Document processing

29 min read

—

Apr 10, 2025

Content Writer

Setting: The accounting department at Dunder Mifflin's Scranton branch. The accounting team – Angela Martin, Oscar Martinez, and Kevin Malone – are at their desks.

Angela: [Noticing Kevin's screen] Kevin, what are you doing?

Kevin: I'm using this new AI tool to automate our expense reports.

Oscar: [Skeptical] AI? Kevin, are you sure that's a good idea?

Kevin: Yeah! It says it can do in minutes what takes us hours.

Angela: [Frowning] And you trust it with our financial data?

Kevin: Why not? It's the future!

Oscar: [Leaning over] Kevin, that's not an AI tool. That's a game of solitaire.

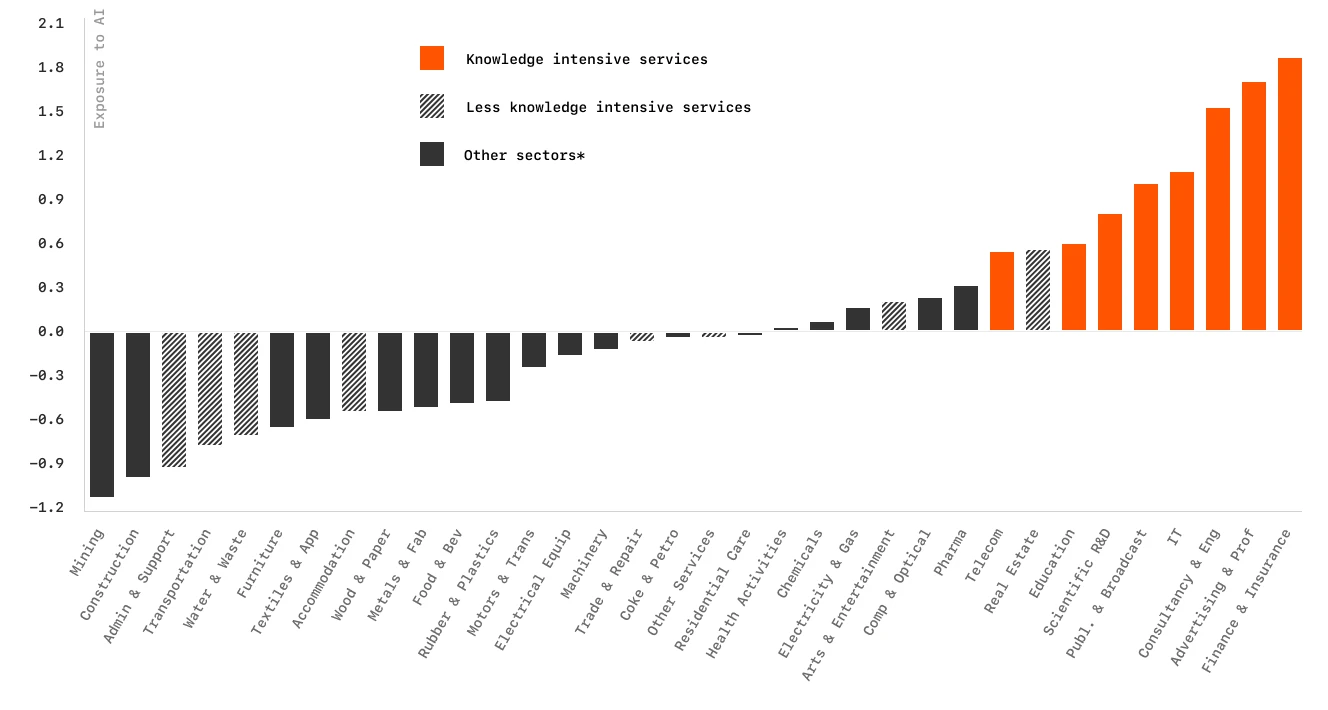

The accounting profession, not unlike the rest of the working world, is embracing AI.

But it’s a patchwork right now. AI-savvy accountants are saving time on individual tasks, but many of their more traditional coworkers are still out of the AI loop.

At the same time as AI tools are boosting productivity for one-off accounting tasks, applying more advanced AI systems to bigger-picture accounting processes is also gaining speed.

What does it all mean for getting value from AI in accounting right now? How can accounting teams use AI to deliver consistent results and boost productivity?

In this article, we’ll take a closer look at:

How artificial intelligence is retooling the accounting profession

The benefits of AI in accounting

Where and how to successfully implement AI in accounting

Which AI tools to consider using today

How AI is used in accounting

Even before the recent blockbuster adoption of generative AI tools, over the past five years or so AI was already making significant inroads in the accounting industry, helping to streamline processes and decision-making.

With the high value for the profession of accuracy, automating data entry and invoice processing with AI-powered OCR technology to handle data extraction and manipulation/transformation has delivered immense ROI by reducing hands-on time and manual error. And as intelligent document processing has evolved, automating complex data processing for accounting has only gotten better, faster, and easier.

AI for predictive analytics has powered more accurate financial forecasting, working with large amounts of historical data to find patterns, boosting budgeting processes and strategic financial planning.

In the audit and compliance arena, AI is invaluable because it can look at giant datasets and analyze every transaction and its context. The result is faster AND higher quality reporting. Similarly, detecting fraud became leaps and bounds more effective with AI on the case to sift through the minutiae of financial transaction data and catch anything fishy.

Another high-value AI application in accounting is tax. AI has simplified tax compliance by automating data collection, error checking, and form completion.

Fast-forward to today, and these specialized AI tools represent just the tip of the AI iceberg.

What’s new and now for AI in accounting

Generative AI and large language models (LLMs) like GPT-4 continue to surprise and delight as new ways to use them in business applications are launched every day. In the field of accounting, just a few examples would be:

Drafting financial reports

Cash flow monitoring and expense management

Tax preparation and compliance

Data validation and expense policy enforcement

Engaging clients with personalized interactions and information

Integrating with business systems like ERP for deep data analysis and flexible process automation

What stands out is how well AI systems can manage growing amounts of data. That translates to a lot of time savings for accounting teams because as process and data volumes increase, there is no need to proportionally increase staffing.

AI adoption rates: Who's ahead of the curve, and who’s behind

Not everyone has jumped on the AI for accounting bandwagon yet, in fact 73% of accounting leaders admitted to not using AI at all last year.

But professionals are keen to get started: A full 84% of tax and accounting professionals see AI as a positive force in their field, eager to realize anticipated time savings of nearly 200 hours a year.

At the firm level, the AI-in-accounting race is heating up, with Big Four firms bringing on bigwigs from the tech world to up their chances of getting ahead with AI.

AI strategy among accounting professionals may be led by larger firms, but the opportunity to adopt AI tools and realize AI’s potential in accounting is a wide open garden of opportunity no matter the size of the firm or accounting team. AI-driven automation is not just accessible– it’s downright easy.

AI and accounting: A match made in spreadsheet heaven

Let's face it—nobody became an accountant because they loved typing numbers into cells for hours on end. That's why AI is such a game-changer.

Across the many specializations and subfields in accounting, there is one thing they all have in common: Processes that are document and data-intensive. Which is the undisputed strength of AI automation and intelligent document processing (IDP) technologies.

Financial accounting

AI can help prepare or analyze financial statements, including balance sheets, income statements, and cash flow statements, collecting, processing, and analyzing documents and data from things like general ledgers, trial balances, journal entries, and transaction records.

The value: Faster, more accurate and comprehensive insight into financial performance and position. Which makes important stakeholders–like investors, creditors, and regulatory bodies–happy.

Management accounting

Making informed, effective decisions at the management level requires better budgeting, forecasting, and internal financial analysis.

AI is a natural here, easily automating data-heavy analyses like variance and cost-benefit analyses, rolling forecasts, predictive cash flow analysis, and anomaly detection in cost structures, to speed and improve the accuracy of budget and internal financial reports, and better serve the needs of strategic planning, allocating resources, and assessing business performance.

Payroll accounting

Accurate payroll processing is core to keeping any company on track, both by maintaining employee satisfaction and staying compliant with labor laws across jurisdictions.

Applying AI makes it possible to automate processing all kinds of supporting documents and data – employee time sheets, payroll registers, tax withholding and benefits enrollment forms – to quickly and accurately calculate salary/wage payments and relevant deductions as well as bonuses.

Tax accounting

Between changing regulations and ever-increasing documentation, tax compliance can feel like navigating a maze blindfolded. You're tasked with guiding clients through this complexity—filing returns, strategic tax planning, and ensuring regulatory compliance across the board.

Here's the secret: we know tedious, detail-oriented processes aren't what drew anyone to accounting. So it’s no surprise AI is making a big difference in tax accounting. Quick, accurate document processing of returns and receipts is helpful for sure. What’s even bigger is using AI to track the details and changes in tax laws, especially when the business operates across regions with separate tax obligations.

AI offers a major win here – better tax compliance means reducing liabilities and avoiding penalties and fines.

Auditing

Auditing is all about ensuring accuracy, transparency, and compliance in financial records. To say that getting to the level of detail needed to verify everything about every transaction was time-consuming would be an understatement: Reviewing countless financial statements, audit trails, internal control documents, and compliance reports is tedious at best and error-prone at worst.

When AI steps in, things look a lot different. AI tools are unrivaled at analyzing massive amounts of data, identifying anomalies, and flagging inconsistencies faster than human reviewers. Beyond speed, these systems enhance accuracy by pinpointing errors or irregularities that might otherwise go unnoticed.

We're still in the honeymoon phase of AI adoption within audit teams—perhaps something similar to how things felt following Microsoft Excel’s birthday in 1985 —but the immediate benefits are already clear. Fast, trustworthy audits give stakeholders confidence in the accuracy of financial reporting and the integrity of internal controls.

Accounts payable and receivable

For accounting teams, the monthly close can feel like Groundhog Day: the same repeating cycle of matching invoices, tracking down approvals, and reconciling discrepancies. But within organizations, manually handling outgoing payments and chasing overdue invoices still eats up valuable time for AP and AR teams. The good news is that managing invoices, purchase orders, payment receipts, and aging reports can now be automated with AI-powered systems.

AI enables intelligent invoice scanning and data extraction, ensures duplicates are flagged, and assists in reconciling payment records. It can even predict late payments using historical data, so AR can get in front of them. AI models can prioritize collection strategies by assessing client payment behaviors and predicting future cash flow.

The best part is that along with better supplier relationships and more optimal liquidity management, teams are free to focus on building better financial strategies.

Inventory accounting

Whoever thinks inventory management doesn’t sound glamorous clearly doesn’t understand its starring role in financial reporting and operational success.

However, keeping track of inventory counts, valuation reports, and cost of goods sold calculations is no easy task, especially for businesses with complex supply chains.

AI brings clarity and efficiency to inventory accounting. From real-time inventory tracking using advanced algorithms to automating inventory valuation processes, AI simplifies tedious calculations and reduces errors. It can also spot trends and recommend just-right stocking levels, balancing supply with demand while avoiding overstocking or stockouts.

Fixed assets accounting

Managing long-term assets like machinery, property, and equipment requires meticulous documentation to comply with accounting standards and establish proper valuation.

Asset registers, depreciation schedules, and maintenance logs are music to AI’s ears. For fixed assets accounting, AI can automate tracking and classifying assets, managing depreciation schedules, and also provide predictive insights for maintenance requirements.

For large organizations with thousands of assets, this level of automation makes a massive difference – improved accuracy in asset valuation, better regulatory compliance, and reduced resource drain on accountants, allowing teams to focus on strategic growth opportunities.

As this still just-scratching-the-surface list shows, the breadth and depth of use cases and applications of AI across accounting is staggering. And without any insight into what is actually going on behind the scenes, it can all sound a bit like magic.

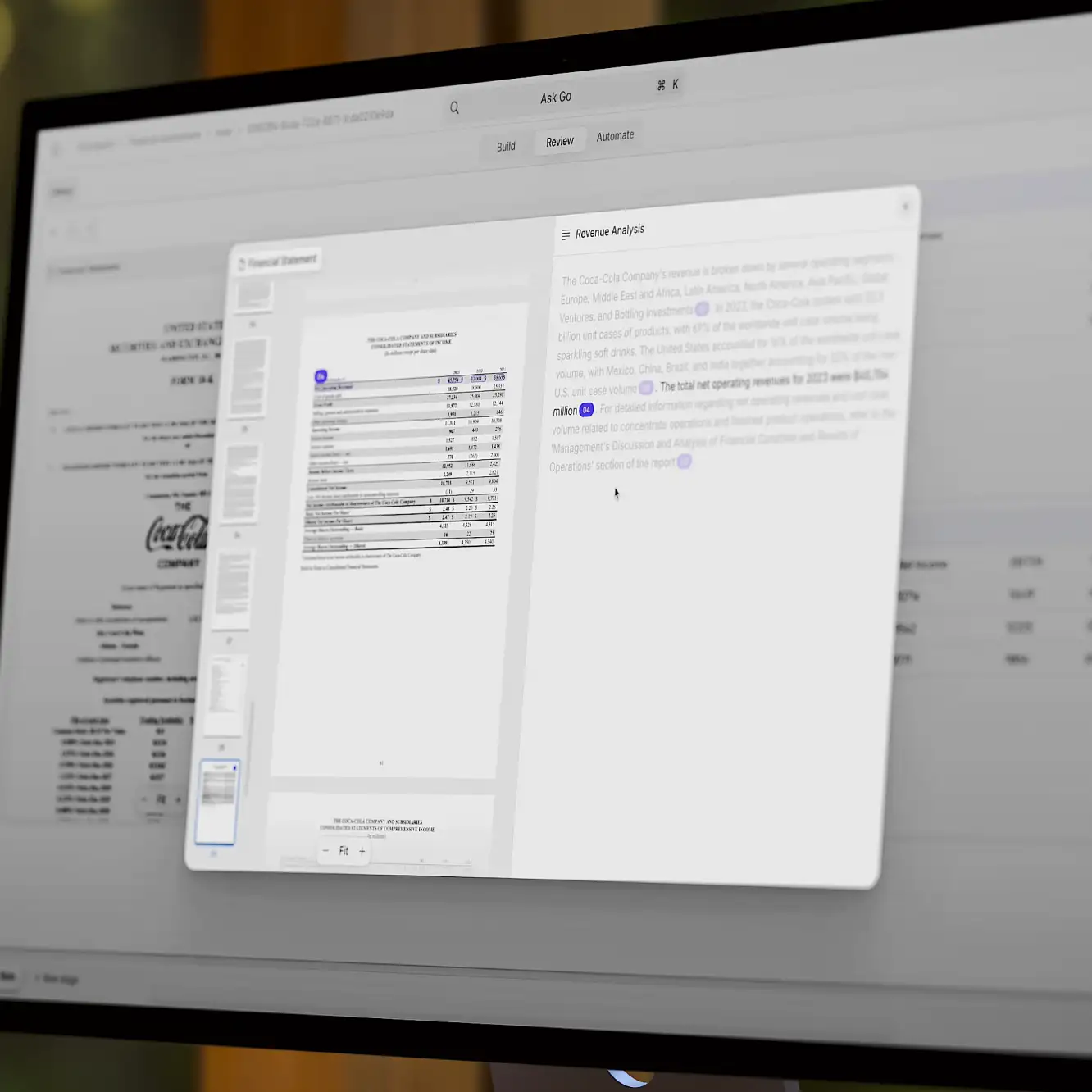

Pulling back the curtain, many of the use cases for AI in accounting are made possible by AI agents. In solutions like V7 Go, for example, you work with AI agents through a familiar chat window. The AI agent takes inputs – the invoices, tax forms, or financial statements you upload – and connects directly with your data and software applications to find and execute its assigned tasks, like extracting key details, cross-references data, or flagging discrepancies. And then it returns answers and results back to you through your natural chat conversation.

So, the big question is, what technologies ensure those outputs are accurate and reliable? Don’t be dismayed by the dizzying number of AI tools and technologies. While the landscape of solutions – and the hype – expands daily, it’s still possible to boil things down to the AI technologies that matter for accounting.

Examples of AI technologies and what they do in accounting

If we take a peek under the hood, there are several core underlying AI technologies powering the automation of accounting workflows. And, just like an engine that includes many specialized parts to become a high-speed driving machine, keep in mind that AI automation platforms for accounting combine AI tools and tech to create a complete solution.

So – let’s break it down:

Intelligent document processing (IDP)

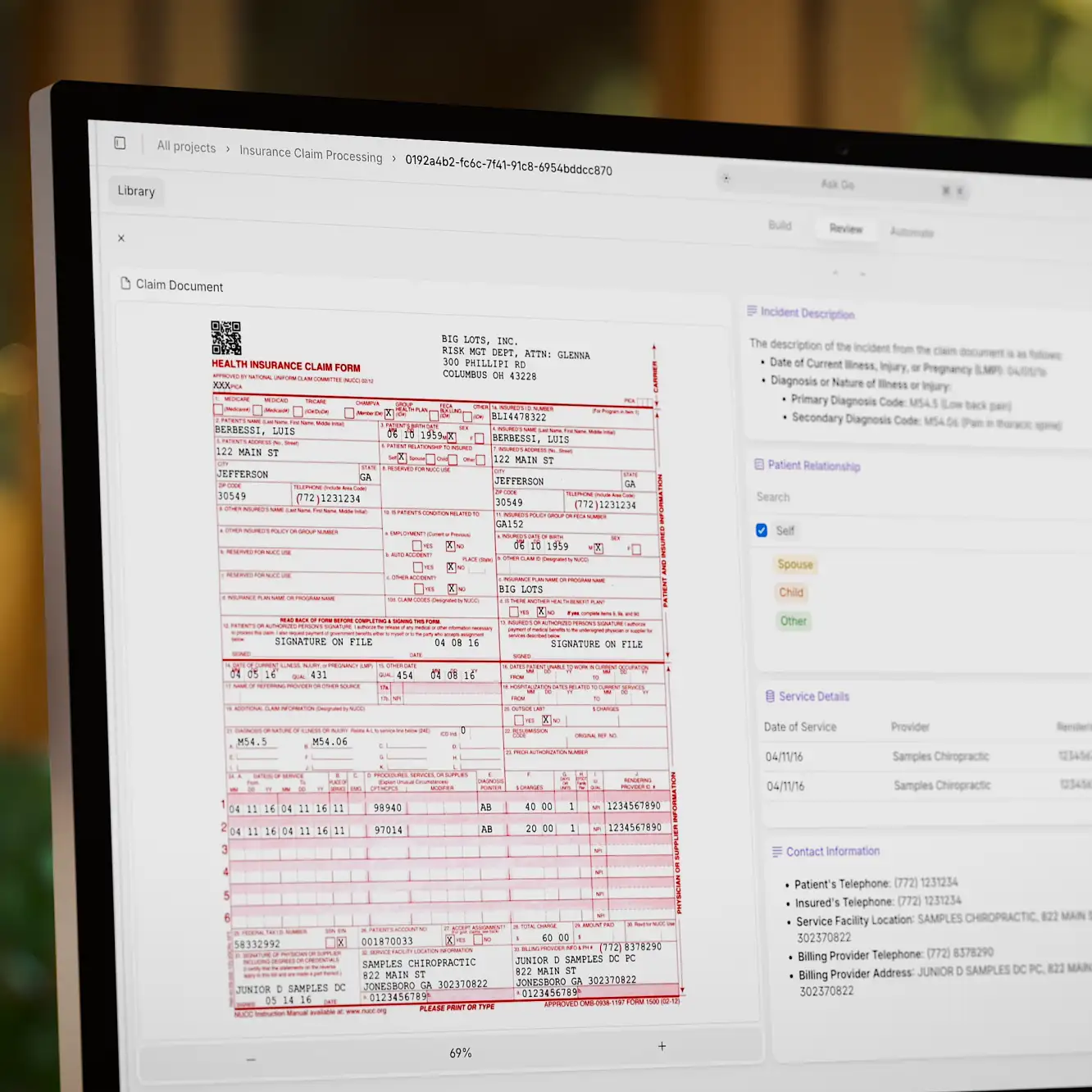

IDP combines AI with OCR (optical character recognition) and NLP (natural language processing) to extract, categorize, and process data from physical and digital documents. Modern AI platforms like V7 Go now integrate generative AI (GenAI) for improved document understanding and analysis, offering a more comprehensive approach to document processing.

Accounting is a document-heavy field, with invoices, receipts, contracts, and financial statements being just a few examples.

How it works: Documents are scanned or uploaded into the IDP tool, which applies AI models, including LLMs and foundation models, to extract, categorize, and process data. These advanced models understand context and preserve relationships between data points. The IDP system validates the data for accuracy and integrates it into accounting systems. Human-in-the-loop features are valuable here for quality assurance.

Common use cases:

Automating invoice processing by extracting payment details.

Reconciling financial transactions faster by scanning documents like receipts.

Improving tax compliance by digitizing and categorizing forms and returns, utilizing AI's capability to manage complex layouts and unstructured data effectively.

Top tools: V7 Go stands out as a platform supporting multiple AI models for flexible implementation. Other vendors include: ABBYY FlexiCapture, Hyperscience, and Kofax.

AI chatbots

Chatbots act as virtual assistants, and while they are a familiar face in customer-driven interactions, there are high-value applications for internal teams, too. Accounting teams might use internal-facing AI chat tools to search financial data, for example. Because they are powered by conversational AI, they understand and help with tasks based on natural language commands, making them an accessible way for teams to use AI.

How it works: Chatbots use NLP to interpret user queries and take predefined actions, such as generating reports or retrieving financial data. For example, a finance team could ask a virtual assistant to "fetch all overdue invoices from last quarter." More advanced AI chatbots today employ AI agents, which expands their usefulness as they can learn, adapt, and get tasks done more autonomously.

Common use cases:

Responding to vendor queries about payment status or accounts.

Assisting employees with payroll-related questions.

Guiding teams through complicated processes like regulatory compliance reporting.

Top tools: Amelia, Kore.ai, UiPath Assistant, and IBM Watson Assistant.

AI agents

AI agents represent a leap forward in automation. Combining adaptability and action, they are the breakout stars of AI applications, where they are particularly effective in data-heavy, process-driven environments like accounting, bridging the gap between document processing and automation.

AI agents completely upend the status quo for speed and accuracy of handling and interpreting large amounts of data, making real-time, accurate decision-making across accounting, finance, auditing, and compliance functions, the new normal.

How it works: AI agents begin by analyzing the task at hand and deconstructing it into smaller, manageable steps. For each step, the agent determines the appropriate tool or data source, such as APIs, databases, or machine learning models, to execute the operation while retaining an understanding of the broader task context.

Common use cases:

Automating financial report and investment memo generation by extracting key data and analyzing trends across documents.

Streamlining auditing by cross-referencing and validating data in bulk against established norms or regulations.

Enhancing compliance by analyzing and verifying data across multiple sources to identify discrepancies or ensure adherence to policies.

Improving research workflows by integrating and analyzing unstructured data from documents, audio files, and web sources for domain-specific insights.

Top tools: V7 Go, UiPath, Pega, and Automation Anywhere. V7 Go offers both pre-built and custom AI agents so users can deploy ready-made agents for common workflows, such as invoice processing or auditing, or customize agents for specialized accounting tasks without requiring deep technical expertise.

What does that look like?

Here is an example:

In the video above an AI agent in V7 Go analyzes a quarterly financial report, identifies relevant metrics, and generates a report with insights. You can ask follow-up questions or use different agents to perform additional tasks within the same interaction.

Generative AI

GenAI is a subset of machine learning that has fast become the new side-kick to human expertise. Most people are familiar with GenAI as a chat-based experience, like ChatGPT, to help find, organize, summarize, and of course generate content. In a business context, it’s often associated with content generation for marketing or sales, but it is equally valuable (if not more so) in areas like human resources and finance.

How it works: Generative AI models are a broad category of artificial intelligence designed to create content, such as text, images, or code. LLMs are a specific type of generative AI focused on processing and generating human-like text. They can comprehend and process natural language, enabling them to extract critical details from financial documents, summarize complex regulations, and validate client data. They also interact with users in plain language, making them accessible to professionals without technical expertise.

Common use cases:

Automating tax compliance tasks by condensing regulations and preparing accurate reports.

Streamlining accounts payable and receivable by efficiently extracting and processing data from invoices and receipts.

Boosting financial reporting capabilities by generating reports with contextual insights.

Top tools: The leading direct-to-consumer GenAI are OpenAI's GPT models, and Anthropic's Claude. But for applications of GenAI in an accounting context, look for solutions that leverage its capabilities within a larger, secure platform, like V7 Go.

Predictive Analytics

Predictive analytics is an application of advanced machine learning algorithms to analyze historical data and forecast future trends. This technology is at the core of tools that help accounting teams identify patterns, anticipate challenges, and make data-driven decisions.

How it works: Machine learning models process historical financial data to identify factors that impact future outcomes, such as cash flow trends or customer payment timelines.

Common use cases:

Forecasting revenue or financial performance.

Enhancing accounts receivable processes by predicting payment delays.

Optimizing budgeting and resource allocation.

Top tools: Microsoft Power BI, Tableau (with Einstein Discovery), and Alteryx.

Robotic Process Automation (RPA)

RPA on its own is not an example of AI. Rather, its strength is automating rule-based tasks, such as data entry and reconciliation, which are predictable processes which can be time-consuming and prone to human error. That said, RPA is a real asset when paired with AI; it becomes a go-to tool for reliably executing tasks where AI does the ‘thinking’ to handle dynamic data and decisions.

How it works: RPA bots are configured to replicate repetitive accounting tasks, like copying data from invoices into accounting software. When powered by AI, these bots can also correct errors or make recommendations.

Common use cases:

Automating payroll processing across regions.

Reconciling accounts payable and receivable more efficiently.

Generating routine monthly or quarterly reports.

Top tools: UiPath, Automation Anywhere, and Blue Prism.

Natural language processing (NLP)

NLP enables systems to understand and analyze human language in text and speech. With its application in accounting, NLP helps extract insights from unstructured text data, such as emails or contracts, and conduct sentiment analysis.

How it works: NLP algorithms process written or spoken language to identify relevant accounting information, such as figures, compliance requirements, or deadlines. The tool then integrates this information into relevant workflows.

Common use cases:

Extracting key clauses from financial contracts to ensure compliance.

Summarizing reports for faster decision-making.

Analyzing customer feedback to improve financial services.

Top tools: OpenAI, Google Cloud Natural Language AI, and Amazon Comprehend.

ML pattern recognition

Machine learning pattern recognition is all about analyzing past information to learn what’s "normal" to become hyper-effective at spotting anything that doesn’t fit. This technology powers everything from facial recognition to spam filters, but it’s also making waves in accounting, helping to catch errors and fraud. By recognizing deviations from expected behaviors, these systems can boost accuracy, mitigate risk, and strengthen compliance efforts.

How it works: In accounting, ML models are trained on historical financial data to recognize typical transaction patterns. When something unusual pops up — like an expense report that doesn’t match spending habits or a sudden, unexplained change in financial statements—the system flags it for review. This helps accountants and compliance teams step in before minor errors or problems have time to morph into significant risks.

Common use cases:

Spotting fraudulent expense claims.

Detecting irregularities in financial statements.

Enhancing internal controls by identifying vulnerabilities in real-time.

Improving compliance to financial reporting standards by highlighting inconsistencies.

Top tools: Popular accounting solutions that use ML-based pattern recognition include SAS Fraud Management, FICO Falcon Fraud Manager, and ThetaRay.

Machine learning integrations with ERP systems

Many enterprise resource planning (ERP) systems now employ machine learning to automate core accounting functions, enhance accuracy, and provide actionable insights.

How it works: Machine learning models are embedded directly into ERP systems, where they analyze real-time data across accounts to offer recommendations or automate processes like journal entries.

Common use cases:

Automating reconciliation of interdepartmental accounts.

Identifying opportunities to optimize costs in procurement processes.

Generating dynamic insights into working capital management.

Top tools: SAP S/4HANA, Oracle NetSuite, and Microsoft Dynamics 365 Finance.

So many AI tools, so little time

It all adds up to a robust (and ever-growing) ecosystem of AI technologies. But while it’s helpful to understand technologies on their own – what their distinct capabilities are, and how they apply to specific accounting challenges – the most value can be gained when they work in concert.

For example, combining IDP's document extraction capabilities with AI agents' decision-making and RPA's execution creates an end-to-end solution that can process invoices, validate data against policies, and update financial systems with minimal human intervention.

Combining complementary AI technologies rather than using isolated tools is where the future of accounting automation is going. Modern platforms like V7 Go exemplify this philosophy by bringing multiple AI capabilities under one roof to create solutions that deliver benefits for accounting that are far greater than the sum of their parts.

The payoff: Benefits and impact of using AI for accounting

In case you felt pressured to implement AI just to look cool or seem “with it”, fear not: Implementing AI delivers real benefits that make the investment worthwhile for both individual accountants and accounting firms. Who wouldn’t want to reduce overhead, achieve faster turnarounds, and get better client retention?

The point is, AI technologies are reshaping accounting processes and the role accounting professionals play. AI tools can slash data processing times by up to 80%, which means no more late nights reconciling accounts or manually entering data. Your family might actually remember what you look like during busy season.

But in all seriousness, applications of AI in accounting are making it possible for accounting teams to refocus on high-level strategy and business growth.

The gold standard: Efficiency and productivity

If you had to sum it up into one thing, it might be that AI means working smarter, not harder (or longer). AI makes it simple to achieve both high speed and accuracy with end-to-end automations of repetitive tasks like data entry, invoice processing, and reconciliations.

AI tools like V7 Go reduce data processing times by up to 80%, enabling accounting teams to meet month-end faster, without compromising quality.

Fewer facepalm moments: Improved accuracy

We all make mistakes, but AI makes fewer of them — especially when it comes to data entry and calculations. By minimizing manual intervention, AI reduces the likelihood of errors in financial records, leading to more reliable data. And fewer errors means fewer awkward emails explaining why the numbers changed – and fewer weekends spent fixing mistakes.

The right insights at the right time: Real-time advanced data analysis

One of the pain points of traditional accounting is delivering business-critical insights when it's too late to act on them.

AI-powered systems can analyze large datasets in real time to find trends and generate predictive insights – right now. That means businesses can make decisions while they still matter.

Another high-value part of this story is that AI enables the analysis of entire datasets rather than samples, making every analysis more thorough, with particular value for audits and continuous financial transaction monitoring to catch anything off-side, as it happens.

Saving money

Get to deliver more of the good news your boss is hoping for: More money in the bank. AI-driven automation leads to reduced labor costs and faster processing times, contributing to overall cost reductions.

Yes, implementing AI requires spending money to make money. But the math checks out:

Less time spent on routine tasks = more time for billable work

Fewer errors = fewer costly fixes

Ability to handle more work/clients without hiring more staff

More time for high-value services

For expense management alone, AI delivers must-have time, money – and sanity – savings:

Categorize expenses automatically (no more guessing which client that lunch was for)

Flag those $500 "team building" charges at the golf course

Process reimbursements before employees start sending passive-aggressive emails

See who's spending what (and whether it's worth it)

Last but certainly not least: Regulatory compliance

Compliance is an example of an extremely valuable application of AI’s ability to process immense amounts of information. AI tools review regulations – including all the fine print and ongoing changes – to keep accounting processes updated, automatically.

But wait, there’s more

AI in accounting delivers knock-on effects that also make a significant impact. For example, better employee satisfaction and retention from working on more meaningful, value-added tasks.

Callout: Remember when preparing financial reports meant late nights, takeout dinners, and questioning your career choices? AI tools like V7 Go are changing that narrative, processing reports 21 times faster than human fingers can type. Your work-life balance sends its thanks.

Scalability is another. Without a proportional impact on resources, AI systems can keep up the pace as process and data volumes increase.

Client and supplier relationships also benefit, whether directly through AI-enhanced experiences like getting instant answers via a chatbot, or by making it possible to directly connect with a real-life accountant (because they now have the time to reply to their email).

So which accounting AI tools should you choose?

Time to talk shop: The best AI tools for accounting are the ones that can do the most for you while asking the least from your teams (including IT).

Setting up and using powerful AI applications in accounting no longer requires a data science degree – or any special technical knowledge at all. Look for advanced tools that are simple to work with, from implementation and training to customizations, integrations, and security.

V7 Go: V7 Go balances powerful AI capabilities with human expertise to boost productivity while maintaining essential oversight in decision-making processes. It has document-reading superpowers, achieving 99% accuracy. And its spreadsheet-like interface will feel like home to any accountant.

V7 Go's unique features include:

Transparency and customization, enabling users to modify prompts and use different tools.

A model-agnostic approach, supporting a variety of AI providers and models.

A workflow designer tailored for complex business processes.

Continuous quality control and human-in-the-loop features for improvement.

Support for multimodal AI, accommodating all data types and layouts.

Secure, private, and compliant operations, for water-tight data privacy and regulatory compliance.

SAP: A global leader in enterprise software, SAP offers AI-driven solutions for accounting and finance, including intelligent document processing capabilities. Their extensive customer base and integrated solutions position them as a major player in the AI accounting market.

Intuit Inc. (QuickBooks): Known for QuickBooks, Intuit provides AI-powered accounting solutions for small to medium-sized businesses. Their tools automate financial tasks and offer insights, making them a key competitor in the AI accounting market. QuickBooks Online is often noted for its extensive integrations and more significant market presence, while FreshBooks is praised for its simplicity and customer service.

Docyt: Pronounced ‘docket’, Docyt provides AI-powered bookkeeping software that automates data entry, document processing, and financial workflows. Their accounting automation software offers a comprehensive suite of tools that use machine learning algorithms and artificial intelligence.

Trullion: Specializes in automating lease accounting, audits, and revenue recognition. Its platform leverages AI to extract data from lease contracts and streamline financial reporting, ensuring compliance with standards like ASC 606 and IFRS 15.

These are of course only a small selection of the variety of AI-powered tools available for accounting. But the bottom line is that the best solutions are those that maximize capabilities while minimizing complexity. Today’s AI solutions are made for ease of setup and use, without compromising on AI sophistication.

Yes, “easy” is by definition easier said than done, but with a clear-eyed approach to getting started, implementing AI can be a smooth, not to mention high-value, experience.

How to implement AI in accounting (and avoid common roadblocks)

The truth is, accounting teams are likely already using many AI-enhanced tools without even realizing. But to gain its full value and merge into the fast lane with the rapid acceleration of AI, taking an informed, strategic approach is key.

A few tips:

Don’t be afraid to ask: Pestering AI solution providers with questions is a great way to gain insider knowledge and understand how to make the most of emerging features and best practices. Really, don’t be shy to book a call and get answers to your questions, big or small.

Blend expertise from accounting, IT, and functions/business units to choose AI applications that fit the organization’s unique needs.

Is it boring? Automate it.

Start by identifying tasks that feel like chores—think data entry, invoice processing, and transaction categorization. These repetitive workflows are prime candidates for AI automation.

Train your AI A-team

Instead of replacing accountants, AI is giving them a promotion: from data entry clerks to financial strategists. Help your team see that AI is taking away the boring parts of their job, not the important parts.

Invest in training and continuous learning to keep pace with AI advancements, but don’t expect AI miracles to materialize overnight.

Give your team time to learn and adopt new tools and ways of working

Rushing implementation leads to resistance and errors. Consider a phased approach where there is time to get comfortable with one AI tool or use case before introducing another. Avoid tracking progress by deadlines alone.

Start small before going all-in

Begin with low-risk, high-reward AI applications like automating bank reconciliations or expense categorization. This builds confidence before tackling more complex implementations.

Find the tech enthusiasts in your office and let them help others

Identify internal champions who naturally gravitate to new technologies. Create a formal or informal "AI mentorship" program where these enthusiasts can guide colleagues through real-world applications. Consider creating "innovation time" where these individuals can showcase successful AI implementations. where they can explain benefits in practical terms that may resonate far better than technical documentation or vendor demonstrations.

Remember that temporary awkwardness leads to long-term gains

The learning curve with AI tools isn’t about technical knowledge, it’s about changing the way things have always been done. Getting to this deeper change takes persistence – but it will pay dividends, both for the organization as well as at the individual/professional level. Remind staff that learning AI skills now positions them for future career growth as the profession evolves.

[create visual with checklist type of chart:

To-do list for skills development and change management:

Create mandatory AI literacy training

Develop role-specific AI competency modules, and continuous learning expectations

Address potential workforce anxieties and demonstrate AI as an augmentation tool

Create transparent communication channels about AI implementation and feedback loops for AI tool refinement

Identify and train AI advocates across departments

Build an AI strategy

Scratching out a strategic plan for AI in accounting makes it easier to evaluate how each idea and initiative fits in. Given the pace of change in AI technology and application, these plans will change. But without anything to orient the journey around, integrating AI might never get off the ground at all. Smart, flexible planning and continuous learning are central to successful AI integration in accounting.

Consider taking the good ol’ phased approach, starting by piloting AI in low-risk, high-potential areas. Then iterate on the successes (and failures) to improve and inform where to go next. These kinds of experiments lay the foundation for defining measurable milestones and KPIs that you’ll use going forward.

Assess AI tools for:

Integration capabilities

Scalability

Compliance features

Vendor reputation

Security protocols

And because change is the only constant, plan regular technology and process reviews with the expectation that new advances and business needs will be worked in, potentially shifting existing plans quite a bit. Remember to allocate budget to make it possible to act on these changes and innovations.

Good data and good governance

It’s true that AI thrives on quality data. And the barrier to implementing AI solutions used to be getting the data ready. But now, AI tools can single-handedly turn messy documents into a data goldmine, which shifts the focus to governance: Robust data governance policies are necessary to maintain data integrity, security, and compliance.

Make sure your AI platforms take security seriously, including encryption and access controls and compliance certifications like GDPR, SOC2, and HIPAA. Tools like V7 Go build security in from the ground up.

Good governance extends to ethical AI use, too. Beyond developing bias detection and mitigation strategies, this also includes establishing transparent AI decision-making processes and accountability mechanisms.

How AI is impacting accounting jobs: Evolution, not extinction

Despite fears that AI might make accountants obsolete, the reality is more like a superhero origin story—accountants aren't disappearing, they're evolving.

Tomorrow's accounting rock stars will blend financial expertise with tech savvy to provide strategic guidance and ensure the AI is making the right decisions. The most valuable accounting skills involve judgment, relationships, and strategic thinking—things that AI makes people better at.

For junior roles, that means less data entry and more technology management. Mid-level positions will focus more on making sense of data rather than just collecting it. And senior roles will be even more about strategy (and less about checking decimal places).

Entry-level accountants: Embracing the AI sidekick

For those just starting out, their role will include working in tandem with AI to increase individual productivity, as well as overseeing AI handling repetitive tasks, like invoice processing. Developing skills in data analysis and effective communication will be valuable to help with interpreting AI-generated information and presenting it in a compelling way.

Senior accountants: Steering the AI-enhanced ship

Seasoned professionals are finding AI an ally for navigating complex financial landscapes. Using AI’s ability to deliver real-time insights and predictive analytics, senior accountants can transition from traditional oversight roles to strategic advisory positions. The path to success will be about learning how to embrace AI tools to effectively identify trends and forecast outcomes in order to guide organizational strategy.

CFOs: Writing the AI playbook

The proverbial AI buck stops (or should it be, starts) with Chief Financial Officers (CFOs). Not just the accounting team, but the organization as a whole, needs them to provide clarity of vision, and supporting budget, for harnessing AI.

The CFO will share ownership of AI strategy for the business, ensuring that AI investments drive value and support business objectives.

What’s next?

Looking ahead, the most valuable accountants will become strategic interpreters and contextual analysts, leveraging AI tools to deliver high-value insights.And smart accountants are capitalizing on this potential today, already putting AI agents to work.

In the near team, networks of coordinated, collaborative AI agents will be able to manage even more complex, long-running accounting workflows.

As AI capabilities expand exponentially, the primary challenge for accounting firms will not be the technology itself, but their ability to seamlessly integrate diverse AI solutions.

This is where flexible, AI-agnostic platforms like V7 stand out, already able to automate document processing with whopping 99% accuracy. By connecting data and chaining multiple AI models,V7 Go can tackle data extraction, summarization, and complex reasoning tasks in exactly the ways accounting wants.

Curious about how V7 Go can fit into your accounting workflows? Consider scheduling a demo to see it in action. It's just like test-driving a sports car, but for your accounting operations.

Get a free demo today and see how AI can make your accounting life easier (and more fun!).

With more than a decade of experience in cloud and AI, Rachel is a product marketing veteran specializing in connecting technology with real-world impact. A recognized thought leader in emerging technologies, Rachel writes extensively about work tech, applied AI, Intelligent Document Processing (IDP), and agentic automation.