AI agent platform

for insurance

AI agent platform

for insurance

Stop wrestling with Excel sheets. Let AI agents handle the manual operational work.

Trusted by fast-growing companies around the world

Trusted by fast-growing

companies around the world

AI built for insurance complexity

"Every Gen AI demo I see handles a simple invoice or something equally basic. But what about ingesting multi-layered, complex slips, or those 50-page risk engineering reports?"

"Every Gen AI demo I see handles a simple invoice or something equally basic. But what about ingesting multi-layered, complex slips, or those 50-page risk engineering reports?"

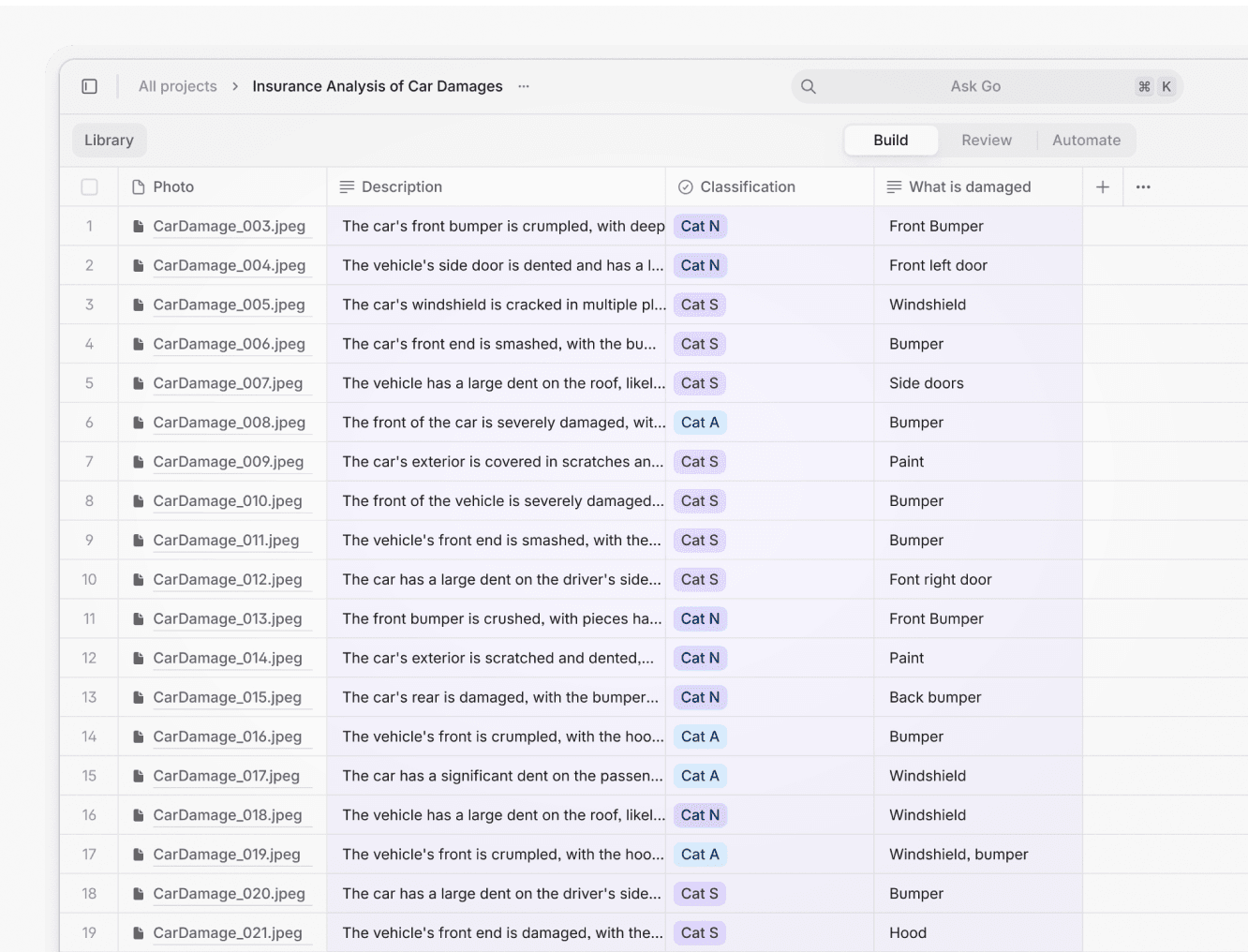

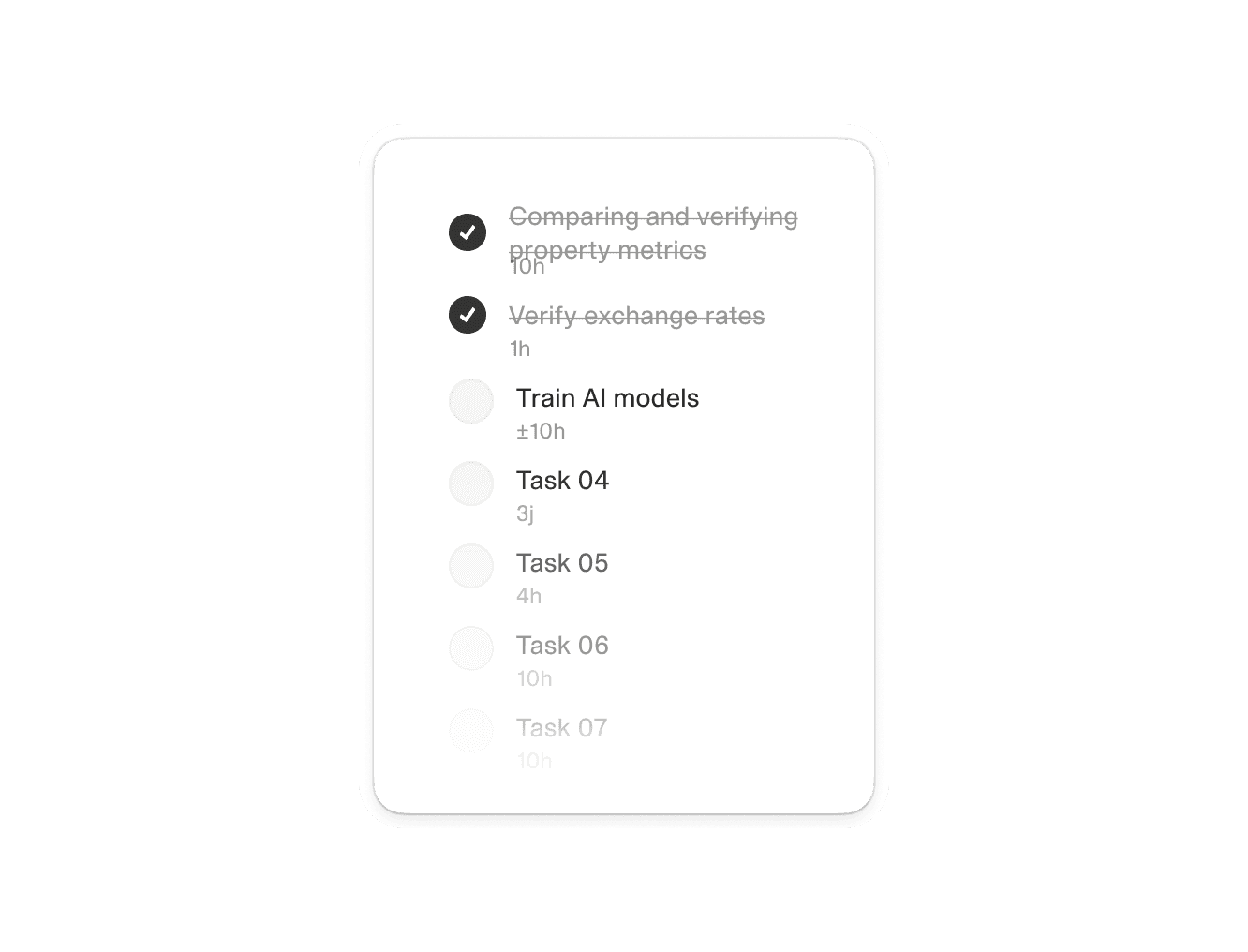

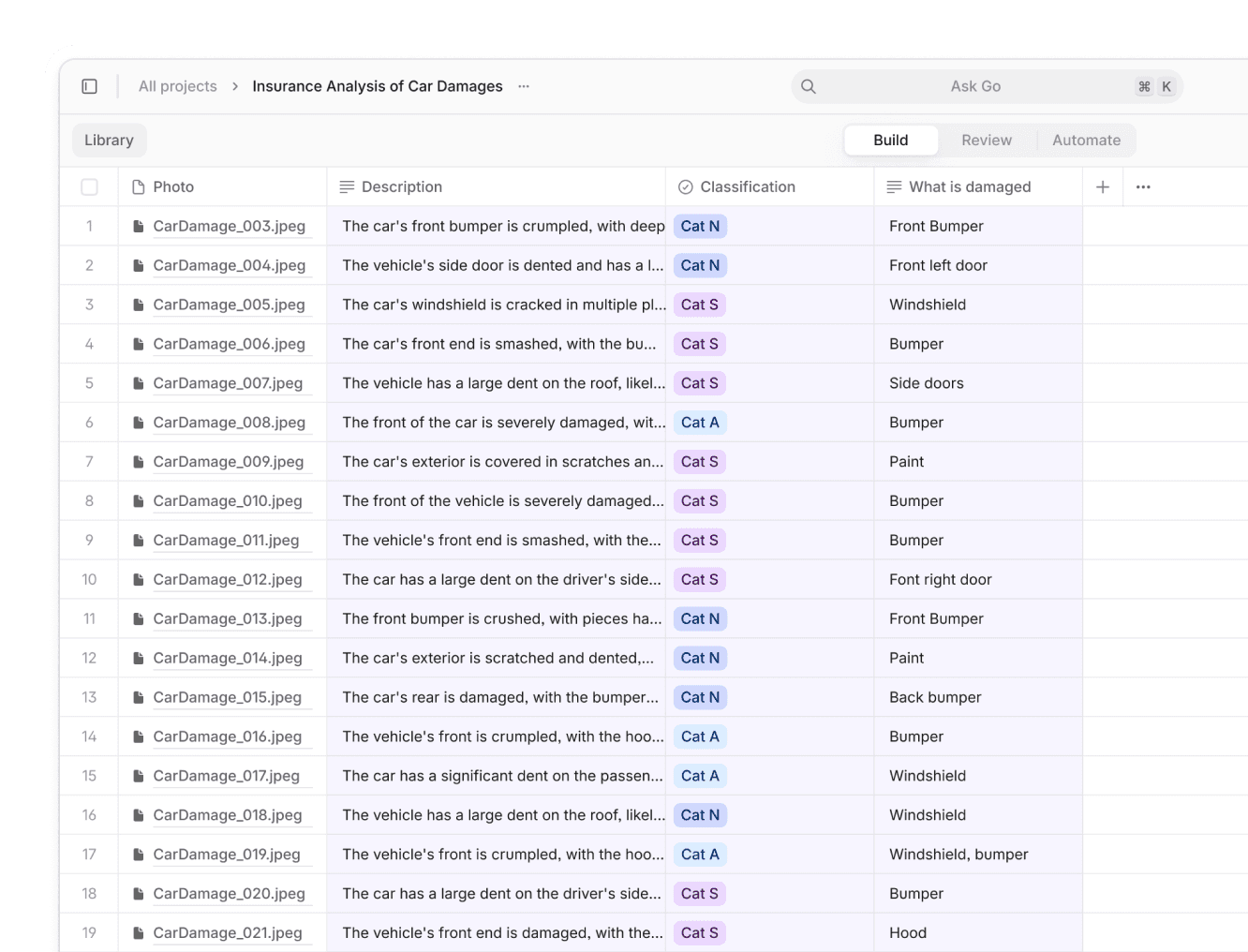

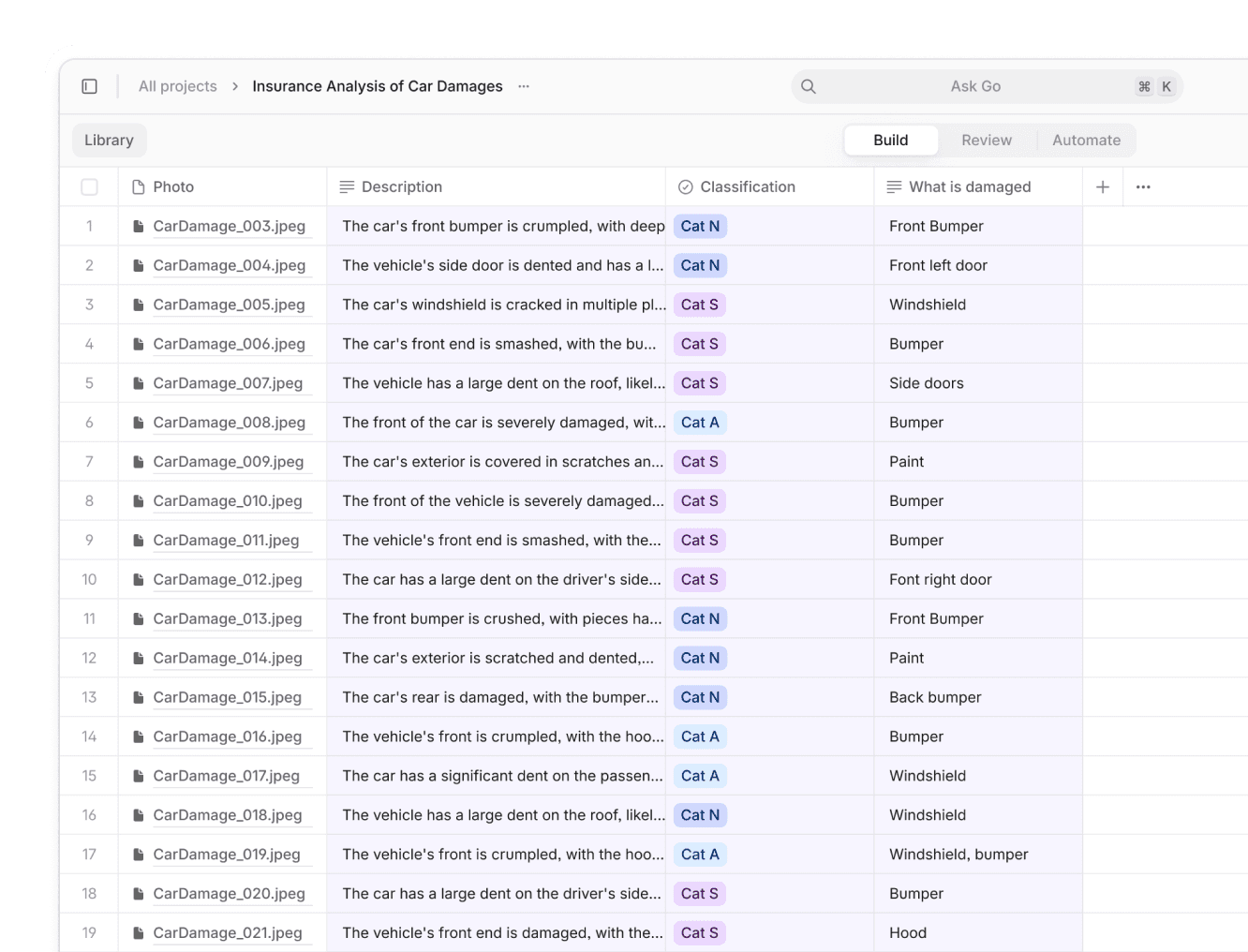

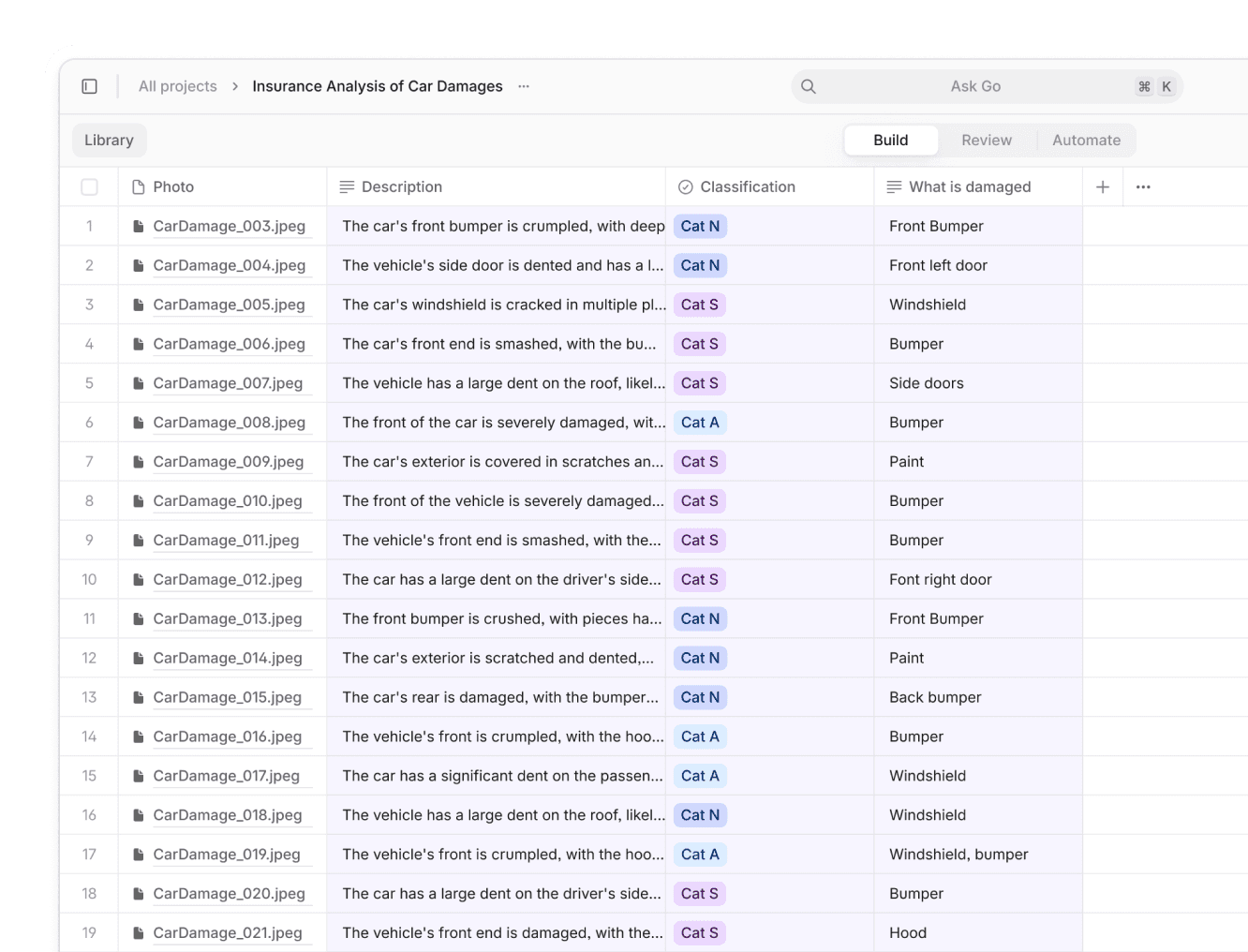

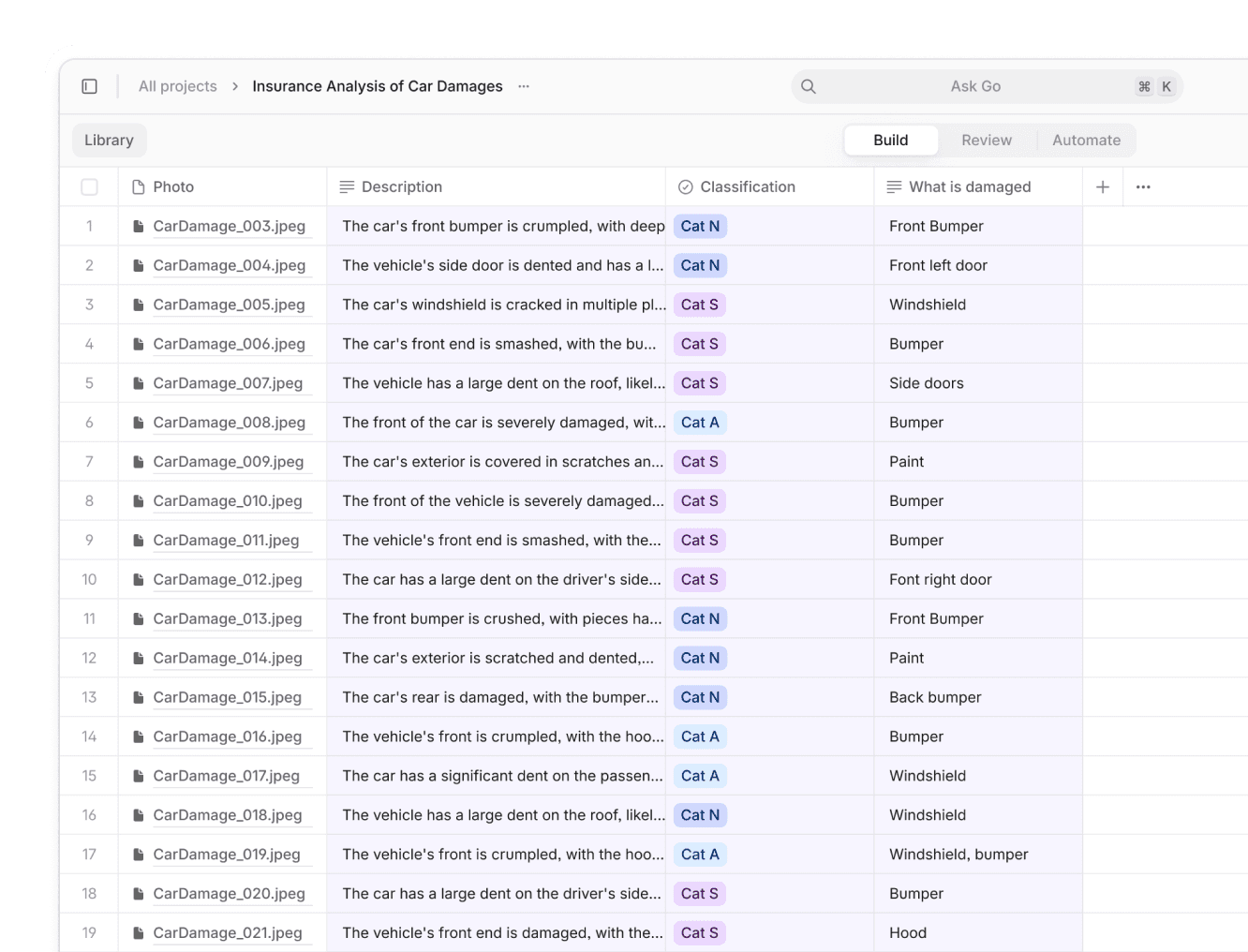

Case study

Case study

Case study

1,900

insurers using custom AI workflows

1 million

document queries saved

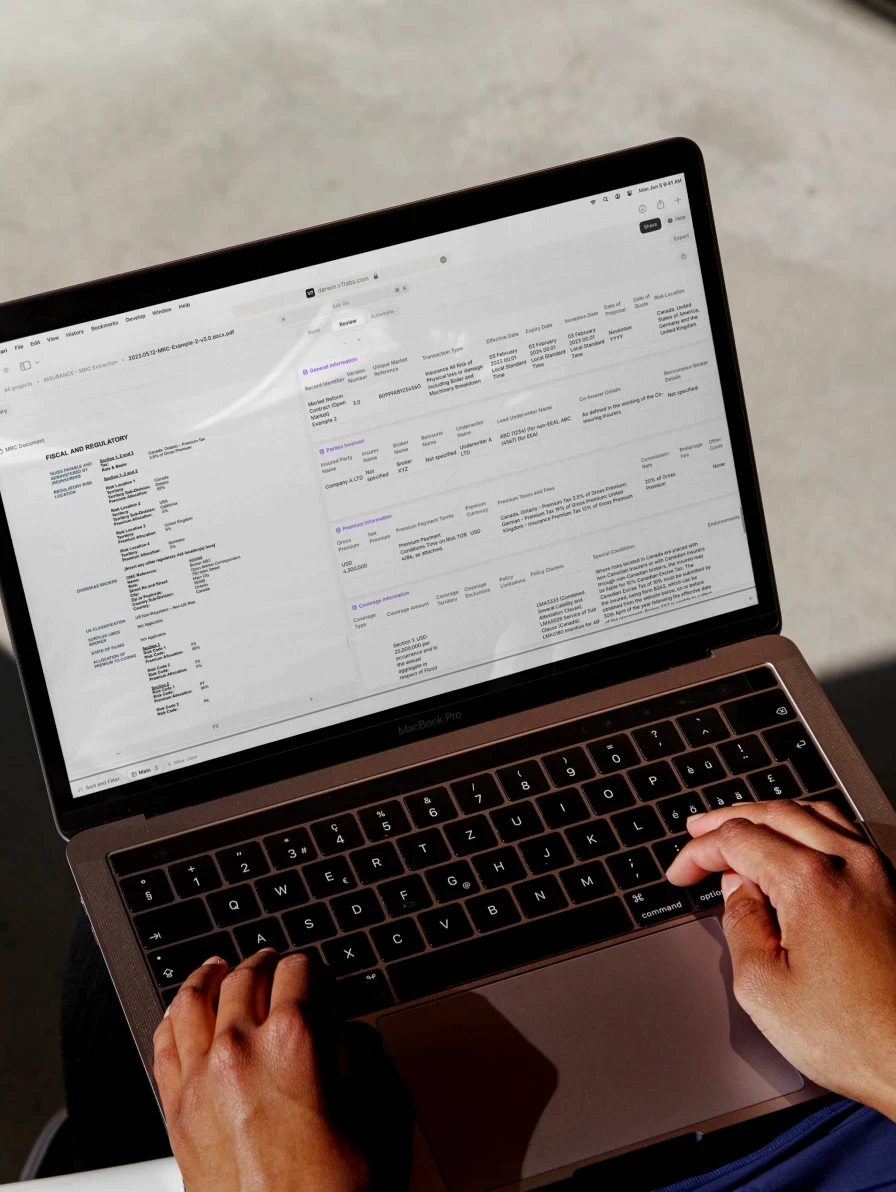

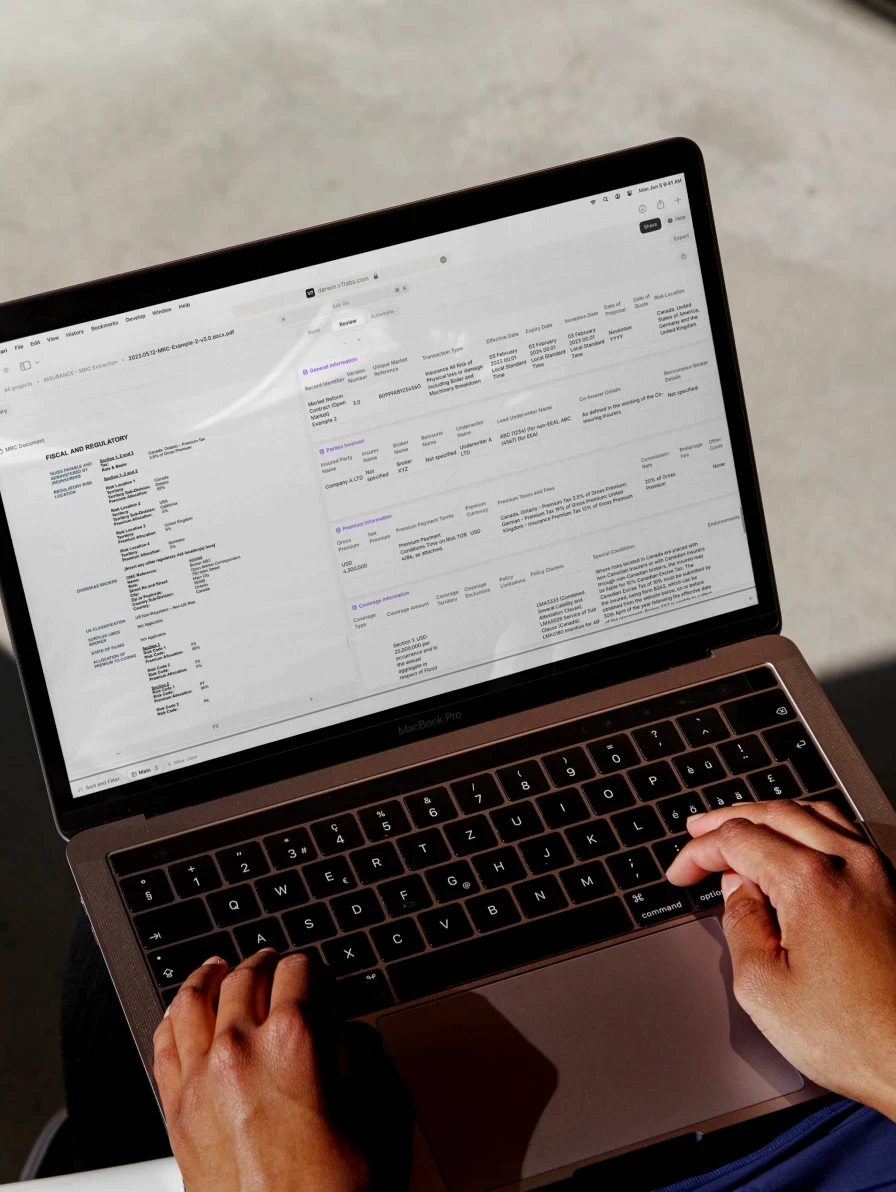

"A major insurance provider uses AI agents powered by V7 Go to automatically extract information from submissions, slips, and MRCs. Their team now processes thousands of documents daily with minimal manual review. Implementation took just two weeks."

Large insurance underwriter

Document ingestion

1,900

insurers using custom AI workflows

1 million

document queries saved

"A major insurance provider uses AI agents powered by V7 Go to automatically extract information from submissions, slips, and MRCs. Their team now processes thousands of documents daily with minimal manual review. Implementation took just two weeks."

Large insurance underwriter

Document ingestion

1,900

insurers using custom AI workflows

1 million

document queries saved

"A major insurance provider uses AI agents powered by V7 Go to automatically extract information from submissions, slips, and MRCs. Their team now processes thousands of documents daily with minimal manual review. Implementation took just two weeks."

Large insurance underwriter

Document ingestion

AI agents

AI agents

AI agents

Proof of concept in hours.

Deployment in days.

→

→

Insurance

agent

Insurance Claims Automation Agent

Validates claims, verifies policy coverage, auto-calculates payments, streamlining insurance claims handling.

Claim Validation

Coverage Verification

Payment Calculation

Insurance

agent

Insurance Coverage Analysis Agent

Verifies insurance policy coverage: maps provisions to requirements, identifies gaps, ensures compliance.

Policy Provision Mapping

Insurance Gap Analysis

Requirement Checking

Insurance

agent

Insurance Policy Review Agent

Reviews insurance documents: extracts coverage details, analyzes policy terms, converts them to structured data.

Coverage Detail Extraction

Policy Term Comparison

Gap Identification

Insurance

agent

Insurance Risk Assessment Agent

Assesses insurance risks by analyzing engineering reports and safety documents for actionable underwriter insights.

Hazard Analysis

Safety Protocol Review

Recommendation Generation

Proof of concept in hours.

Deployment in days.

→

→

Insurance

agent

Insurance Claims Automation Agent

Validates claims, verifies policy coverage, auto-calculates payments, streamlining insurance claims handling.

Claim Validation

Coverage Verification

Payment Calculation

Insurance

agent

Insurance Coverage Analysis Agent

Verifies insurance policy coverage: maps provisions to requirements, identifies gaps, ensures compliance.

Policy Provision Mapping

Insurance Gap Analysis

Requirement Checking

Insurance

agent

Insurance Policy Review Agent

Reviews insurance documents: extracts coverage details, analyzes policy terms, converts them to structured data.

Coverage Detail Extraction

Policy Term Comparison

Gap Identification

Insurance

agent

Insurance Risk Assessment Agent

Assesses insurance risks by analyzing engineering reports and safety documents for actionable underwriter insights.

Hazard Analysis

Safety Protocol Review

Recommendation Generation

Proof of concept in hours.

Deployment in days.

→

→

Insurance

agent

Insurance Claims Automation Agent

Validates claims, verifies policy coverage, auto-calculates payments, streamlining insurance claims handling.

Claim Validation

Coverage Verification

Payment Calculation

Insurance

agent

Insurance Coverage Analysis Agent

Verifies insurance policy coverage: maps provisions to requirements, identifies gaps, ensures compliance.

Policy Provision Mapping

Insurance Gap Analysis

Requirement Checking

Insurance

agent

Insurance Policy Review Agent

Reviews insurance documents: extracts coverage details, analyzes policy terms, converts them to structured data.

Coverage Detail Extraction

Policy Term Comparison

Gap Identification

Insurance

agent

Insurance Risk Assessment Agent

Assesses insurance risks by analyzing engineering reports and safety documents for actionable underwriter insights.

Hazard Analysis

Safety Protocol Review

Recommendation Generation

Why V7 Go

Why V7 Go

Why V7 Go

AI assistant for

insurance operations

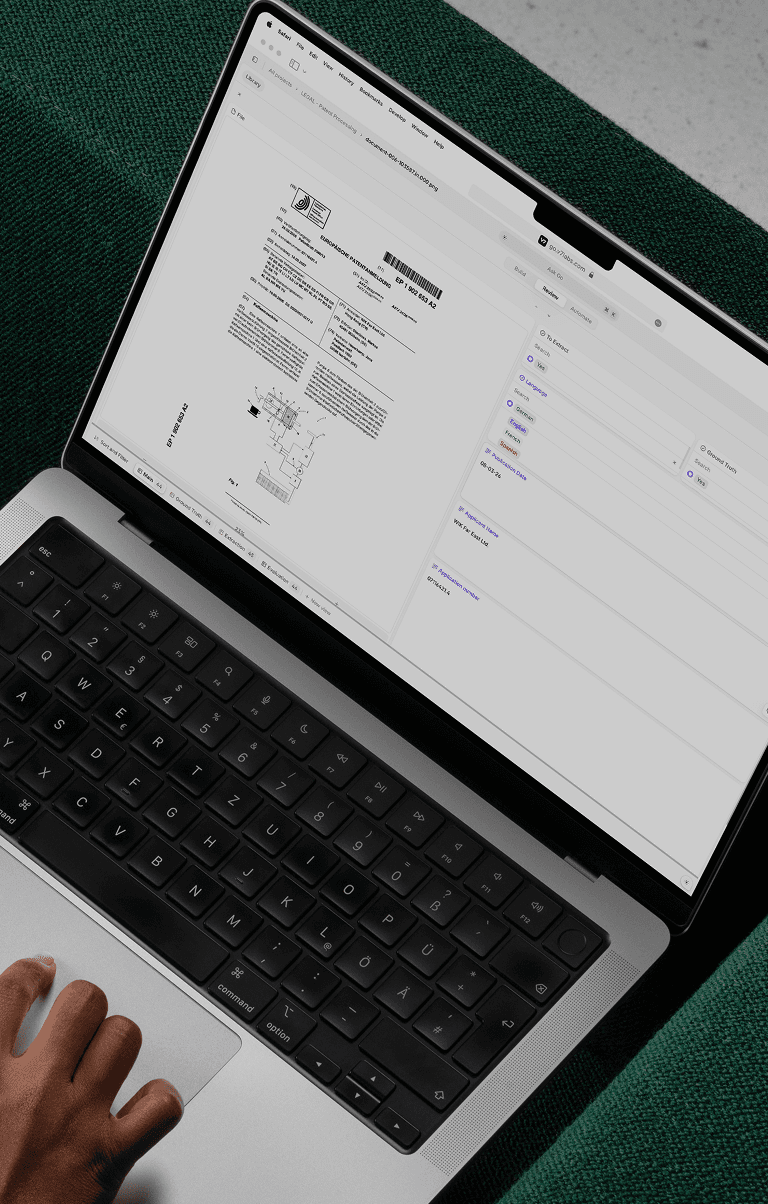

Start solving real problems from day one. No training, no data labeling, no hassle.

Experience intelligent document processing powered by GenAI. Hit accuracy rates around 99% across complex documents.

Outputs you can trust

V7 Go highlights document sections behind each output for quick, accurate verification.

Outputs you can trust

V7 Go highlights document sections behind each output for quick, accurate verification.

No-code AI agents

Build multi-step automations that adapt to each case and document type. Use agents as AI assistants or integrate them seamlessly into processes behind the scenes via API.

No-code AI agents

Build multi-step automations that adapt to each case and document type. Use agents as AI assistants or integrate them seamlessly into processes behind the scenes via API.

Flexible integration options

Connect V7 Go to your legacy systems and existing insurance CRM software through our flexible API or native integrations.

Flexible integration options

Connect V7 Go to your legacy systems and existing insurance CRM software through our flexible API or native integrations.

Multi-modal support

Analyze any file format, from medical report photos, PDFs, and CSVs to PowerPoints, or even audio files.

Multi-modal support

Analyze any file format, from medical report photos, PDFs, and CSVs to PowerPoints, or even audio files.

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Automate processes

Automate processes

Automate processes

Trustworthy insurance AI

from ingestion to decision

Trustworthy insurance AI

from ingestion to decision

Automate the entire chain of insurance processes. Every insight linked to source documents.

Import your files

Guidewire

,

Salesforce

,

SAP

Insurance Policies

Claims Histories

Property Appraisals

Inspection Reports

Loss Run Reports

Coverage Summaries

Policy Coverage Details

Premium Amounts

Risk Factors

Historical Claims Data

Inspection Findings

Property Value Appraisals

Policy Expiry Dates

Liability Coverage Limits

Loss Ratios

Compliance Check Results

Import your files

Guidewire

,

Salesforce

,

SAP

Insurance Policies

Claims Histories

Property Appraisals

Inspection Reports

Loss Run Reports

Coverage Summaries

Policy Coverage Details

Premium Amounts

Risk Factors

Historical Claims Data

Inspection Findings

Property Value Appraisals

Policy Expiry Dates

Liability Coverage Limits

Loss Ratios

Compliance Check Results

Import your files

Guidewire

,

Salesforce

,

SAP

Insurance Policies

Claims Histories

Property Appraisals

Inspection Reports

Loss Run Reports

Coverage Summaries

Policy Coverage Details

Premium Amounts

Risk Factors

Historical Claims Data

Inspection Findings

Property Value Appraisals

Policy Expiry Dates

Liability Coverage Limits

Loss Ratios

Compliance Check Results

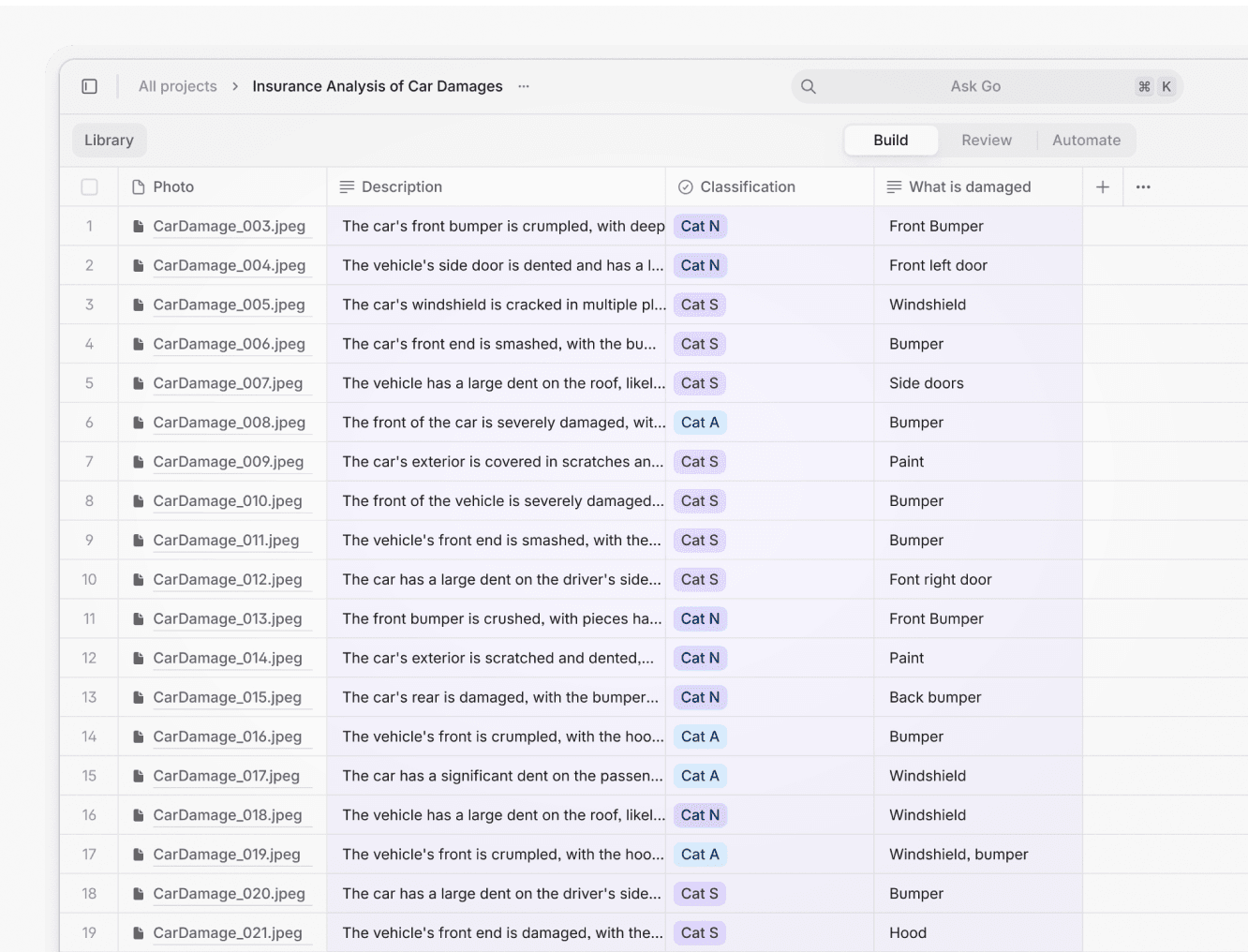

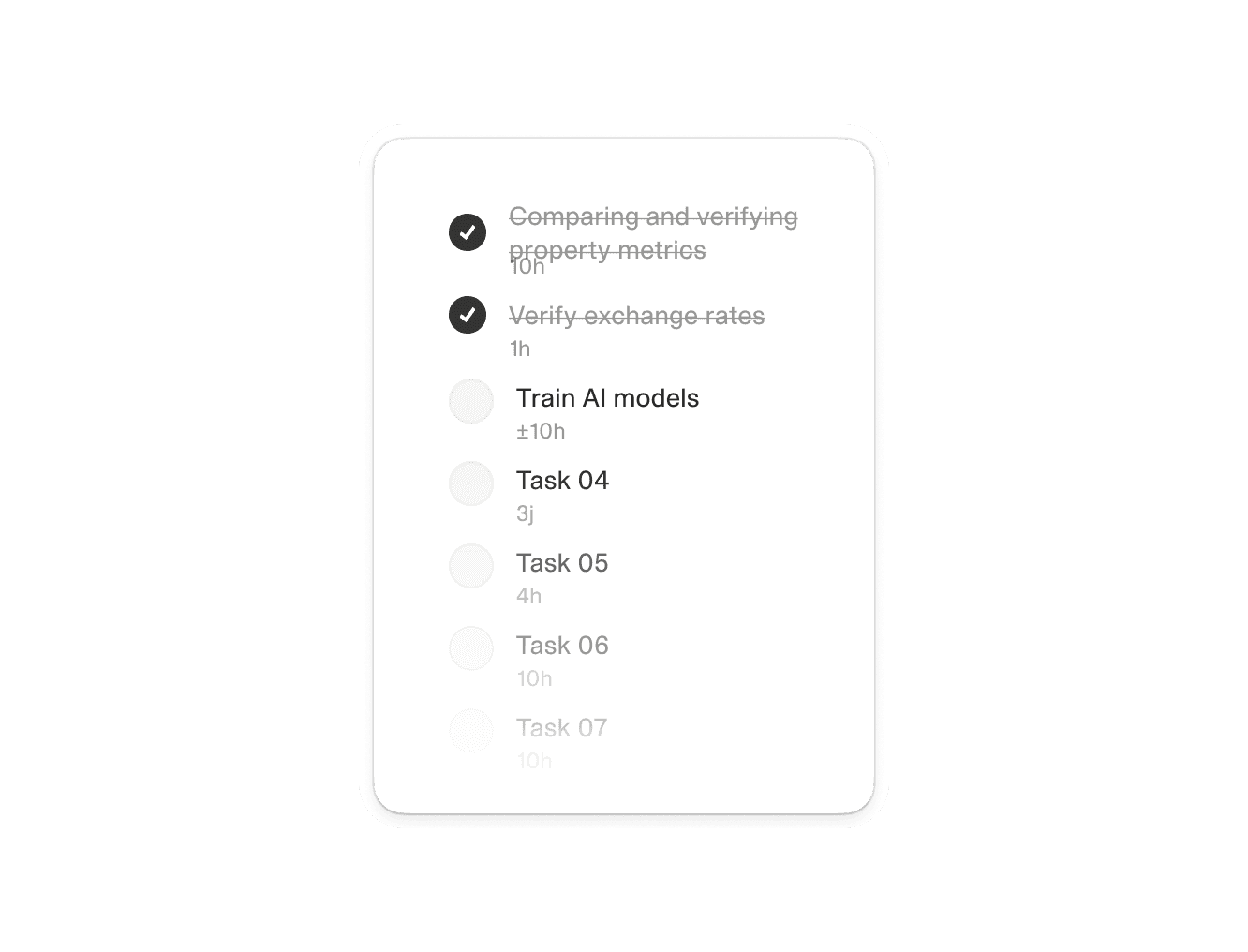

No more manual, repetitive work.

Save hours on every claim or risk review.

Spending 3 hours reading risk engineering reports

Manually googling exchange rates and checking sanctions

Training AI models that never quite work

No more manual, repetitive work.

Save hours on every claim or risk review.

Spending 3 hours reading risk engineering reports

Manually googling exchange rates and checking sanctions

Training AI models that never quite work

No more manual, repetitive work.

Save hours on every deal.

Analysts stuck copy-pasting from PDFs to Excel

Hours spent verifying single data points

Valuable deals missed due to processing delays

Limited deal evaluation capacity

No more manual, repetitive work.

Save hours on every deal.

Analysts stuck copy-pasting from PDFs to Excel

Hours spent verifying single data points

Valuable deals missed due to processing delays

Limited deal evaluation capacity

No more manual, repetitive work.

Save hours on every deal.

Automated data extraction and verification

Investment memos drafted in minutes

More time for strategic analysis

3x more deals evaluated with the same team

No more manual, repetitive work.

Save hours on every deal.

Automated data extraction and verification

Investment memos drafted in minutes

More time for strategic analysis

3x more deals evaluated with the same team

Learn more

Learn more

Learn more

Document processing

May 12, 2025

AI in TPA Software: Advancing Insurance Administration

Document processing

May 12, 2025

AI in TPA Software: Advancing Insurance Administration

Document processing

Jan 14, 2025

Automated Claims Processing: Implementation Guide for Insurance Operations

Document processing

Jan 14, 2025

Automated Claims Processing: Implementation Guide for Insurance Operations

Document processing

Dec 13, 2024

Artificial Intelligence for Insurance Underwriting: Key Use Cases & Tools

Document processing

Dec 13, 2024

Artificial Intelligence for Insurance Underwriting: Key Use Cases & Tools

FAQs

FAQs

FAQs

Have questions?

Find answers.

Have questions?

Find answers.

How is V7 Go different from using GPT models directly?

Unlike GPT's "black box" responses, V7 Go provides insights that are fully traceable to their source documents. It’s designed to handle the complexity of insurance-specific files, such as statements of value, risk engineering reports, and intricate document layouts—not just plain text. Think of V7 Go as an insurance-specialized knowledge worker, capable of truly understanding your documents and automating entire processes, rather than a general-purpose language model limited to text analysis.

+

Is V7 Go truly no-code?

Yes! V7 Go is a no-code platform designed for insurance professionals. You can create sophisticated document automation workflows without any coding knowledge. Our no-code playbook makes it easy to set up everything from claims processing to compliance checks. For developers, we also provide APIs to integrate V7 Go with your existing insurance workflows.

+

Can V7 Go help reduce customer churn and improve engagement?

Yes. V7 Go powers intelligence behind customer engagement by extracting and structuring data from your documents and workflows. This enables better customer churn propensity analysis and dynamic customer segmentation. Our API can integrate with your existing systems to provide real-time access to insights, supporting everything from policy renewal rates tracking to omnichannel marketing campaigns.

+

How does V7 Go handle end-to-end process automation?

V7 Go automates the entire chain of document processing and knowledge work. It connects with other solutions via API or native integrations. For example, we can automate time-consuming tasks like First Notification of Loss (FNOL) processing and policy data consolidation. The platform connects with both modern and legacy systems to enable true end-to-end process automation.

+

Can V7 Go enhance my customer service operations?

While V7 Go isn't a chatbot builder, it excels as the intelligence layer behind customer service solutions. Our platform processes customer documents and queries in real-time, enabling AI-driven next best action recommendations. We integrate with communication platforms and messaging solutions to provide the document intelligence needed for better customer lifecycle management.

+

How does V7 Go help with cross-selling and customer retention?

Our platform enables tailored solutions through intelligent data analysis. By processing customer documents and interactions, V7 Go helps identify cross-/up sales recommendations and supports your loyalty & reward programs. The engagement analytics help you understand customer behavior and optimize policy renewal rates through attended automation.

+

How is V7 Go different from using GPT models directly?

Unlike GPT's "black box" responses, V7 Go provides insights that are fully traceable to their source documents. It’s designed to handle the complexity of insurance-specific files, such as statements of value, risk engineering reports, and intricate document layouts—not just plain text. Think of V7 Go as an insurance-specialized knowledge worker, capable of truly understanding your documents and automating entire processes, rather than a general-purpose language model limited to text analysis.

+

Is V7 Go truly no-code?

Yes! V7 Go is a no-code platform designed for insurance professionals. You can create sophisticated document automation workflows without any coding knowledge. Our no-code playbook makes it easy to set up everything from claims processing to compliance checks. For developers, we also provide APIs to integrate V7 Go with your existing insurance workflows.

+

Can V7 Go help reduce customer churn and improve engagement?

Yes. V7 Go powers intelligence behind customer engagement by extracting and structuring data from your documents and workflows. This enables better customer churn propensity analysis and dynamic customer segmentation. Our API can integrate with your existing systems to provide real-time access to insights, supporting everything from policy renewal rates tracking to omnichannel marketing campaigns.

+

How does V7 Go handle end-to-end process automation?

V7 Go automates the entire chain of document processing and knowledge work. It connects with other solutions via API or native integrations. For example, we can automate time-consuming tasks like First Notification of Loss (FNOL) processing and policy data consolidation. The platform connects with both modern and legacy systems to enable true end-to-end process automation.

+

Can V7 Go enhance my customer service operations?

While V7 Go isn't a chatbot builder, it excels as the intelligence layer behind customer service solutions. Our platform processes customer documents and queries in real-time, enabling AI-driven next best action recommendations. We integrate with communication platforms and messaging solutions to provide the document intelligence needed for better customer lifecycle management.

+

How does V7 Go help with cross-selling and customer retention?

Our platform enables tailored solutions through intelligent data analysis. By processing customer documents and interactions, V7 Go helps identify cross-/up sales recommendations and supports your loyalty & reward programs. The engagement analytics help you understand customer behavior and optimize policy renewal rates through attended automation.

+

How is V7 Go different from using GPT models directly?

Unlike GPT's "black box" responses, V7 Go provides insights that are fully traceable to their source documents. It’s designed to handle the complexity of insurance-specific files, such as statements of value, risk engineering reports, and intricate document layouts—not just plain text. Think of V7 Go as an insurance-specialized knowledge worker, capable of truly understanding your documents and automating entire processes, rather than a general-purpose language model limited to text analysis.

+

Is V7 Go truly no-code?

Yes! V7 Go is a no-code platform designed for insurance professionals. You can create sophisticated document automation workflows without any coding knowledge. Our no-code playbook makes it easy to set up everything from claims processing to compliance checks. For developers, we also provide APIs to integrate V7 Go with your existing insurance workflows.

+

Can V7 Go help reduce customer churn and improve engagement?

Yes. V7 Go powers intelligence behind customer engagement by extracting and structuring data from your documents and workflows. This enables better customer churn propensity analysis and dynamic customer segmentation. Our API can integrate with your existing systems to provide real-time access to insights, supporting everything from policy renewal rates tracking to omnichannel marketing campaigns.

+

How does V7 Go handle end-to-end process automation?

V7 Go automates the entire chain of document processing and knowledge work. It connects with other solutions via API or native integrations. For example, we can automate time-consuming tasks like First Notification of Loss (FNOL) processing and policy data consolidation. The platform connects with both modern and legacy systems to enable true end-to-end process automation.

+

Can V7 Go enhance my customer service operations?

While V7 Go isn't a chatbot builder, it excels as the intelligence layer behind customer service solutions. Our platform processes customer documents and queries in real-time, enabling AI-driven next best action recommendations. We integrate with communication platforms and messaging solutions to provide the document intelligence needed for better customer lifecycle management.

+

How does V7 Go help with cross-selling and customer retention?

Our platform enables tailored solutions through intelligent data analysis. By processing customer documents and interactions, V7 Go helps identify cross-/up sales recommendations and supports your loyalty & reward programs. The engagement analytics help you understand customer behavior and optimize policy renewal rates through attended automation.

+

Get started

AI assistant

for insurance operations

You’ll hear back in less than 24 hours

Next steps

AI assistant

for insurance operations