AI implementation

16 min read

—

Apr 7, 2025

Content Creator

You know what’s funny in 2025? I can use AI to generate a complex table that summarizes the pros and cons of something in seconds. Then I try to copy/paste it into a Google Doc table, and it breaks the formatting, or forces me to sync it with a Spreadsheet table and do 10 other different, infuriating things that will ultimately just force me to copy the whole thing manually, cell by cell.

With that in mind, let’s take a look at a typical day for a finance professional in the year 2025.

It's Monday morning at a mid-sized private equity firm. Sarah, a senior financial analyst, arrives early to tackle the quarterly reporting cycle that has just begun. Her inbox is already filled with updates from portfolio companies—some as standardized Excel templates, others as custom spreadsheets with idiosyncratic formatting, and still others as narrative PDFs burying key metrics within pages of text.

She sighs, knowing what's ahead: weeks of tedious data extraction, manual reconciliation, late nights fixing formula errors, and the inevitable last-minute revisions when someone catches a discrepancy between page 37 and page 112 of a consolidated report.

The irony isn't lost on her. Many firms have already started piloting sophisticated AI for finance and investment screening, yet here she is—highly educated, well-paid—about to spend most of her waking hours for the next three weeks essentially copying numbers between documents, and especially into this 10-year old half-broken Excel held together with duct tape and prayers.

How is it possible that in 2025, the age of generative AI, this fundamental aspect of financial operations remains so stubbornly manual?

In this article, we’ll explore:

Key obstacles to fully automated investor reporting

Can AI solve these challenges or will it just create more problems?

How to implement generative AI and LLMs for financial reporting

Even in the age of generative AI, investor reporting is riddled with complexities that hinder full automation. In the next section, we'll dive into the key obstacles that prevent firms from streamlining operations and reporting with document processing software.

Investor reporting is the structured process of compiling, analyzing, and delivering financial and operational information to investors, stakeholders, and regulatory bodies. It includes periodic reports such as quarterly and annual statements, fund performance summaries, and compliance disclosures. Investor reporting is a cornerstone of investor relations (IR), as it fosters trust, supports informed decision-making, and strengthens communication between companies and their investors.

Can AI clean up the investor reporting mess?

Every quarter, armies of analysts endure the same ritual: collecting data from disparate sources that use non-standard terminology and require three clarification emails to understand, manually extracting figures, normalizing calculations to enable comparisons, ensuring compliance with regulatory requirements, and packaging it all into reports that attempt to satisfy diverse investor needs.

The problem with investor reporting is that it combines several difficult challenges. You need to gather information from entities using different accounting standards and calculation methodologies. You also need absolute accuracy because mistakes damage credibility. You need to meet tight deadlines because investors want timely information. And you need to satisfy both regulatory requirements and investor preferences that often pull in opposite directions.

What makes this process so persistently painful? Consider what happens when a portfolio company reports its EBITDA. One might include stock-based compensation while another excludes it. One might adjust for one-time events while another doesn't. Both call it "EBITDA" on their reports, but they're calculating fundamentally different metrics. Now multiply this complexity across dozens of performance indicators and dozens of portfolio companies. How do you create meaningful comparisons?

Or think about what it takes to extract performance data from a financial statement. It's not just about finding a number—you need to understand its context. Is it an annualized or quarterly figure? Does it include or exclude certain subsidiaries? Are there footnotes that modify its meaning?

Time pressure only compounds these challenges. While some investors might tolerate delayed reporting, many institutional clients have strict requirements for timely updates to feed into their own analysis frameworks. Missing deadlines can strain investor relationships and raise questions about operational competence.

The human cost is equally significant. Bright, talented financial professionals spend countless hours on mind-numbingly tedious tasks instead of delivering the strategic insights they were hired to provide. Junior analysts regularly pull all-nighters during reporting seasons. Experienced professionals grow frustrated with systems that seem stuck in the previous century.

You didn't get an MBA to copy-paste numbers between spreadsheets. But that's exactly what you spend 60% of your time doing. It's demoralizing, and it's why turnover in reporting teams tends to be so high.

While technology promises to alleviate these challenges, the transition from legacy processes to modern AI-driven solutions is far from straightforward. Many firms find that automating investor reporting isn't just about adopting new tools—it requires rethinking entrenched workflows, overcoming system incompatibilities, and ensuring AI solutions understand the nuanced, high-stakes nature of financial data.

Many firms assume AI will be the silver bullet. If self-driving cars and medical diagnostics are possible, surely automating investor reporting should be simple. Yet, in practice, most AI solutions fall short—struggling with precision, context, and the complexity of financial data. Instead of eliminating errors, they often introduce new risks, creating a false sense of reliability.

The false promise of AI solutions

The reality has proven disappointing for many firms that have tried to implement AI for investor reporting. The problem isn't that AI lacks potential—it's that conventional approaches aren't equipped to handle the domain-specific nature of financial reporting.

ChatGPT and similar large language models are trained on information that can be scraped from the internet, but not on specialized financial information and domain-specific know-how. They perform impressively on general tasks but quickly show their limitations with specialized financial documents. Ask ChatGPT to extract key metrics from a quarterly report, and you might get plausible-sounding but inaccurate results. It might miss important footnotes, confuse similar metrics, or even hallucinate figures that don't exist in the document.

The hallucination problem is particularly dangerous because the AI delivers incorrect information with the same confidence as accurate information. There's no built-in uncertainty indicator to flag when it's guessing versus when it's retrieving verified data.

Beyond accuracy issues, conventional AI approaches struggle with financial context. They don't understand the significance of specific terminology in financial documents or the relationships between different metrics. They fail to recognize when a methodology note on page 50 fundamentally changes how a figure on page 3 should be interpreted.

Document formatting presents another major hurdle. Financial reports often contain complex tables, charts, and specialized layouts that confuse general-purpose AI. Traditional OCR (Optical Character Recognition) systems can extract text but struggle to maintain the structural relationships that give the data meaning. Without understanding table structure, AI can extract numbers but loses critical context.

Most companies found that off-the-shelf AI could extract about 70% of the information correctly. But that remaining 30% required so much manual verification and correction that AI didn't save much time. And in financial reporting, 70% accuracy might as well be 0%—it's all or nothing.

The context window limitation of many AI models presents yet another barrier. When processing lengthy financial documents, models like ChatGPT can only "see" a limited portion at once. This means they might miss important information elsewhere in the document that provides essential context for proper interpretation.

Security and compliance concerns add further complications. Many powerful AI tools operate via cloud-based APIs, requiring firms to send potentially sensitive financial data to third-party providers. For regulated financial institutions with strict data governance requirements, this approach raises serious privacy and compliance risks. If you are sending confidential investor statements to a third-party AI service without proper data protection agreements, it is a non-starter from a regulatory perspective.

These failures have led many financial professionals to view AI with skepticism. They've heard the promises before—that technology would streamline reporting—only to find themselves still copying numbers between spreadsheets at midnight before deadlines.

But what if the problem isn't with AI itself, but with how it's being applied to financial reporting? What if there's a fundamentally different approach that could finally deliver on the promise?

The game-changer: Agentic AI for financial documents

While conventional AI approaches have disappointed, a new paradigm is emerging that addresses their fundamental limitations: agentic AI specifically designed for financial document processing.

What makes this approach different? Instead of treating AI as a general-purpose tool that happens to be applied to financial documents, agentic AI is built from the ground up to understand the unique characteristics of financial information. It combines multiple specialized capabilities—document understanding, financial knowledge, multi-step reasoning, and tool integration—in a system that can tackle complex reporting tasks with human-like comprehension but machine-like efficiency.

We have mentioned that AI lacks knowledge and is untrustworthy, that it cannot perform calculations or work with numbers, that it has a limited context window, and that it doesn’t know what to do with visual data and tables. Now, imagine an AI tool that can plan ahead and pick the right tools for the job. To retrieve information from a lengthy document, it will use advanced retrieval augmented generation (RAG) and then link outputs back to the original data sources. On top of that, a separate computer vision model can parse information from tables, charts, and complex document layouts and understand the visual cues and hierarchy—not just random numbers without context. Then, to perform calculations on the extracted data, it will use Python-based calculations with relevant libraries or even integrate with specialized platforms.

This agentic approach addresses the key limitations that have plagued conventional AI in financial contexts:

First, it solves the hallucination problem through retrieval-augmented generation (RAG). Rather than generating responses based solely on its training data, the AI retrieves specific information from verified financial documents that can be uploaded and kept in a dedicated Knowledge Hub. Every statement it makes, every figure it cites, comes directly from source documents with clear provenance. If an investor asks about Fund III's Q2 NAV, the system finds that exact figure in the appropriate report rather than generating a plausible-sounding approximation.

With a retrieval-based approach, we can trace every figure back to its source. The AI isn't inventing information—it's finding and organizing what already exists in your documents, file bundles, or databases.

Agentic AI overcomes context limitations by breaking large documents into meaningful chunks while maintaining relationships between them. It understands that information is connected across different sections, pages, and even different documents. A footnote reference isn't just text—it's a pointer to information that modifies how other data should be interpreted.

AI agents can also address the structural comprehension problem through specialized computer vision and table understanding capabilities. Instead of just extracting text, they comprehend the meaning conveyed by document layout, table structure, and visual elements. AI can finally know that a particular value belongs to a specific column and row, and that it represents a specific metric for a specific period. When equipped with the right computer vision model that pre-processes tables behind the scenes, AI agents can interpret and understand which value represents Q1 EBITDA versus Q2 EBITDA, even when dealing with complex nested tables or unusual formatting.

When dealing with additional calculations, AI agents can access and use specialized calculation tools rather than attempting complex financial math itself. When tasks require precise financial calculations—like normalizing metrics across different accounting standards or projecting returns under different scenarios—it orchestrates purpose-built computational tools rather than relying on its own limited mathematical capabilities.

Finally, AI agents can be integrated with your existing software. You can connect them to portfolio management platforms (e.g., eFront, Addepar), business intelligence tools (e.g., Tableau, Power BI), accounting systems (e.g., NetSuite, SAP, QuickBooks), and document management solutions (e.g., SharePoint, Box, DocuSign). This ensures that AI-driven reporting operates within the firm’s established workflows rather than disrupting them. Agentic AI maintains transparency and auditability throughout its process. Unlike black-box systems that provide answers without explanation, it documents every step of its reasoning and data extraction, allowing users to validate its work. This creates an audit trail that satisfies both internal verification needs and regulatory requirements.

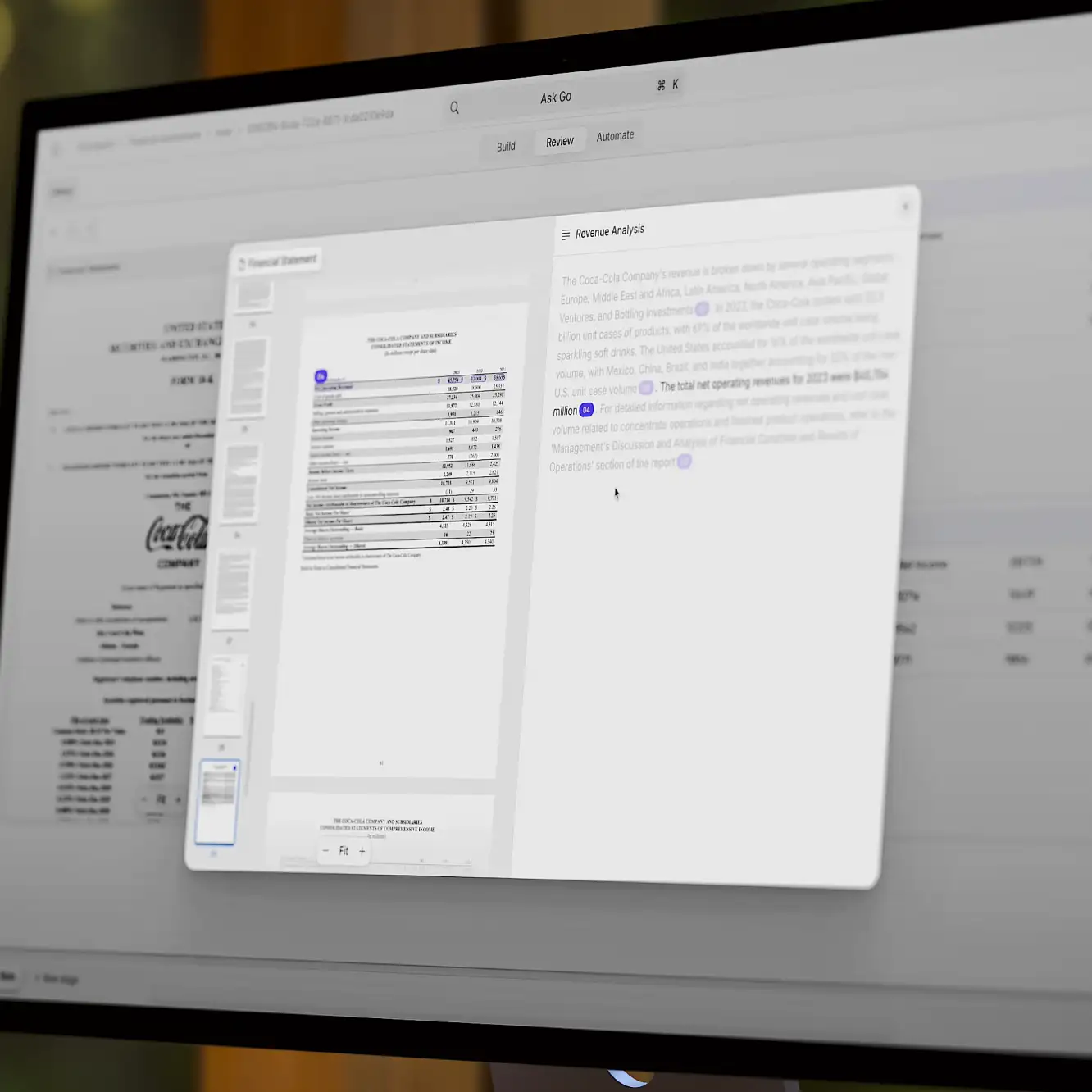

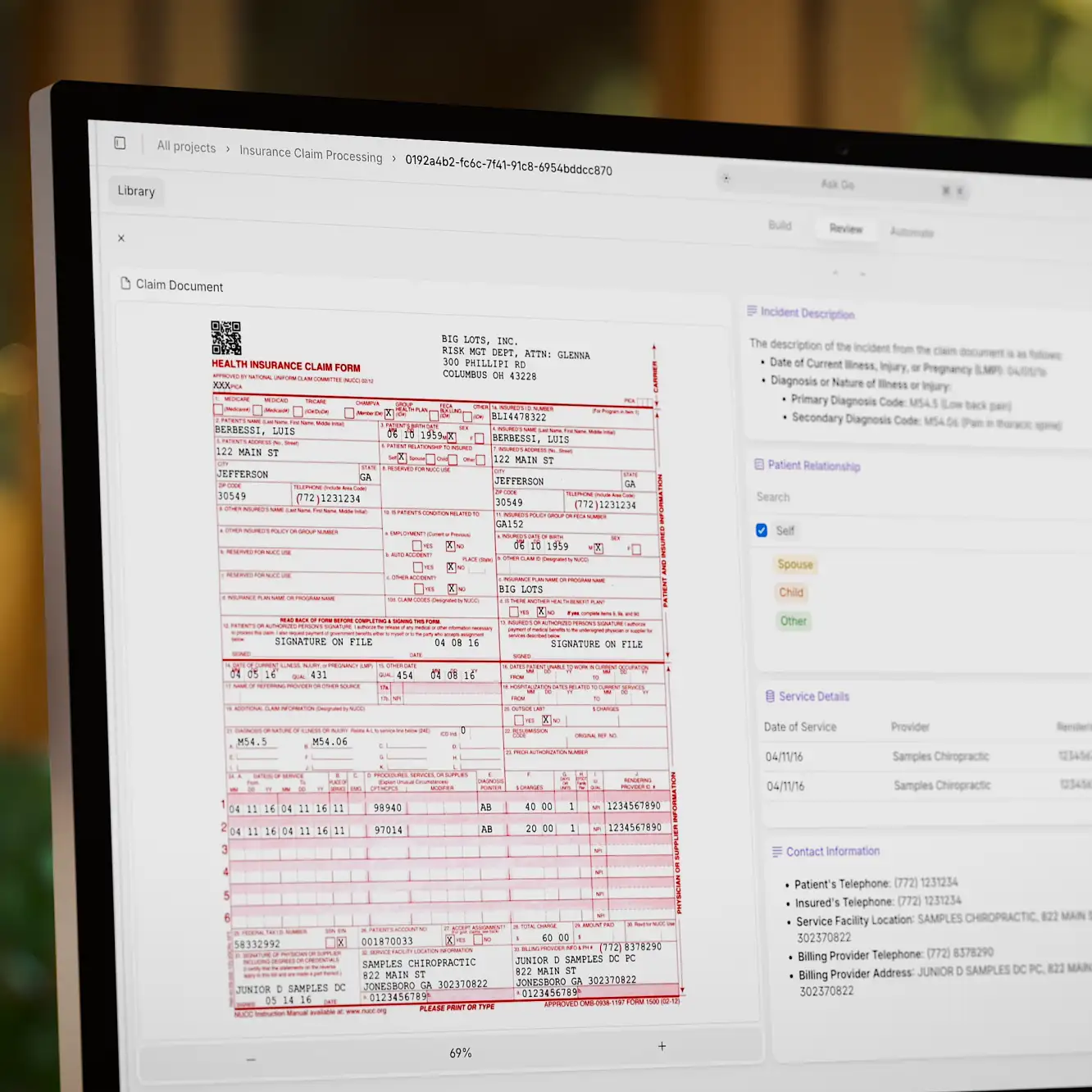

V7 Go is a good example of the agentic approach to financial document processing. Built specifically to handle the complexity of investment documents, it combines natural language understanding, computer vision, financial platform integration, and workflow orchestration to automate previously manual reporting tasks.

Agentic AI for real-world investor reporting workflows

How does agentic AI translate from theoretical capability to practical impact? Let's examine how systems like V7 Go address specific reporting challenges that have long plagued financial firms.

Traditionally, analysts spend days manually extracting data from diverse documents—financial statements, management reports, market analyses—each with its own format and structure. It's tedious, error-prone work that consumes valuable analyst time.

With V7 Go, this process transforms dramatically. The system ingests documents in whatever format they arrive—PDFs, Excel files, PowerPoint presentations, Word documents—and automatically extracts relevant information while preserving context and relationships. No standardization is required beforehand. The system recognizes different document types and can apply appropriate extraction approaches to each, based on pre-configured workflows or custom automations.

You upload the documents to V7 Go, and within minutes you have structured data ready for analysis. And analysts can now spend the week actually analyzing the information instead of just extracting it.

What makes this possible is the system's multimodal understanding—it doesn't just process text but comprehends document structure, table layouts, visual elements, and even media like audio files. When it encounters a complex financial table, it recognizes headers, understands relationships between rows and columns, and correctly interprets numerical formats. It knows that parentheses typically indicate negative values in financial statements. It recognizes when values are expressed in thousands or millions. It understands that a percentage might be written as "15%" or "0.15" depending on context.

Beyond extraction, agentic AI transforms data reconciliation—the process of normalizing information from different sources to enable meaningful comparison. Traditionally, this requires extensive manual work as analysts adjust for different accounting methodologies, calculation approaches, and reporting conventions. One of the important parts is that you can specify what the expected outputs should be, for instance by enforcing numeric outputs in a specific format that can be used for Python-based calculations or ML forecasting. The AI will understand that you work with numbers and not just plain text.

V7 Go recognizes when two portfolio companies are using different methodologies to calculate the same metric, understands the adjustments needed to normalize them, and implements those adjustments automatically. It flags potential inconsistencies for human review, focusing analyst attention on areas that require judgment rather than requiring them to check every figure manually.

For time-pressed investor relations teams, agentic AI also transforms query handling. When an investor asks about a specific metric or performance aspect, traditional approaches require manually searching through reports and databases, often involving multiple internal teams and creating delays.

With V7 Go, these queries can be addressed much more efficiently. You can use the AI Concierge to ask questions or drop files via a regular chat interface, similar to ChatGPT. However, this AI assistant has access to your files and can use AI search functionality that goes beyond keywords or terms. V7 Go quickly locates relevant information across all firm documents, understands the specific question being asked, and generates comprehensive, accurate responses based on verified data. This dramatically improves both response speed and consistency.

The result of these capabilities go beyond operational efficiency. Using an AI agent platform for financial reporting is a fundamental improvement in report quality, analyst productivity, and investor satisfaction.

Implementation realities for AI reporting

While the capabilities of agentic AI for investor reporting are impressive, successful implementation requires addressing several practical considerations. How do organizations move from concept to reality?

The most successful implementations begin with focused applications. Starting small allows organizations to demonstrate clear ROI while building internal comfort with the technology.

High-impact starting points often include portfolio company report processing, investment memorandum generation, investor query response, and AI due diligence document analysis. These applications typically deliver immediate value through time savings and improved consistency.

Effective implementation also requires thoughtful integration with existing systems and workflows. Rather than replacing current processes entirely, agentic AI typically augments them—extracting data that feeds into established analysis frameworks, generating insights that inform human decisions, and automating routine tasks while preserving human oversight for judgment-intensive aspects.

V7 Go offers flexible integration options, including APIs for programmatic access, native connectors for common financial systems, and customizable export formats. This allows firms to enhance existing processes rather than disrupting them, gradually increasing AI involvement as confidence grows.

Security and compliance considerations are equally important, particularly given the sensitive nature of financial information. Systems processing investor data must meet rigorous security standards, provide comprehensive audit trails, and comply with relevant regulations.

V7 Go addresses these concerns through SOC 2 and ISO27001 compliance, comprehensive data security features, and flexible deployment options that allow firms to maintain control over sensitive information while still benefiting from AI capabilities.

Perhaps the most overlooked aspect of successful implementation is change management. Financial professionals may initially be skeptical of AI-generated outputs or concerned about how new tools will affect their roles. Effective approaches include early stakeholder involvement, clear success metrics, appropriate training, and explicit guidance on how roles will evolve.

Organizations that approach implementation with realistic expectations and a focus on human-AI collaboration typically achieve the most successful outcomes. The goal isn't to replace human expertise with artificial intelligence—it's to create partnerships where each contributes its unique strengths.

Where will agentic AI take investor reporting?

Investor reporting has long been constrained by fragmented data, manual workflows, and outdated systems that slow down financial professionals rather than empowering them. While conventional AI solutions have struggled to bridge this gap, agentic AI presents a new paradigm—one that is already reshaping how firms handle reporting, due diligence, and investor relations.

As highlighted in recent trends, agentic AI is gaining traction precisely because it can autonomously analyze vast amounts of financial data, prioritize critical tasks, and generate actionable insights far beyond human speed. While enterprise-wide adoption remains a work in progress, frontline employees are increasingly embracing AI informally, using it to streamline tedious reporting tasks even before official policies catch up.

The financial industry also benefits from AI’s declining deployment costs, enabling firms of all sizes to process unprecedented volumes of data without sacrificing accuracy. However, challenges remain. AI still struggles with context, particularly in volatile markets or non-traditional financial environments. While automation will play an ever-larger role in investor reporting, human oversight will remain essential to ensuring AI-generated insights are reliable, nuanced, and applicable across diverse economic conditions.

Looking ahead, the future of investor reporting won’t be about replacing analysts with AI—it will be about amplifying their capabilities. As agentic AI systems mature, firms that integrate them effectively will move beyond manual data wrangling and finally focus on what truly matters: delivering strategic insights, fostering stronger investor relationships, and navigating financial markets with greater agility and confidence.

Are you ready to automate your financial operations? Book a demo and share your challenges with us. Once we sign an NDA and receive your sample data, we can begin developing a proof-of-concept AI agent tailored to your needs.