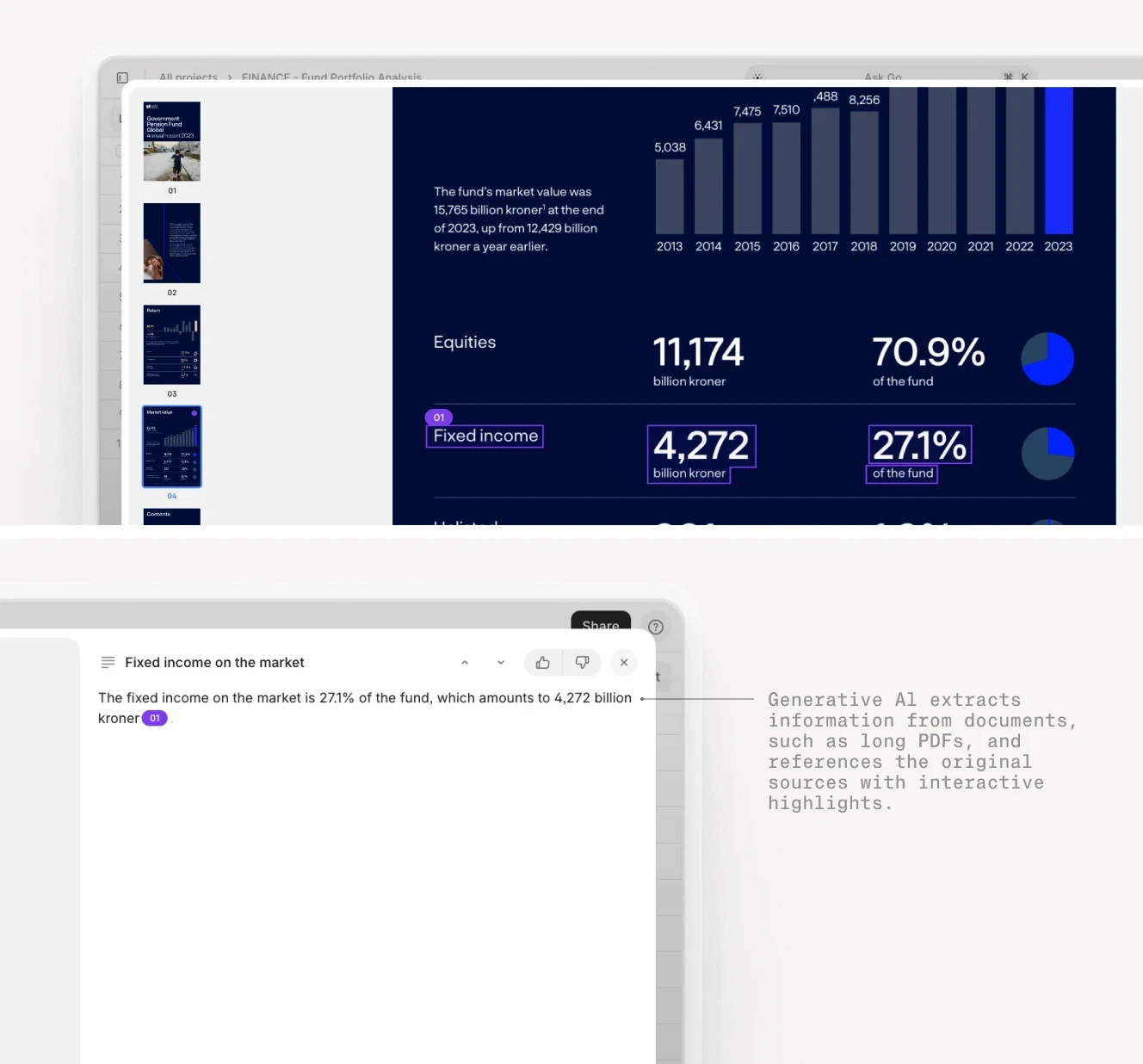

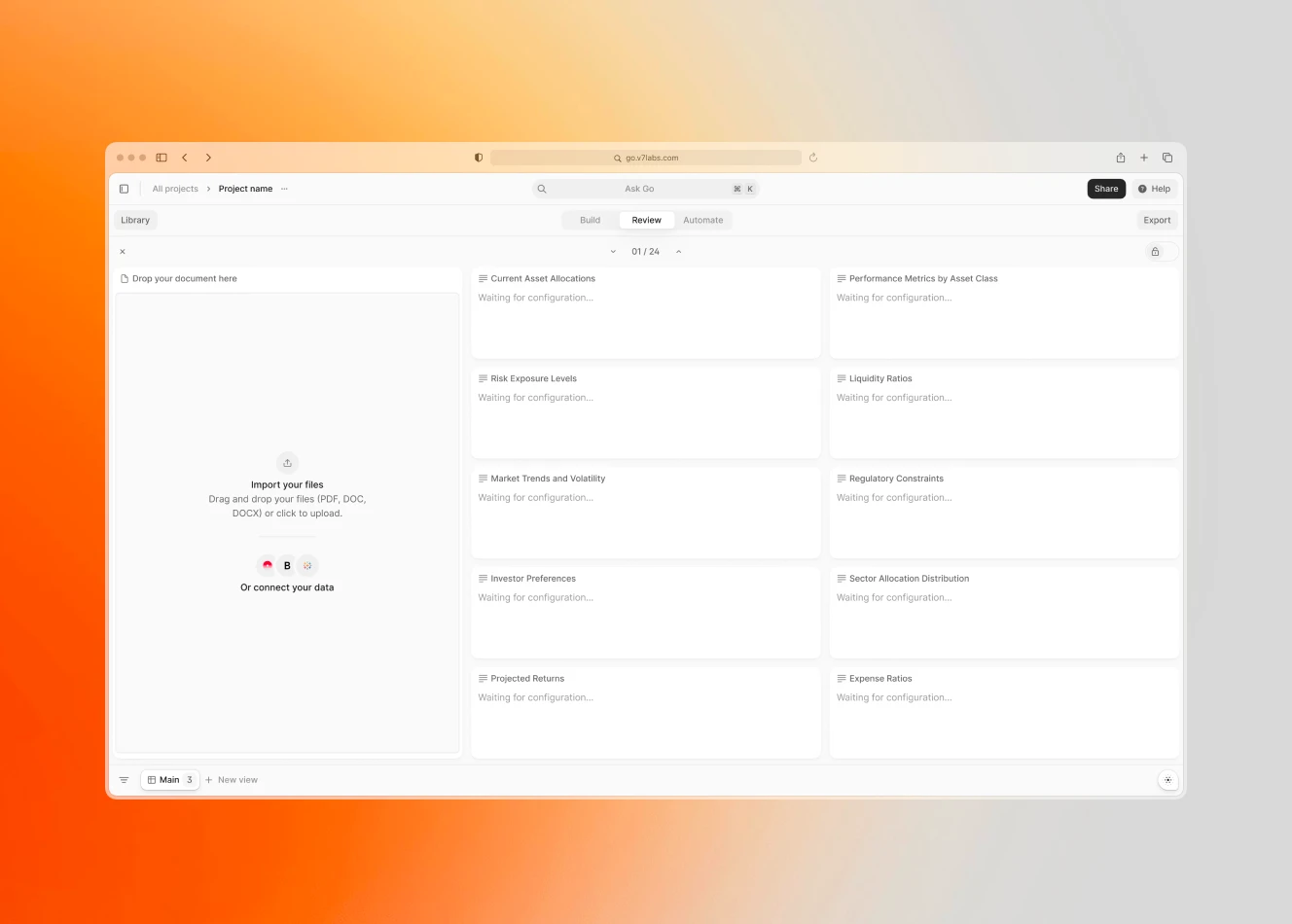

We have reached a point where you can drag and drop a bundle of financial reports in different formats, length, produced by different parties, and generate a uniform, accurate summary with clickable references to original sources.

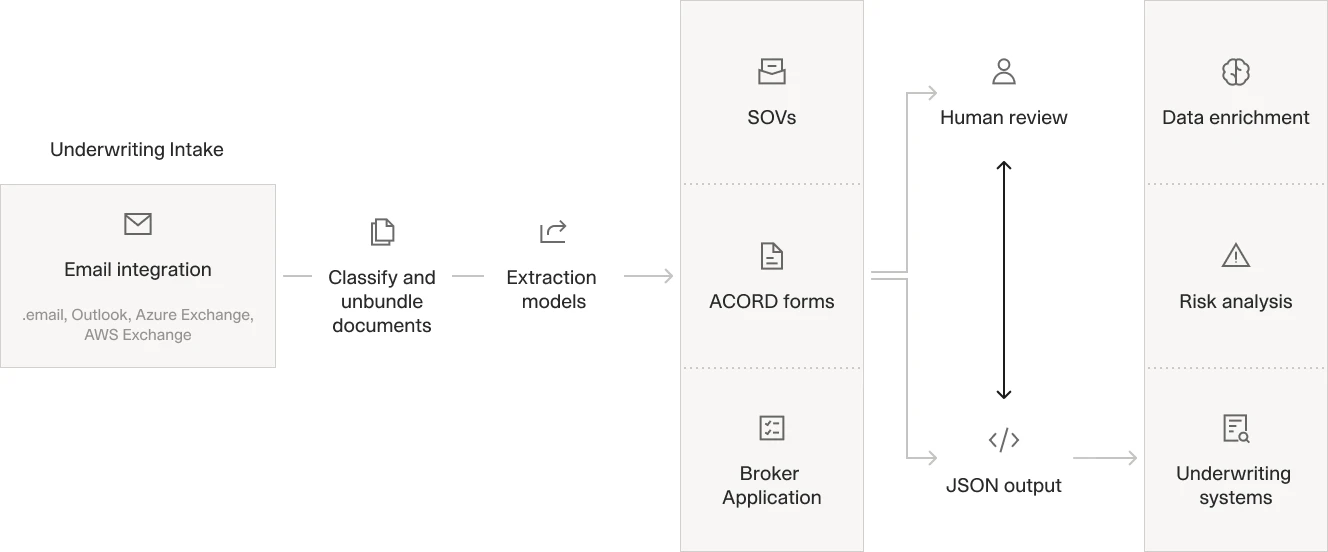

The key technologies running behind the scenes include:

OCR and Computer Vision. Advanced optical character recognition software and computer vision can read text and understand document layout. They can extract data from charts and graphs, and handle everything from PDFs to charts or scanned historical documents.

LLMs. Modern language models do more than process text—they understand context and relationships between different pieces of information. They identify relevant data points even when they appear in unexpected formats, making them invaluable for processing unstructured documents. Additionally, you can interact with them using plain English—or almost any other language, for that matter.

RAG and Vector Databases. Retrieval Augmented Generation (RAG) and vector databases allow you to query large datasets and ground outputs in the source data. Essentially, they enable AI systems to quickly search through vast document repositories and maintain accuracy by always referring back to source documents.

AI Agents and Workflows. The real magic happens when these technologies work together in automated workflows. AI agents orchestrate the process, deciding which tools to use for each task and how to combine their outputs into meaningful insights.

Some of these solutions have been around for quite some time. But it is the latest wave of AI platforms that allow you to orchestrate these technologies together without coding and spending months on building a working prototype. It got much, much easier.

So, what are the best applications of generative AI for finance?

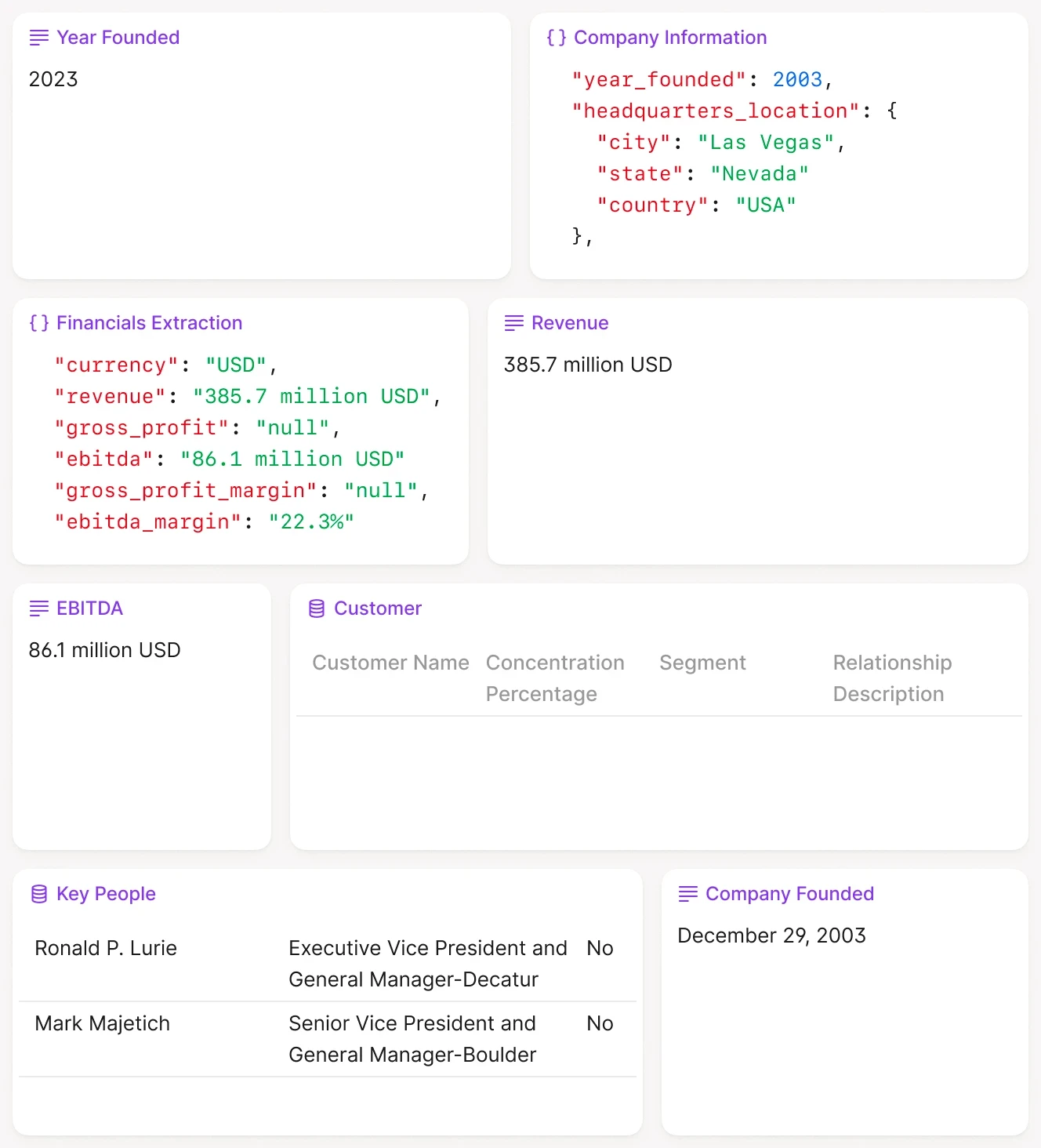

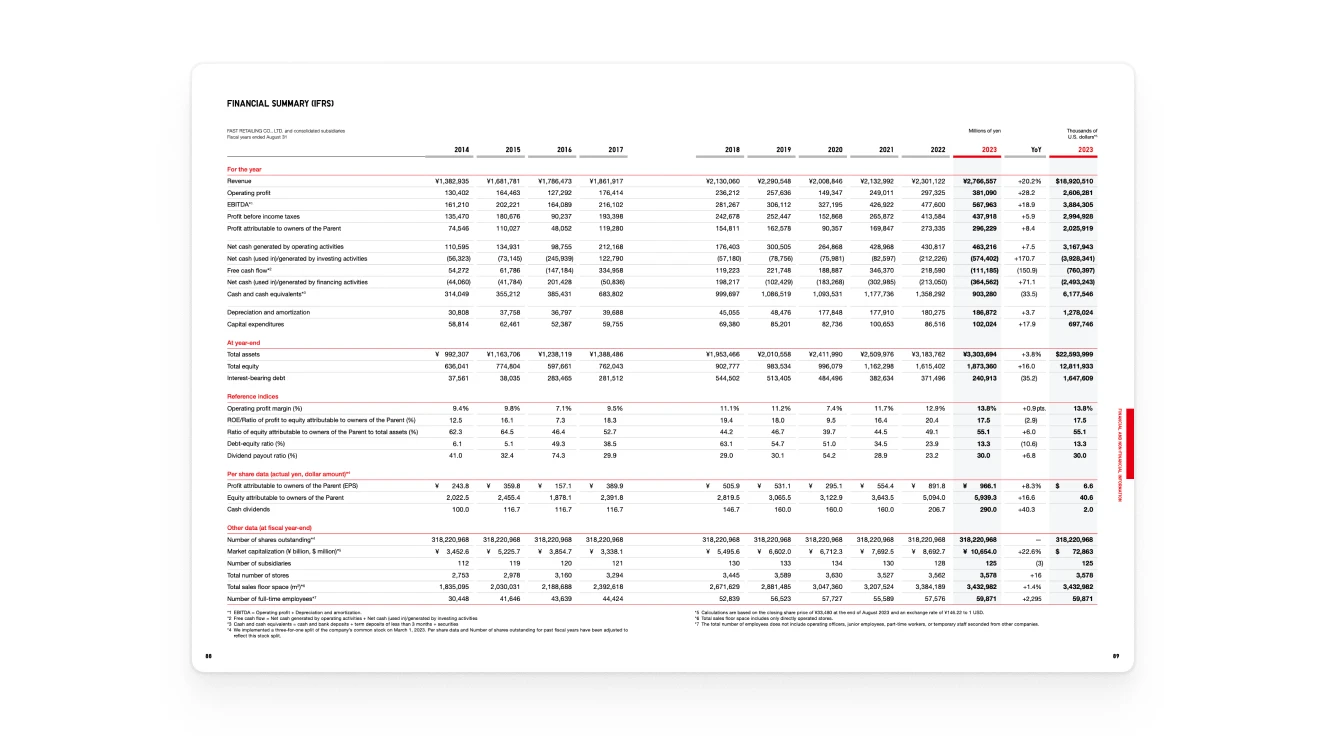

Private Equity (PE): Automating due diligence by extracting metrics (e.g., EBITDA, revenue growth) from CIMs and financial documents.

Venture Capital (VC): Analyzing startup pitch decks for insights like TAM, burn rate, and MRR to prioritize investments.

Accounting Offices: Automating tax compliance by summarizing regulations, validating client data, and preparing error-free reports.

Financial Analysts: Generating dynamic investment reports with market trends and portfolio performance summaries.

Commercial Banks: Enhancing customer support with AI chatbots for routine banking queries and account issues.

Insurance Companies: Streamlining claims processing by validating claims against policies and flagging errors.

Asset Managers: Automating ESG reporting by extracting data from diverse sources and creating compliance-ready summaries.

Investment Banks: Accelerating M&A analysis by highlighting IRR, ROI, and cash flow metrics from financial models.

Regulatory Compliance Teams: Automating AML/KYC checks by reviewing documents, flagging risks, and generating reports.

Financial Services Firms: Preparing fund performance reports by extracting metrics like NAV and Sharpe Ratio for standardized summaries.

Let’s explore them one by one in more detail.

Myth #2: The technology isn't mature enough. Fact: Financial institutions are already achieving measurable results. Those waiting for "perfect" solutions risk falling behind.

1. Private Equity: A New Approach to Due Diligence

The Challenge: Private equity firms often review thousands of pages of documents—CIMs, financial statements, and contracts—during due diligence. These processes are labor-intensive and prone to human error, often delaying deal timelines.

The irony of private equity due diligence is that some of the most sophisticated financial analysis starts with the mind-numbing task of manually reviewing thousands of pages of documents. This grunt work served a purpose—you never knew what critical detail might be buried in a footnote on page 387 of a contract.

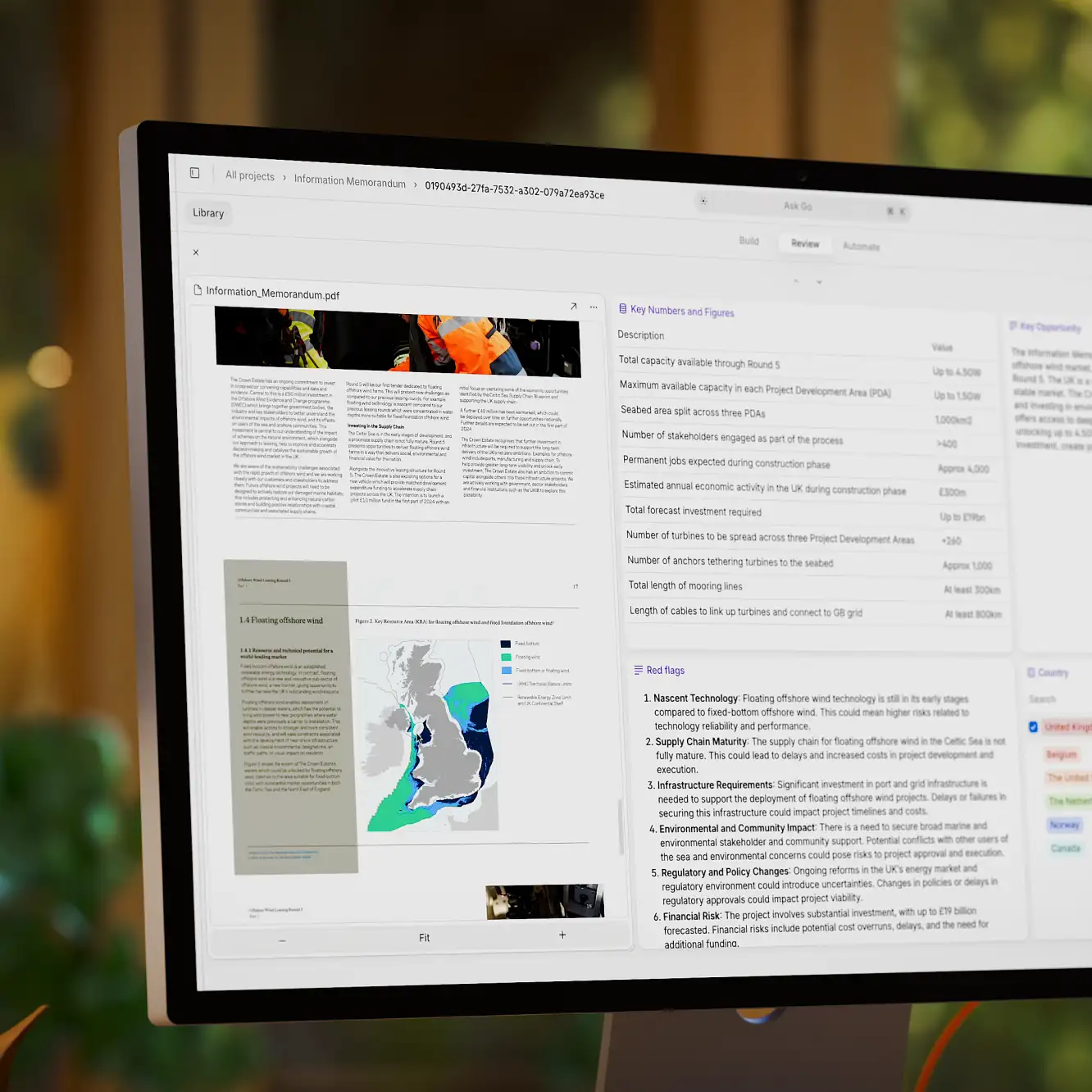

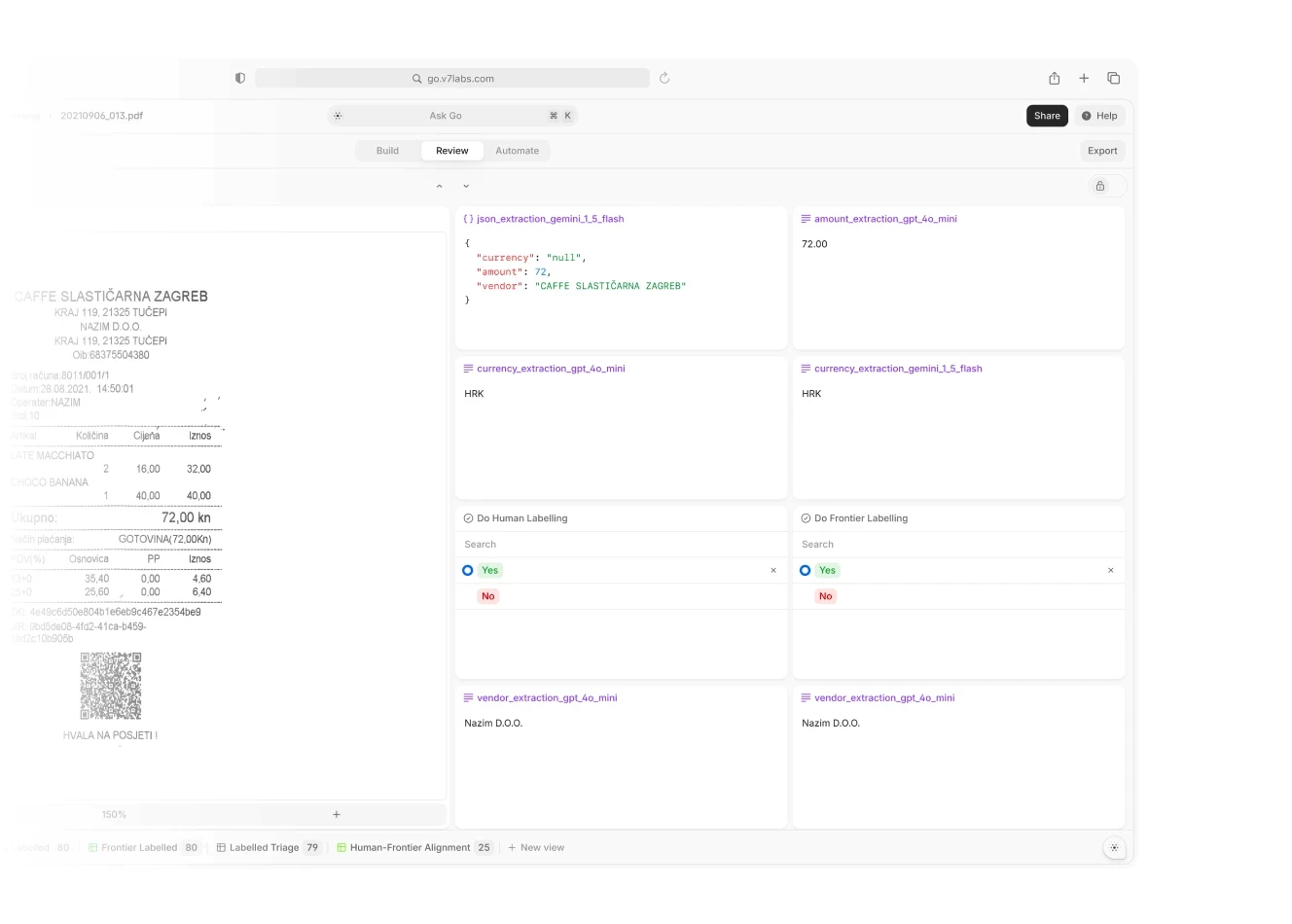

Instead of replacing the analytical work, AI is changing how PE firms approach the initial document review process. For example, you can use a platform like V7 Go to extract critical information or flag issues in documents. Think of it as having an army of infinitely patient associates who can read every document, understand industry context, and flag anything that seems unusual or worth a deeper look.

What makes this particularly powerful is the ability to work with documents in their natural state. No need to standardize formats or create structured databases—the AI can work with everything from well-formatted financial statements to poorly scanned contracts. This means PE firms can spend less time organizing data and more time analyzing it.

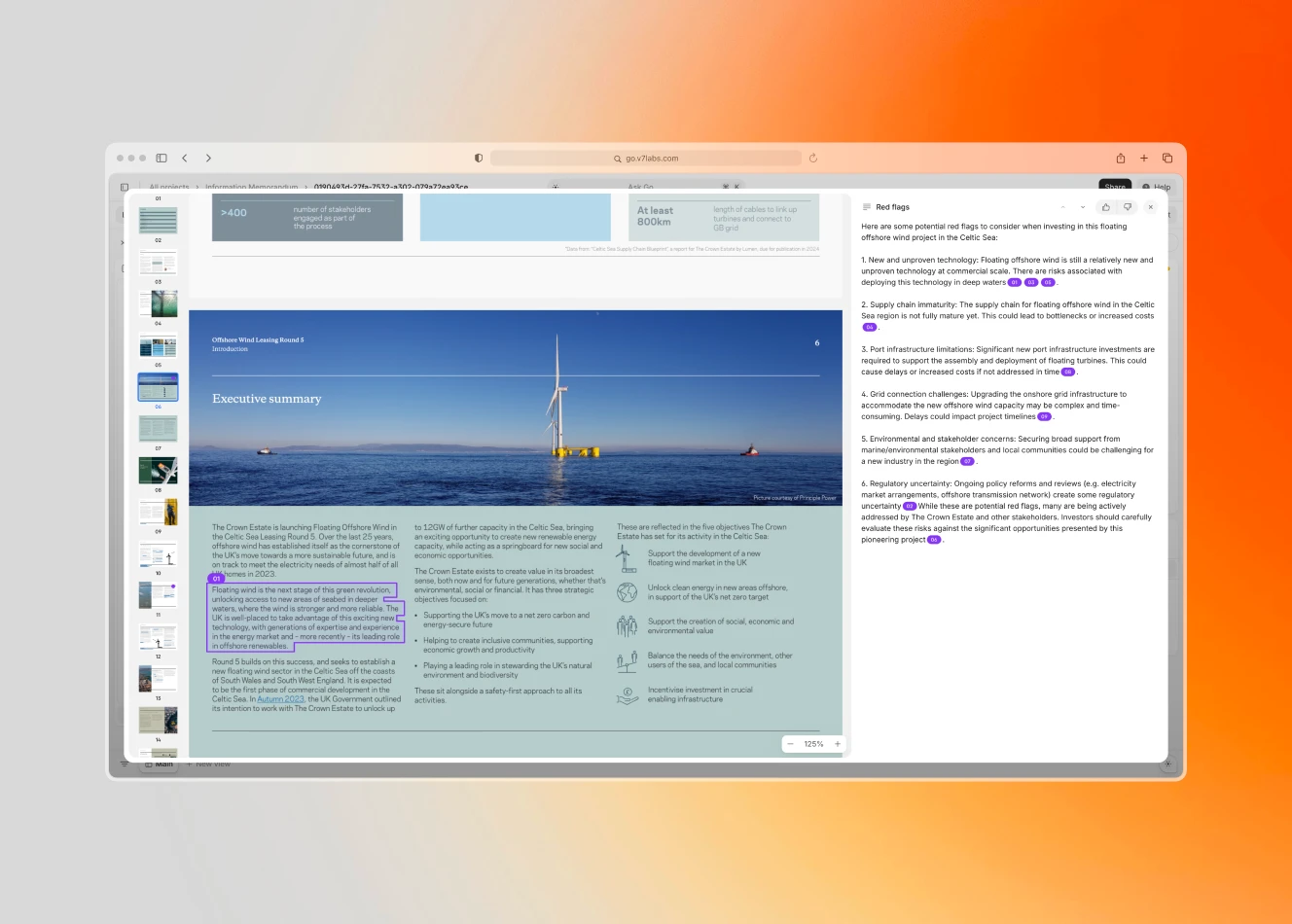

2. Venture Capital: Beyond Pattern Matching

The Challenge: Venture capitalists evaluate hundreds of startup pitch decks weekly. Manually identifying key insights—like TAM, burn rate, or customer acquisition costs—takes significant time and risks missing crucial details.

Venture capital has always been about pattern matching—recognizing trends or similarities between current opportunities and past successes. The challenge is that these patterns often lie in unstructured data—pitch decks, market research, founder backgrounds, and even social media presence.

This is where generative AI brings something new to the table. Unlike traditional analysis tools that needed structured data feeds, modern AI can process and understand information in its natural form. More importantly, it can explain its thinking—pointing out why certain pieces of information or data might be relevant and what might be different this time.

VCs can now walk into a pitch meeting with a deep understanding of the market landscape, competitive positioning, and potential red flags, allowing for more meaningful conversations with founders.

3. Tax Compliance and Accounting: The End of the Paper Chase

The Challenge: Tax compliance requires accounting firms to navigate constantly changing regulations while managing large volumes of client data. Mistakes can lead to penalties and damage client relationships.

The accounting profession has a love-hate relationship with automation. Previous waves of technology promised to automate the routine work, yet somehow accountants found themselves spending more time than ever managing increasingly complex data pre-processing requirements.

This shift from rule-based automation to intelligent assistance is subtle but profound. Accountants can now focus on advising clients rather than hunting through documents and cross-referencing regulations. The technology isn't replacing judgment—it's making it possible to exercise that judgment more often and more effectively.

4. Investment Research: From Information Overload to Insight

The Challenge: Compiling investment reports often involves gathering data from disparate sources, cleaning it, and formatting it into readable insights. Analysts spend more time on grunt work than actual analysis.

The challenge in investment research has never been a lack of information—it's been making sense of the overwhelming amount of data available. Traditional tools could help analyze structured data like price movements and financial statements, but they struggled with the qualitative information that often drives markets.

Gen AI is surprisingly good at exactly this type of information processing. It can read earnings call transcripts, news articles, and social media sentiment, understanding not just the words but their context and implications. More importantly, it can synthesize this information into coherent narratives that help analysts understand the bigger picture.

The most interesting development isn't the automation of research tasks—it's how this technology is changing the questions analysts can ask. Instead of being limited by what's easily measurable, they can explore nuanced questions about market sentiment, competitive dynamics, and emerging trends.

5. Commercial Banking: Reimagining Customer Service

The Challenge: High volumes of customer queries overwhelm support teams, leading to long wait times and inconsistent service quality.

Despite massive investments in digital transformation, many customers still end up calling support centers with basic questions. Why? Because traditional banking interfaces are built around the bank's processes, not the customer's needs.

LLM-powered chatbots are changing this dynamic in an unexpected way. Instead of just automating responses to common questions, it allows banks to understand and respond to customer queries in their natural form. Want to know if you can afford a house in your neighborhood based on your current spending patterns? That's the kind of nuanced question that would have previously required a conversation with a personal banker.

Banks are using AI to bridge the gap between their complex internal systems and what customers actually want to know. The technology acts as a translator, turning banking jargon and complex product specifications into clear, contextual information that matches the customer's perspective.

6. Insurance Claims: From Process to Partnership

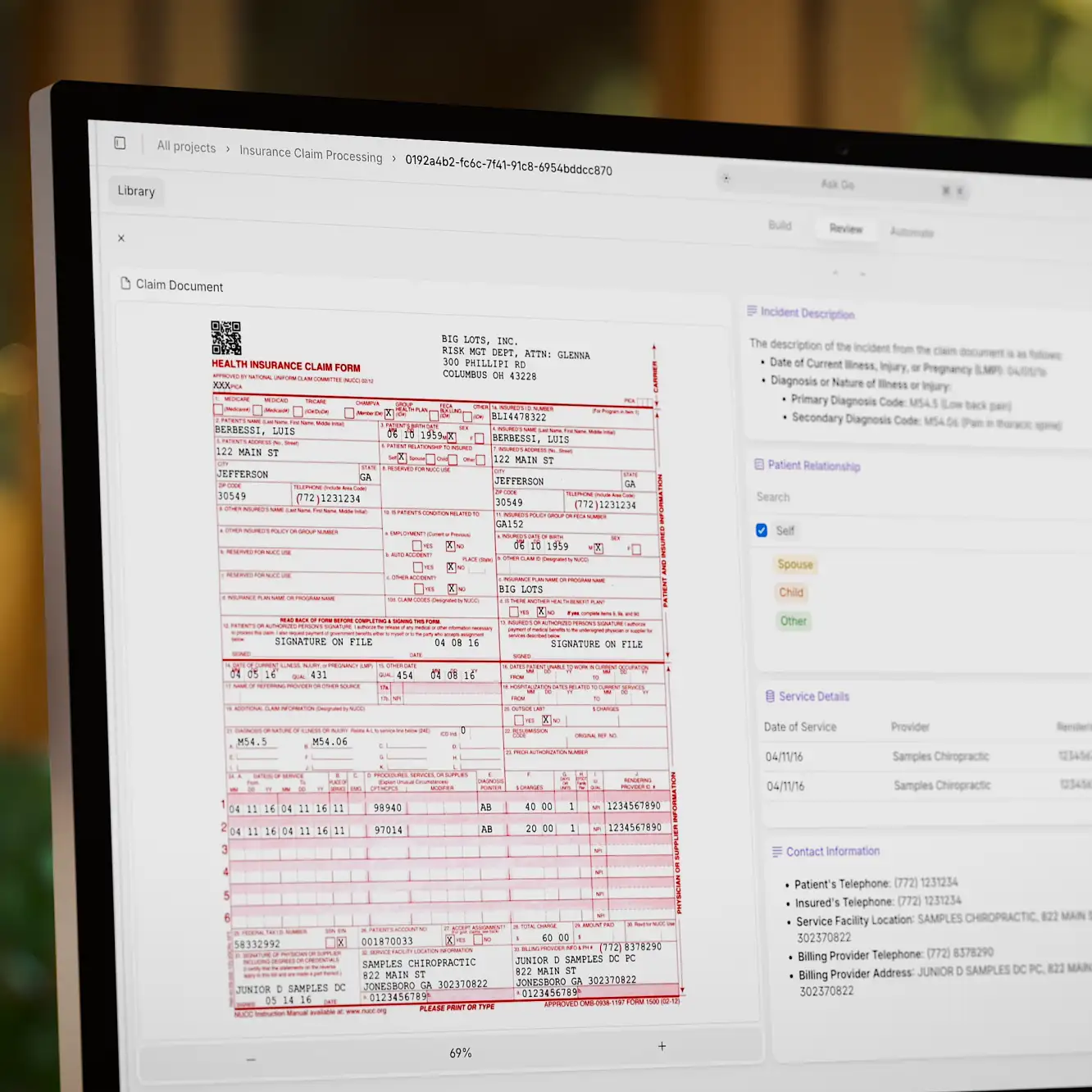

The Challenge: Processing insurance claims requires reviewing extensive documentation, such as policy terms, claims forms, and medical records. This process is time-consuming and prone to inconsistencies.

The insurance industry has a reputation for being slow to change, but it's quietly becoming one of the most innovative users of generative AI. Insurance claims are almost perfectly suited for this technology—they involve large amounts of unstructured data, require consistent judgment calls, and need to balance efficiency with accuracy.

Latest AI systems can read policy documents, understand coverage terms, and cross-reference them with claim details in real-time. But more importantly, they can explain to customers what's covered, what's not, and why—in plain language that references specific policy terms. This transparency makes the process more efficient and it changes the dynamic between insurers and their customers.

7. Asset Management: The ESG Challenge

The Challenge: ESG reporting involves aggregating data from diverse sources, verifying compliance with complex regulatory frameworks, and delivering transparent reports to stakeholders.

ESG reporting might be the perfect example of why generative AI is different from previous automation technologies. Traditional ML could help analyze structured ESG metrics, but most of the important information about a company's environmental and social impact isn't found in neat spreadsheets—it's buried in sustainability reports, news articles, social media, and regulatory filings.

AI can read and understand these diverse sources, identify relevant information, and connect dots that might not be obvious at first glance. But perhaps more importantly, it can explain its findings in a way that helps asset managers make informed decisions. Asset managers can now consider a broader range of factors and sources, leading to more nuanced and accurate assessments of companies' ESG performance.

8. Investment Banking: M&A in the Age of AI

The Challenge: Mergers and acquisitions require detailed financial model analysis, transaction evaluations, and risk assessments. These processes are resource-intensive and often delay deal closure.

It is proving most valuable in the complex task of due diligence and deal documentation. Think about the challenge of reviewing thousands of contracts to identify potential issues in a merger—not just finding specific terms, but understanding their implications in different contexts.

Modern AI systems can identify potential issues and explain why they matter and how they might affect the deal structure. This isn't replacing the judgment of experienced bankers—it's giving them better information to work with.

9. Regulatory Compliance: From Checkbox to Intelligence

The Challenge: Ensuring compliance with AML and KYC regulations involves painstakingly reviewing and cross-referencing client documentation. Non-compliance risks fines and reputational damage.

Here's a truth about financial compliance: most violations don't happen because someone deliberately broke the rules. They happen because someone didn't realize a rule applied in their specific situation. This is why traditional, rule-based compliance systems, while necessary, have never been sufficient.

Software powered by generative AI can understand the intent behind regulations and identify situations where they might apply. More importantly, it can explain complex requirements in context, helping employees understand not just what they need to do, but why.

This shift from checkbox compliance to intelligent oversight is particularly valuable in areas like AML and KYC, where context is crucial for making accurate judgments.

10. Fund Performance Reporting: Beyond the Numbers

The Challenge: Preparing fund performance reports for investors requires aggregating data from multiple sources, ensuring accuracy, and presenting it in a clear format.

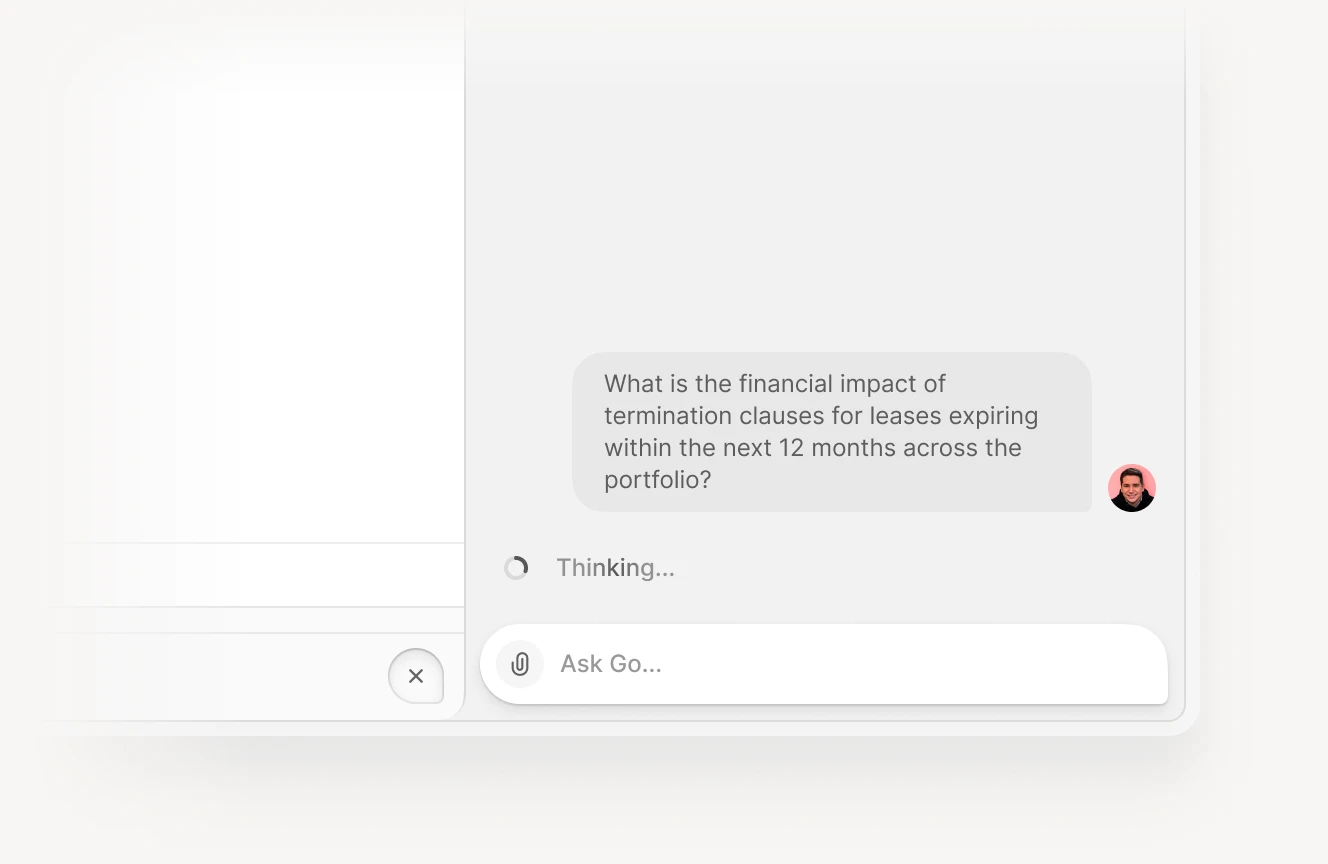

Fund performance reporting seems like it should be straightforward—after all, isn't it just about presenting numbers? But anyone who's worked in the field knows that the real challenge isn't calculating the numbers—it's explaining what they mean in a way that's both accurate and meaningful to different audiences.

This is where generative AI is making an unexpected impact. Instead of just automating the production of standard reports, it's enabling a more dynamic and contextual approach to performance communication. The same underlying data can be presented differently for institutional investors, retail clients, or regulatory filings—each with appropriate explanations.

More importantly, the technology can help identify and explain the factors driving performance, turning raw numbers into actionable insights.

Implementation Challenges

Remember that Excel spreadsheet that nobody dares to touch? Now multiply that by a hundred. Most financial institutions are running on a patchwork of systems accumulated over decades. Getting these systems to play nicely with modern generative AI can be tricky.

Moreover, generative AI might be great at handling unstructured data, but it still needs that data to be accurate and accessible. Many firms discover that their "digital transformation" from the past decade left them with a mess of inconsistent formats, duplicate records, and data silos. Cleaning this up is a good idea.

The human element is where things get really interesting. The same people who've been asking for automation are often the ones who push back hardest when it arrives. A successful AI rollout requires as much investment in change management as it does in technology.

Security, data privacy, and compliance add another layer of complexity. How do you ensure that your AI isn't leaking sensitive financial data? How do you maintain audit trails when AI is making decisions? These aren't just technical problems. Instead, they can become fundamental business challenges that need to be addressed before any AI solution goes live. This is especially true for customer-facing interactive systems that are deployed online.

But here's the good news: these challenges are pushing firms to be smarter about how they implement AI. Successful organizations are starting small, focusing on specific use cases where the value is clear and the risks are manageable. It is best to start with out-of-the box AI workflow templates that are designed for specific tasks.

Myth #3: AI implementation is too complex. Fact: Modern AI solutions are increasingly modular and adaptable, designed to integrate with existing systems.

The Road Ahead: Gen AI for financial sector

As we've seen across these different sectors, the real impact of generative AI isn't just in automating existing processes—it's in enabling new approaches to old problems.

The machines handle the grunt work while professionals tackle the high-value problems that actually require human judgment. For more information on how AI is changing document workflows in finance and beyond, read our guide to Intelligent Document Processing.

Tools and analyses that were once available only to the largest institutions are becoming accessible to mid-sized firms and even individuals. This could lead to a more level playing field in finance—though that's a story still being written.

Want to find out if your use case can be automated with the latest AI built for finance and other knowledge-intensive processes? Book a demo to tell us more, and let’s create a proof of concept.