AI agent platform

for private markets & finance

AI agent platform

for private markets & finance

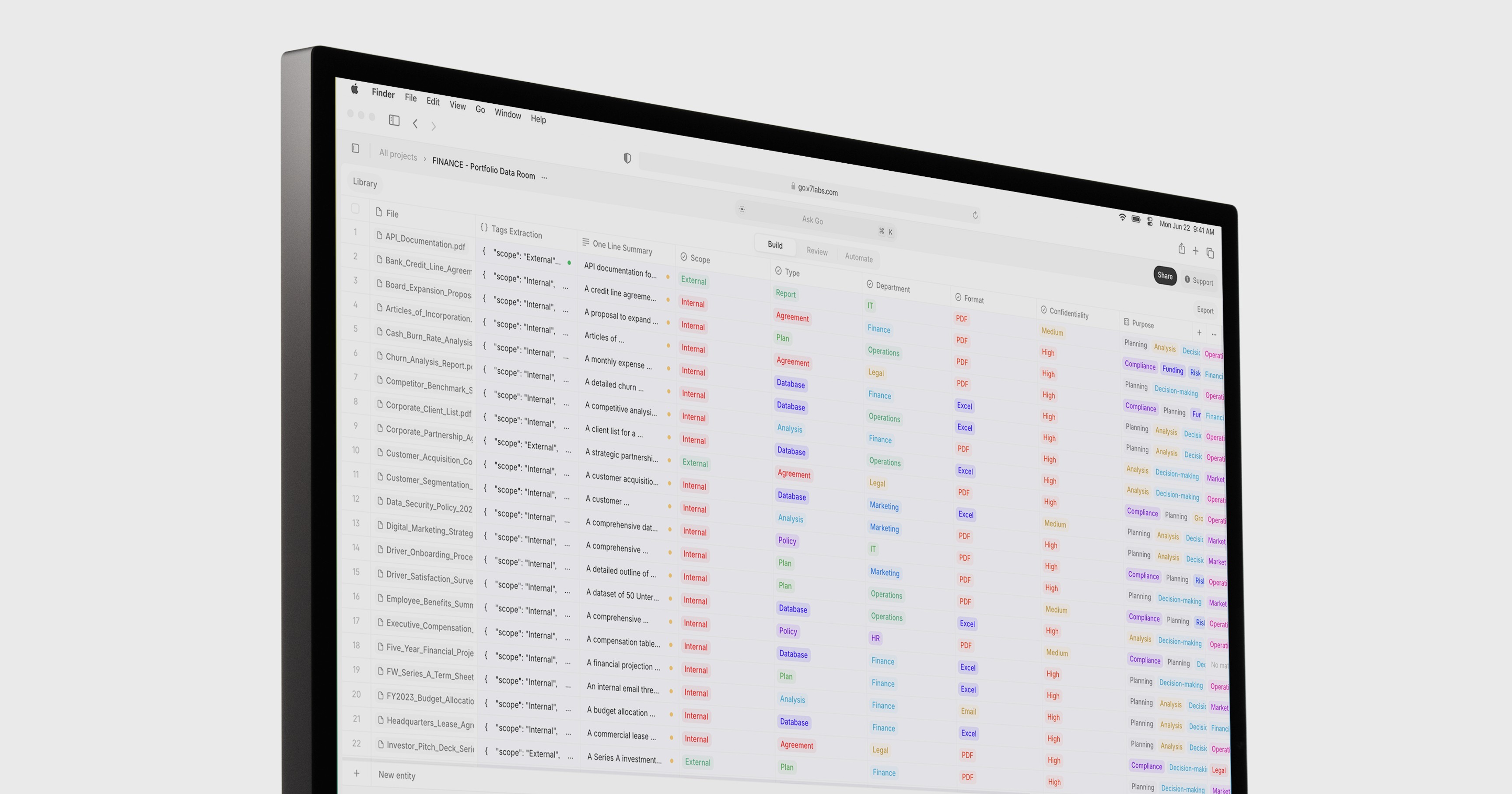

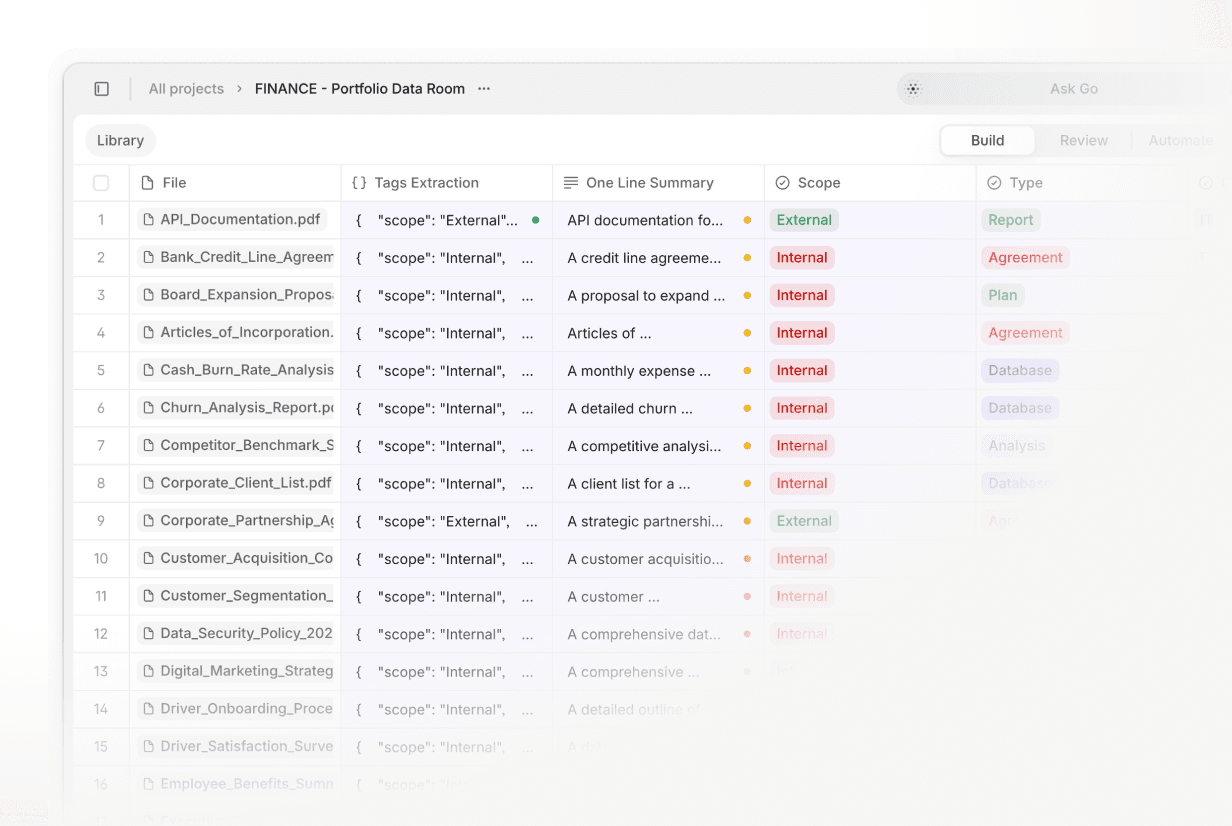

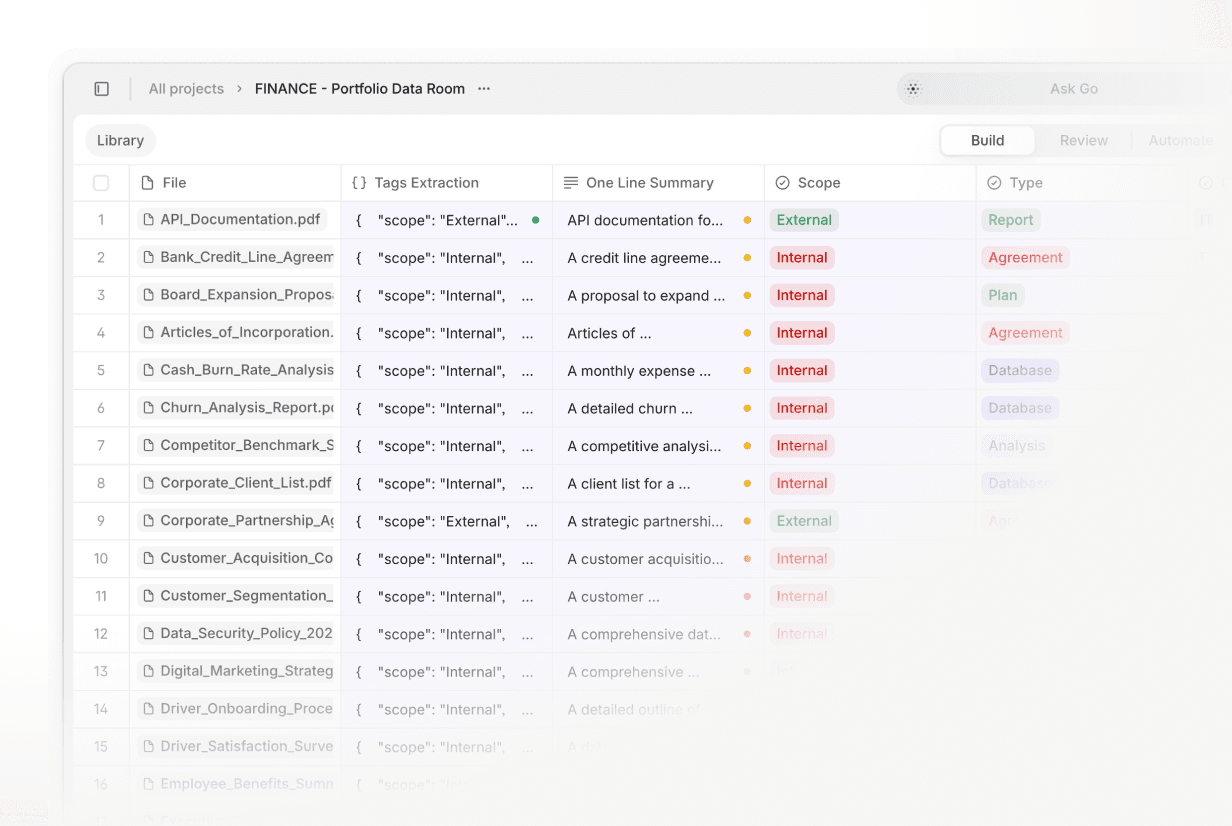

Process entire data rooms in minutes. Extract precise metrics from CIMs and financial statements.

Experience intelligent document processing powered by GenAI. Hit accuracy rates around 99% across complex documents.

Trusted by fast-growing companies around the world

Trusted by fast-growing

companies around the world

Let AI agents handle the heavy lifting of your deal due diligence

“Every AI demo we see handles basic invoices or short forms. But what about those 100-page CIMs packed with tables, footnotes, and clauses? That's where most solutions fall apart. We need more than text extraction—we need real analysis.”

“Every AI demo we see handles basic invoices or short forms. But what about those 100-page CIMs packed with tables, footnotes, and clauses? That's where most solutions fall apart. We need more than text extraction—we need real analysis.”

Case study

Case study

Case study

10x

faster processing

"An asset management giant uses AI agents powered by V7 Go to extract data from CIMs, analyze offering memorandums, unify financial statements, and clean up their CRM. They replaced legacy systems in just two weeks and saw significant productivity gains."

Large asset management firm

Financial analysis

10x

faster processing

"An asset management giant uses AI agents powered by V7 Go to extract data from CIMs, analyze offering memorandums, unify financial statements, and clean up their CRM. They replaced legacy systems in just two weeks and saw significant productivity gains."

Large asset management firm

Financial analysis

10x

faster processing

"An asset management giant uses AI agents powered by V7 Go to extract data from CIMs, analyze offering memorandums, unify financial statements, and clean up their CRM. They replaced legacy systems in just two weeks and saw significant productivity gains."

Large asset management firm

Financial analysis

AI agents

AI agents

AI agents

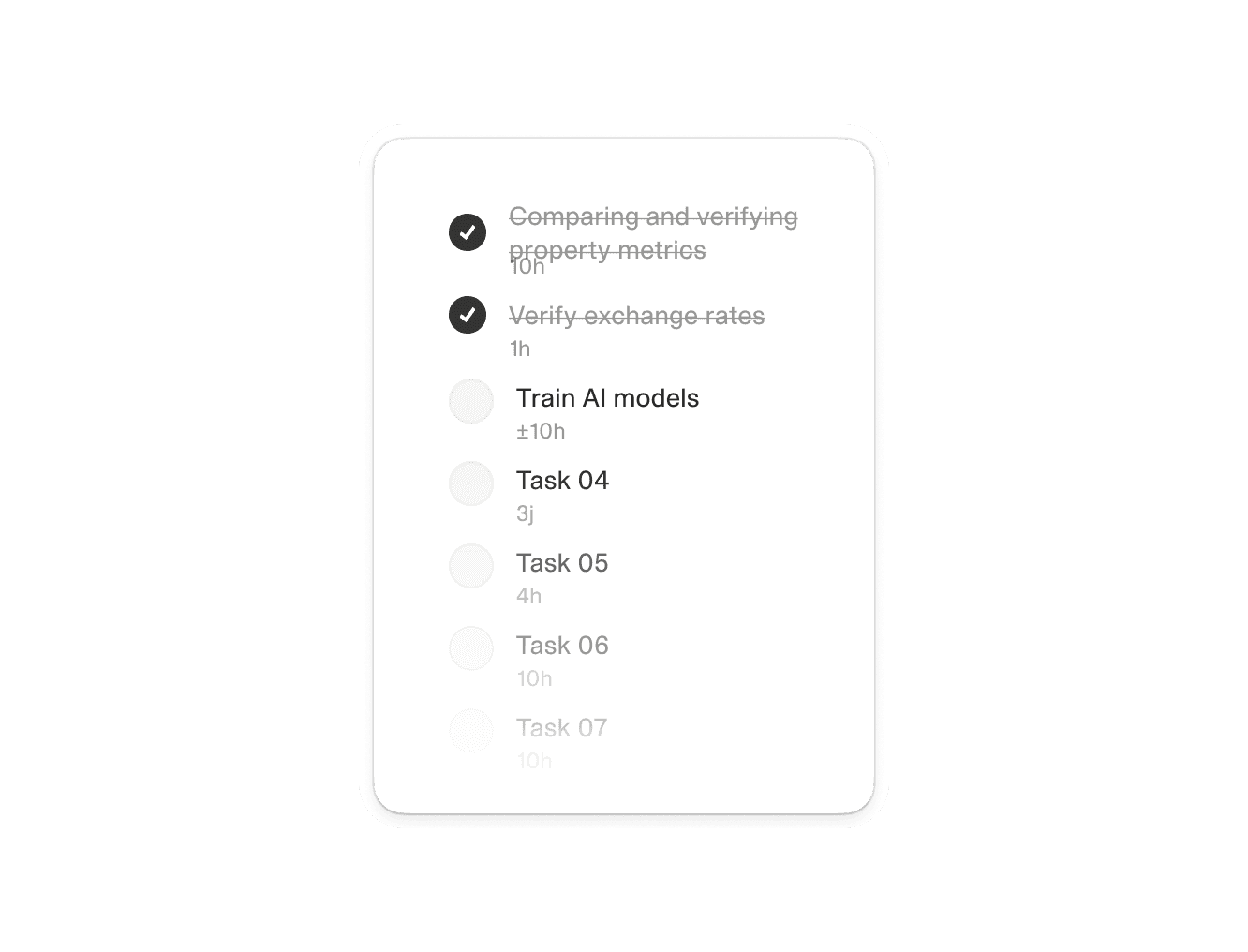

Proof of concept in hours.

Deployment in days.

→

→

Finance

agent

Data Room Analysis Agent

Analyzes investment data rooms, extracts key metrics, identifies risks, and organizes data for faster deal evaluation.

Automated Data Extraction

Insight Generation

Data Room Risk ID

Finance

agent

AI Financial Due Diligence Agent

Analyzes complex deal documents: verifies financials, organizes information, flags risks for investment decisions.

Financial Data Verification

Document Systemization

Investment Risk ID

Finance

agent

AI Financial Statement Analysis Agent

Extracts key metrics, identifies trends, calculates ratios from financial statements and 10-Q reports with accuracy.

Key Metric Extraction

Financial Trend Analysis

Ratio Calculation

Finance

agent

AI Investment Analysis Agent

Evaluates financial opportunities: analyzes performance, compares market positions, calculates returns from documents.

Performance Metrics

Market Comparisons

ROI Calculation

Proof of concept in hours.

Deployment in days.

→

→

Finance

agent

Data Room Analysis Agent

Analyzes investment data rooms, extracts key metrics, identifies risks, and organizes data for faster deal evaluation.

Automated Data Extraction

Insight Generation

Data Room Risk ID

Finance

agent

AI Financial Due Diligence Agent

Analyzes complex deal documents: verifies financials, organizes information, flags risks for investment decisions.

Financial Data Verification

Document Systemization

Investment Risk ID

Finance

agent

AI Financial Statement Analysis Agent

Extracts key metrics, identifies trends, calculates ratios from financial statements and 10-Q reports with accuracy.

Key Metric Extraction

Financial Trend Analysis

Ratio Calculation

Finance

agent

AI Investment Analysis Agent

Evaluates financial opportunities: analyzes performance, compares market positions, calculates returns from documents.

Performance Metrics

Market Comparisons

ROI Calculation

Proof of concept in hours.

Deployment in days.

→

→

Finance

agent

Data Room Analysis Agent

Analyzes investment data rooms, extracts key metrics, identifies risks, and organizes data for faster deal evaluation.

Automated Data Extraction

Insight Generation

Data Room Risk ID

Finance

agent

AI Financial Due Diligence Agent

Analyzes complex deal documents: verifies financials, organizes information, flags risks for investment decisions.

Financial Data Verification

Document Systemization

Investment Risk ID

Finance

agent

AI Financial Statement Analysis Agent

Extracts key metrics, identifies trends, calculates ratios from financial statements and 10-Q reports with accuracy.

Key Metric Extraction

Financial Trend Analysis

Ratio Calculation

Finance

agent

AI Investment Analysis Agent

Evaluates financial opportunities: analyzes performance, compares market positions, calculates returns from documents.

Performance Metrics

Market Comparisons

ROI Calculation

Why V7 Go

Why V7 Go

Why V7 Go

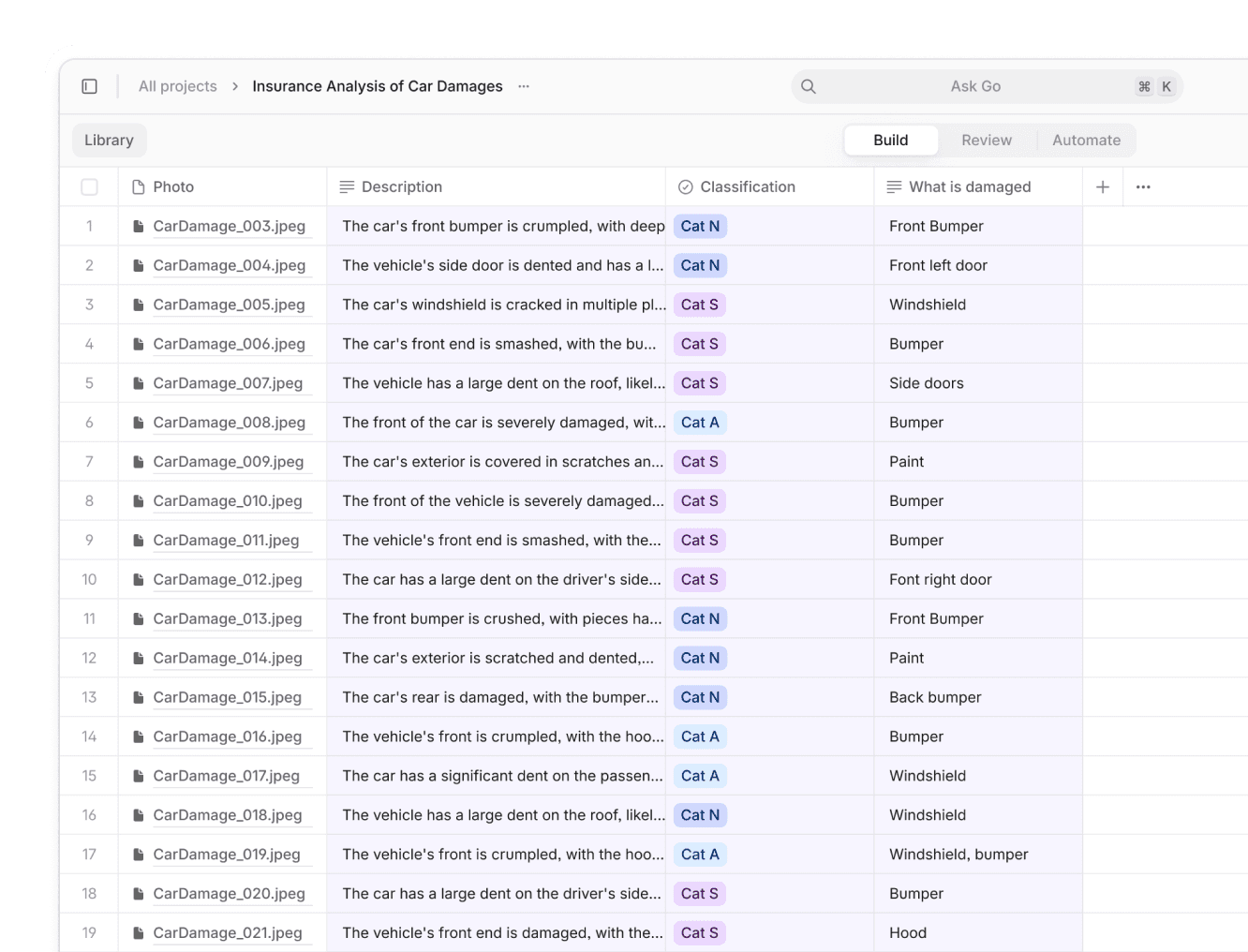

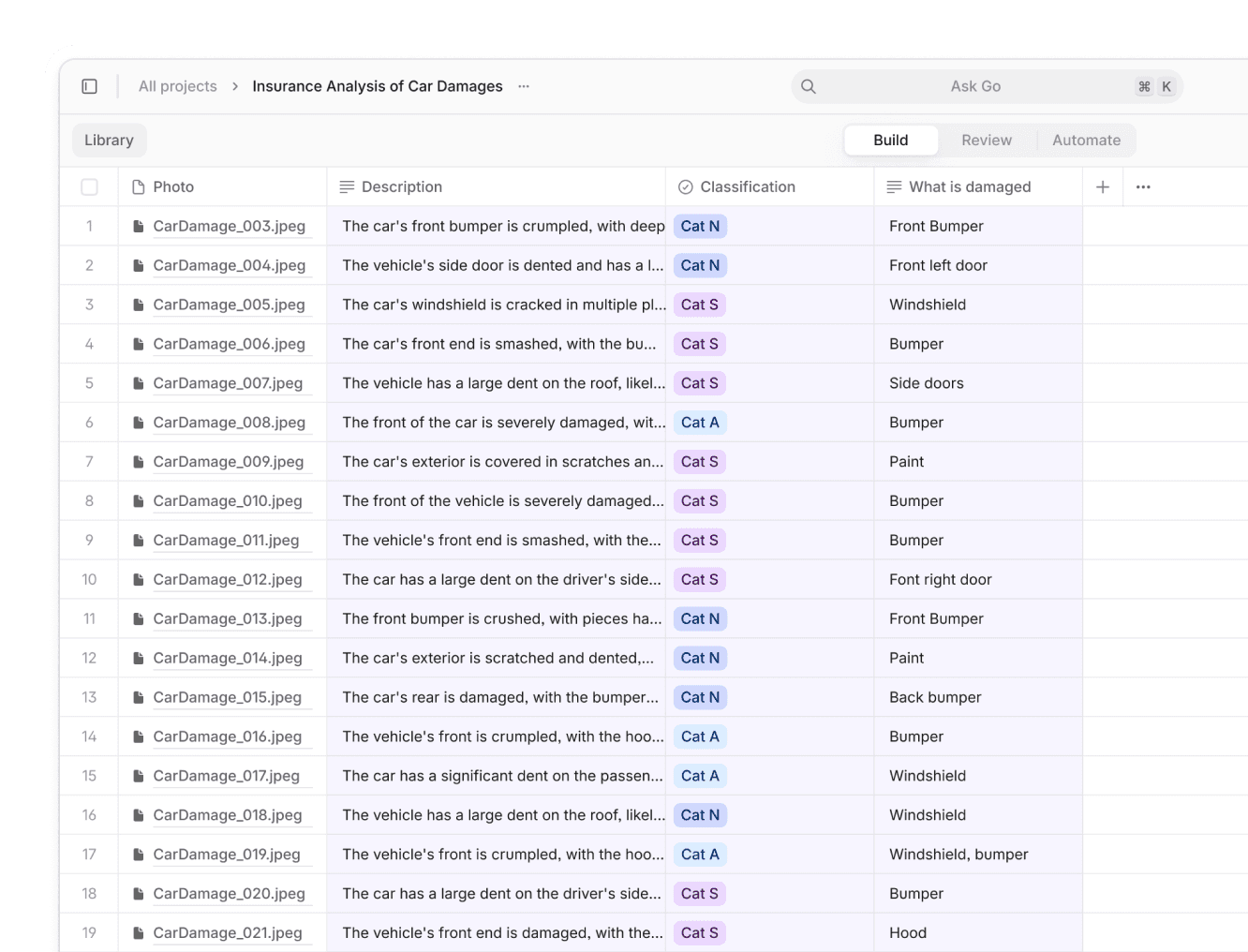

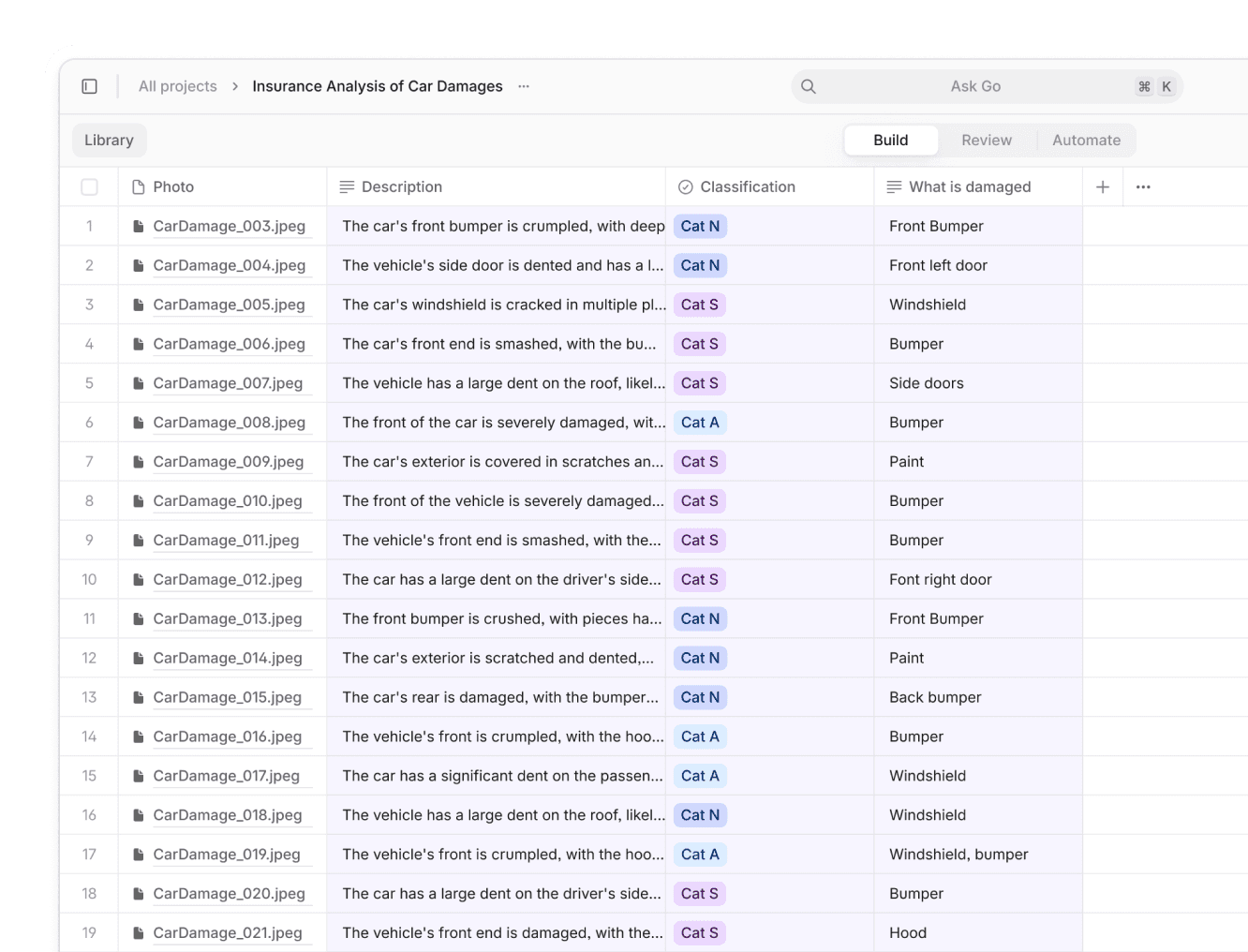

AI that actually understands

unstructured financial data

Handle CIMs, due diligence packs, and multi-document data rooms with ease

Experience intelligent document processing powered by GenAI. Hit accuracy rates around 99% across complex documents.

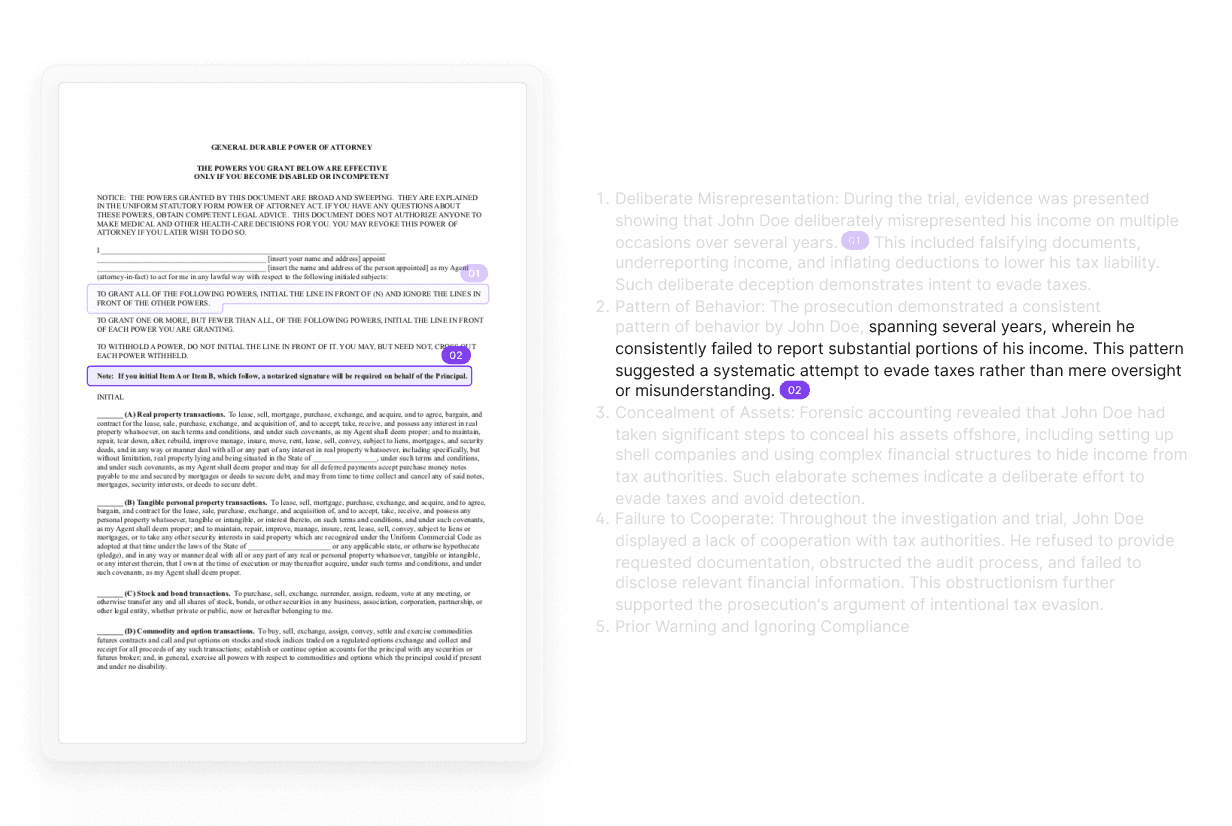

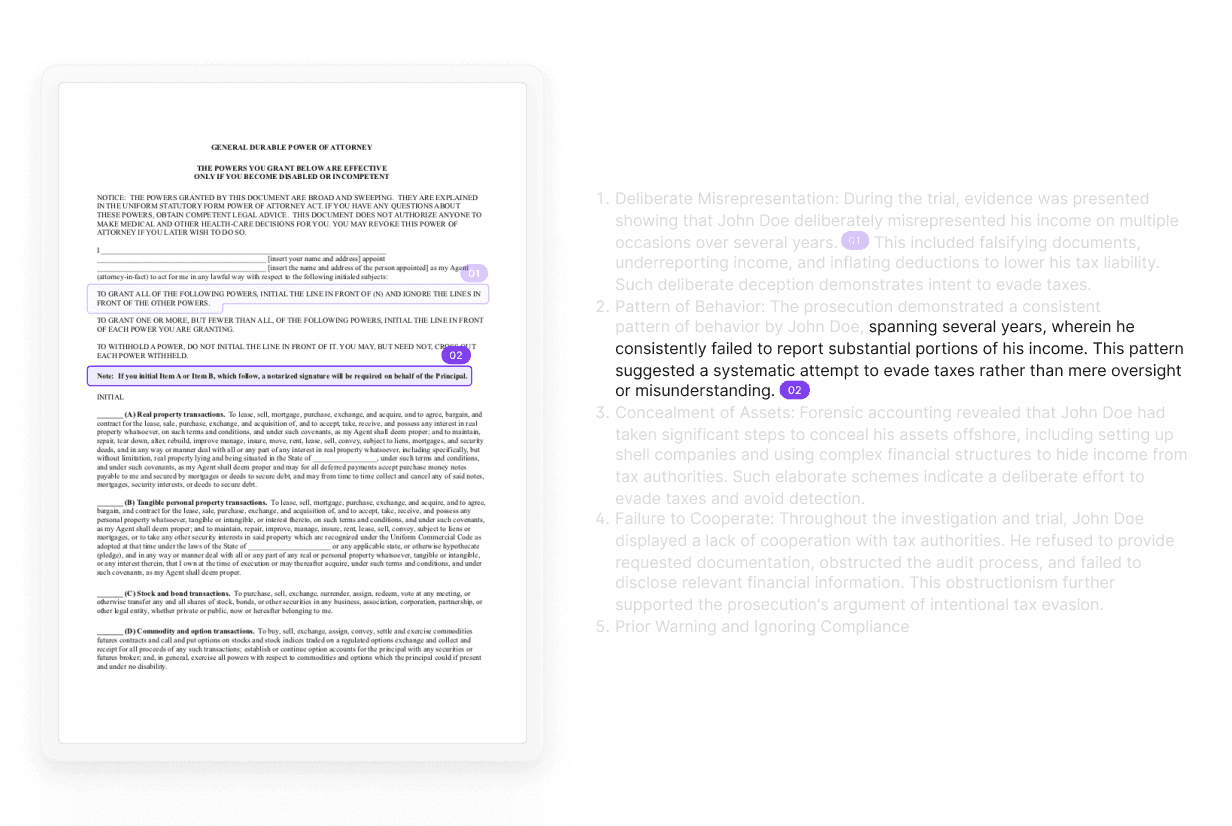

Outputs you can trust

Link every insight to the exact page in your CIM or statement. You’re just one click away from verifying every figure and note.

Outputs you can trust

Link every insight to the exact page in your CIM or statement. You’re just one click away from verifying every figure and note.

No-code AI agents

Build multi-step automations that adapt to various deal workflows like CIM parsing. Use these automations via chat interface by dropping documents and asking questions.

No-code AI agents

Build multi-step automations that adapt to various deal workflows like CIM parsing. Use these automations via chat interface by dropping documents and asking questions.

Flexible integration options

Plug V7 Go into your deal sourcing tools, data room systems, or financial modeling systems. Our flexible API and native connectors make it simple to embed automated intelligence into your processes.

Flexible integration options

Plug V7 Go into your deal sourcing tools, data room systems, or financial modeling systems. Our flexible API and native connectors make it simple to embed automated intelligence into your processes.

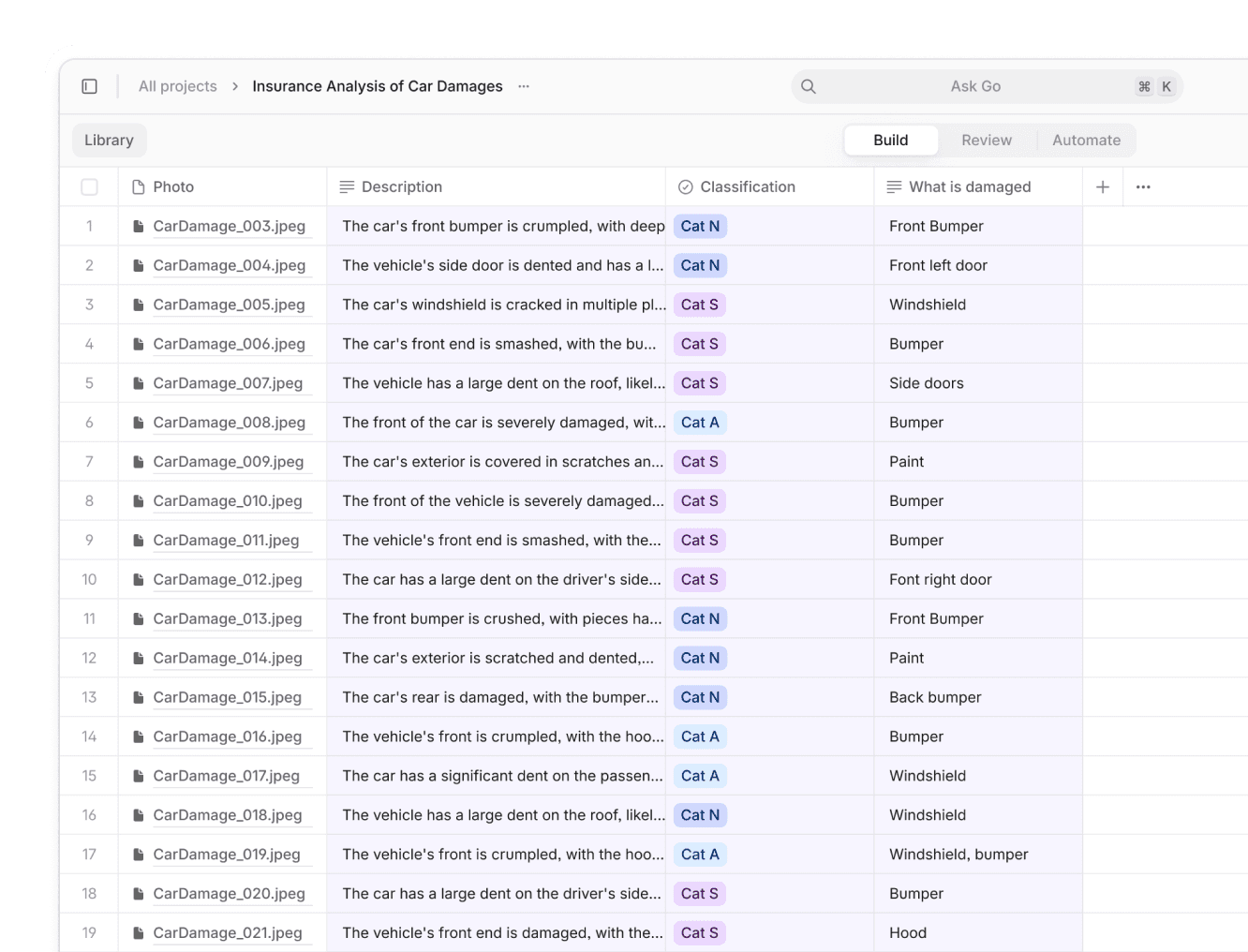

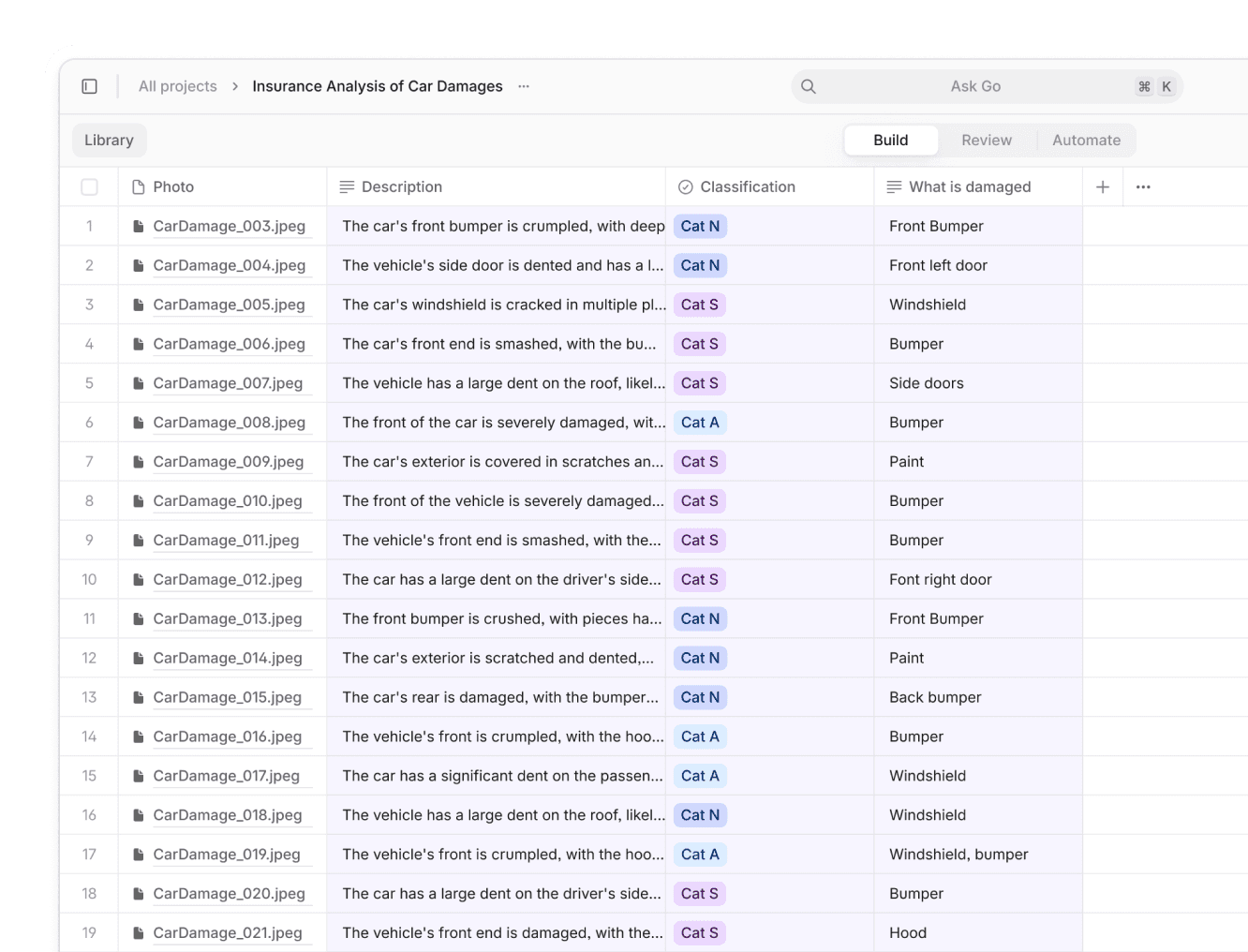

Multi-modal support

Analyze any file format—from scanned PDFs and Excel sheets to PowerPoints and even images of tables. Perfect for multi-format data rooms.

Multi-modal support

Analyze any file format—from scanned PDFs and Excel sheets to PowerPoints and even images of tables. Perfect for multi-format data rooms.

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Security

Scale with security

V7 is fully secure & compliant

SOC 2, ISO27001 and GDPR compliant

Role-based access control

Secure data handling

SOC 2 Type 2

ISO 27001

GDPR

Automate processes

Automate processes

Automate processes

Trustworthy finance AI

from intake to decision

Trustworthy finance AI

from intake to decision

V7 Go acts like a team of analysts. Speed up the whole process from deal screening to final memos.

Import your files

Xchanging

,

Crunchbase

,

Affinity

Pitch decks

Financial models

Market research reports

Competitor analysis

Customer contracts

Cap tables

Revenue growth rate

Customer acquisition cost (CAC)

Lifetime value (LTV)

Burn rate and runway

Market size and growth

Competitive landscape

Team experience and track record

Product-market fit indicators

Key risks and mitigations

Valuation and deal terms

Import your files

Xchanging

,

Crunchbase

,

Affinity

Pitch decks

Financial models

Market research reports

Competitor analysis

Customer contracts

Cap tables

Revenue growth rate

Customer acquisition cost (CAC)

Lifetime value (LTV)

Burn rate and runway

Market size and growth

Competitive landscape

Team experience and track record

Product-market fit indicators

Key risks and mitigations

Valuation and deal terms

Import your files

Xchanging

,

Crunchbase

,

Affinity

Pitch decks

Financial models

Market research reports

Competitor analysis

Customer contracts

Cap tables

Revenue growth rate

Customer acquisition cost (CAC)

Lifetime value (LTV)

Burn rate and runway

Market size and growth

Competitive landscape

Team experience and track record

Product-market fit indicators

Key risks and mitigations

Valuation and deal terms

No more manual, repetitive work.

Save hours on every deal.

Analysts stuck copy-pasting from PDFs to Excel

Hours spent verifying single data points

Valuable deals missed due to processing delays

Limited deal evaluation capacity

No more manual, repetitive work.

Save hours on every deal.

Analysts stuck copy-pasting from PDFs to Excel

Hours spent verifying single data points

Valuable deals missed due to processing delays

Limited deal evaluation capacity

No more manual, repetitive work.

Save hours on every deal.

Analysts stuck copy-pasting from PDFs to Excel

Hours spent verifying single data points

Valuable deals missed due to processing delays

Limited deal evaluation capacity

No more manual, repetitive work.

Save hours on every deal.

Automated data extraction and verification

Investment memos drafted in minutes

More time for strategic analysis

3x more deals evaluated with the same team

No more manual, repetitive work.

Save hours on every deal.

Automated data extraction and verification

Investment memos drafted in minutes

More time for strategic analysis

3x more deals evaluated with the same team

Learn more

Learn more

Knowledge work automation

Jul 17, 2025

Definitive Guide to AI Auditing Software for Accountants in 2025

Knowledge work automation

Jul 17, 2025

Definitive Guide to AI Auditing Software for Accountants in 2025

Document processing

Jul 16, 2025

AI for Offering Memorandum Review: Streamlining Due Diligence

Document processing

Jul 16, 2025

AI for Offering Memorandum Review: Streamlining Due Diligence

Document processing

Jun 17, 2025

AI Funding Prospectus Analysis: A Comprehensive Guide for Investors & Firms

Document processing

Jun 17, 2025

AI Funding Prospectus Analysis: A Comprehensive Guide for Investors & Firms

FAQs

FAQs

FAQs

Have questions?

Find answers.

Have questions?

Find answers.

How does V7 Go bring AI in deal sourcing to private market investment processes?

V7 Go uses large language models to parse the unstructured data that fuels most private market evaluations—think pitch decks, financials, and external market reports. By combining proprietary databases with predictive lead scoring, our platform delivers customized insights that speed up deal flow management and help identify promising targets early on. The system can generate numerical representations of deal structures, making it easier to spot red flags and plan portfolio construction strategies. For deeper, more specialized work, your in-house data science team can tune the platform to automate tailored emails during the due diligence process, making sure vital milestones aren’t missed.

+

How does V7 Go bring AI to portfolio management for private equity firms?

V7 Go delivers an AI-driven portfolio management experience by merging your internal metrics with external data integration, so you can maintain real-time oversight of each holding. The platform’s portfolio optimization tools include features for portfolio risk management, performance monitoring, and portfolio valuation, giving you deep visibility into both new and existing assets. And because V7 Go supports investment discovery and deal sourcing, you can seamlessly transition from investment screening and analysis to ongoing portfolio company reporting, all in one place. From asset allocation to tracking potential exit strategies, V7 Go centralizes the data you need for timely, well-informed decisions.

+

How does V7 Go bring AI to risk management in private markets?

V7 Go specializes in data extraction and summarizing information from documents—think due diligence materials, financial statements, and board reports—so you can quickly surface potential risk factors. While it doesn’t perform in-platform risk assessments, scenario analysis, or market forecasts, you can integrate those workflows via code snippets or webhooks. For instance, once V7 Go identifies key performance indicators (KPIs) or flags for fraud detection, you can seamlessly send that structured data into your existing risk governance or operational risk management solutions. By handling the tedious parts of investment analysis and collecting signals around portfolio risk trends, V7 Go supports deeper modeling efforts elsewhere—allowing you to respond more effectively to regulatory uncertainty, investigate synthetic data generation, and ultimately make more informed decisions on risk.

+

What are some future trends in AI for private markets to watch out for?

Fueled by machine learning algorithms and natural language processing (NLP), the future of AI implementation in private markets increasingly involves near-autonomous decision-making while still adhering to self-regulation practices. Investment decision-making benefits from more robust market analysis and portfolio valuation, with customer sentiment analyses providing additional context. Meanwhile, blockchain integration and enhanced cybersecurity play key roles in safeguarding data, and regulatory developments continue to shape how firms adopt AI solutions.

+

How does V7 Go handle regulatory compliance and data privacy for private markets?

V7 Go maintains strict data governance policies and supports regulatory compliance automation to help private market investors meet SEC regulations, GDPR compliance, and other global regulatory requirements. We enforce real-time compliance monitoring, conduct regular security audits, and ensure data quality and consistency throughout the entire performance reporting cycle. By prioritizing proprietary information protection and offering role-based access, V7 Go safeguards sensitive documents while accommodating diverse technology partners and talent needs—all with a clear audit trail to streamline audit reporting.

+

What does implementation and integration look like for a typical private equity firm?

We understand that technology partners and talent needs vary significantly across firms. Our SaaS-based solutions are designed for rapid POCs and MVPs, with flexible LLM APIs and hosting options that can support both in-house data science team requirements and standalone deployments. Most clients set up a quick proof-of-concept, ingesting a handful of CIMs or data-room docs in just hours or days.

+

How does V7 Go bring AI in deal sourcing to private market investment processes?

V7 Go uses large language models to parse the unstructured data that fuels most private market evaluations—think pitch decks, financials, and external market reports. By combining proprietary databases with predictive lead scoring, our platform delivers customized insights that speed up deal flow management and help identify promising targets early on. The system can generate numerical representations of deal structures, making it easier to spot red flags and plan portfolio construction strategies. For deeper, more specialized work, your in-house data science team can tune the platform to automate tailored emails during the due diligence process, making sure vital milestones aren’t missed.

+

How does V7 Go bring AI to portfolio management for private equity firms?

V7 Go delivers an AI-driven portfolio management experience by merging your internal metrics with external data integration, so you can maintain real-time oversight of each holding. The platform’s portfolio optimization tools include features for portfolio risk management, performance monitoring, and portfolio valuation, giving you deep visibility into both new and existing assets. And because V7 Go supports investment discovery and deal sourcing, you can seamlessly transition from investment screening and analysis to ongoing portfolio company reporting, all in one place. From asset allocation to tracking potential exit strategies, V7 Go centralizes the data you need for timely, well-informed decisions.

+

How does V7 Go bring AI to risk management in private markets?

V7 Go specializes in data extraction and summarizing information from documents—think due diligence materials, financial statements, and board reports—so you can quickly surface potential risk factors. While it doesn’t perform in-platform risk assessments, scenario analysis, or market forecasts, you can integrate those workflows via code snippets or webhooks. For instance, once V7 Go identifies key performance indicators (KPIs) or flags for fraud detection, you can seamlessly send that structured data into your existing risk governance or operational risk management solutions. By handling the tedious parts of investment analysis and collecting signals around portfolio risk trends, V7 Go supports deeper modeling efforts elsewhere—allowing you to respond more effectively to regulatory uncertainty, investigate synthetic data generation, and ultimately make more informed decisions on risk.

+

What are some future trends in AI for private markets to watch out for?

Fueled by machine learning algorithms and natural language processing (NLP), the future of AI implementation in private markets increasingly involves near-autonomous decision-making while still adhering to self-regulation practices. Investment decision-making benefits from more robust market analysis and portfolio valuation, with customer sentiment analyses providing additional context. Meanwhile, blockchain integration and enhanced cybersecurity play key roles in safeguarding data, and regulatory developments continue to shape how firms adopt AI solutions.

+

How does V7 Go handle regulatory compliance and data privacy for private markets?

V7 Go maintains strict data governance policies and supports regulatory compliance automation to help private market investors meet SEC regulations, GDPR compliance, and other global regulatory requirements. We enforce real-time compliance monitoring, conduct regular security audits, and ensure data quality and consistency throughout the entire performance reporting cycle. By prioritizing proprietary information protection and offering role-based access, V7 Go safeguards sensitive documents while accommodating diverse technology partners and talent needs—all with a clear audit trail to streamline audit reporting.

+

What does implementation and integration look like for a typical private equity firm?

We understand that technology partners and talent needs vary significantly across firms. Our SaaS-based solutions are designed for rapid POCs and MVPs, with flexible LLM APIs and hosting options that can support both in-house data science team requirements and standalone deployments. Most clients set up a quick proof-of-concept, ingesting a handful of CIMs or data-room docs in just hours or days.

+

How does V7 Go bring AI in deal sourcing to private market investment processes?

V7 Go uses large language models to parse the unstructured data that fuels most private market evaluations—think pitch decks, financials, and external market reports. By combining proprietary databases with predictive lead scoring, our platform delivers customized insights that speed up deal flow management and help identify promising targets early on. The system can generate numerical representations of deal structures, making it easier to spot red flags and plan portfolio construction strategies. For deeper, more specialized work, your in-house data science team can tune the platform to automate tailored emails during the due diligence process, making sure vital milestones aren’t missed.

+

How does V7 Go bring AI to portfolio management for private equity firms?

V7 Go delivers an AI-driven portfolio management experience by merging your internal metrics with external data integration, so you can maintain real-time oversight of each holding. The platform’s portfolio optimization tools include features for portfolio risk management, performance monitoring, and portfolio valuation, giving you deep visibility into both new and existing assets. And because V7 Go supports investment discovery and deal sourcing, you can seamlessly transition from investment screening and analysis to ongoing portfolio company reporting, all in one place. From asset allocation to tracking potential exit strategies, V7 Go centralizes the data you need for timely, well-informed decisions.

+

How does V7 Go bring AI to risk management in private markets?

V7 Go specializes in data extraction and summarizing information from documents—think due diligence materials, financial statements, and board reports—so you can quickly surface potential risk factors. While it doesn’t perform in-platform risk assessments, scenario analysis, or market forecasts, you can integrate those workflows via code snippets or webhooks. For instance, once V7 Go identifies key performance indicators (KPIs) or flags for fraud detection, you can seamlessly send that structured data into your existing risk governance or operational risk management solutions. By handling the tedious parts of investment analysis and collecting signals around portfolio risk trends, V7 Go supports deeper modeling efforts elsewhere—allowing you to respond more effectively to regulatory uncertainty, investigate synthetic data generation, and ultimately make more informed decisions on risk.

+

What are some future trends in AI for private markets to watch out for?

Fueled by machine learning algorithms and natural language processing (NLP), the future of AI implementation in private markets increasingly involves near-autonomous decision-making while still adhering to self-regulation practices. Investment decision-making benefits from more robust market analysis and portfolio valuation, with customer sentiment analyses providing additional context. Meanwhile, blockchain integration and enhanced cybersecurity play key roles in safeguarding data, and regulatory developments continue to shape how firms adopt AI solutions.

+

How does V7 Go handle regulatory compliance and data privacy for private markets?

V7 Go maintains strict data governance policies and supports regulatory compliance automation to help private market investors meet SEC regulations, GDPR compliance, and other global regulatory requirements. We enforce real-time compliance monitoring, conduct regular security audits, and ensure data quality and consistency throughout the entire performance reporting cycle. By prioritizing proprietary information protection and offering role-based access, V7 Go safeguards sensitive documents while accommodating diverse technology partners and talent needs—all with a clear audit trail to streamline audit reporting.

+

What does implementation and integration look like for a typical private equity firm?

We understand that technology partners and talent needs vary significantly across firms. Our SaaS-based solutions are designed for rapid POCs and MVPs, with flexible LLM APIs and hosting options that can support both in-house data science team requirements and standalone deployments. Most clients set up a quick proof-of-concept, ingesting a handful of CIMs or data-room docs in just hours or days.

+

Get started

AI assistant for deal evaluation

and financial analysis

Use V7 Go as an intelligent co-pilot for your team or deploy it silently via API to power end-to-end deal workflows. Book a demo to see how AI agents built for private equity, venture capital firms, and investment banks can handle your unstructured financial documents and complex analysis needs.

You’ll hear back in less than 24 hours

Next steps

AI assistant for deal evaluation

and financial analysis

Use V7 Go as an intelligent co-pilot for your team or deploy it silently via API to power end-to-end deal workflows. Book a demo to see how AI agents built for private equity, venture capital firms, and investment banks can handle your unstructured financial documents and complex analysis needs.