Knowledge work automation

17 min read

—

Mar 13, 2025

Content Creator

Financial analysts dedicate substantial time to acquiring and standardizing financial data from SEC filings, annual reports, and earnings releases—a process often involving manual data extraction, format standardization, and reconciliation. This time-consuming data preparation can take up a significant portion of the workday and it delays the start of actual analysis.

So, you might find yourself occasionally thinking: Did I spend years earning an MBA just to spend my days copying and pasting data from PDFs to spreadsheets?

As frustrating as it can be, this meticulous work is fundamental. Understanding the intricacies of financial documents and where crucial details are often hidden is essential for accurate analysis. The most valuable financial insights aren't in the headline numbers. They're buried in footnotes, hidden in accounting policy changes, and concealed in off-balance-sheet disclosures. Overlook these subtle signals, and you might not realize a company’s true financial risks until it’s too late.

But traditional financial statement analysis isn't just tedious—it’s prone to error. Every manual data entry is a potential mistake, and in an industry where a misplaced decimal can cost millions, that’s not a risk worth taking. Meanwhile, as your team plays find the footnote, your competitors are already using AI to process entire financial statements faster than you can say quarterly earnings report.

So, how do you get started with AI-powered financial statement analysis?

This article covers:

The evolution of AI-assisted financial analysis

Examples of AI workflows for financial statement review

Best practices and high-impact use cases

Inefficiencies of Traditional Financial Analysis

Reading a financial statement can take hours but reading it critically and performing due diligence means days or weeks of work per report.

Up until quite recently, financial statement analysis was synonymous with tedious manual effort. Analysts at investment firms and banks would literally copy-paste numbers from PDF filings into spreadsheets, comb through pages of footnotes line by line, and spend hours interpreting the narrative sections of reports.

This labor-intensive process not only eats up analysts’ time but also inherently carries a high risk of error. In fact, studies have found that nearly 88% of spreadsheets, including the ones used in finance, contain errors—a sobering statistic that underscores how manual data handling can lead to mistakes. From transcription errors (mis-typing a figure) to formula mishaps, the reliance on human effort means critical mistakes can creep into valuation models and credit analyses. Important details can be overlooked simply due to fatigue or information overload.

Manual data extraction

Traditional analysis is slow and limited in scope. A single 10-K filing for a Fortune 500 company can stretch well over 100 pages. If an analyst spends days parsing one annual report, that’s time not spent on other companies or more strategic tasks. Financial analysts often spend hours processing financial reports, earnings calls, and public filings just to make basic assessments. This significantly limits the number of companies an analyst can cover and increases the chance of oversights.

Details buried in dense reports

Key information might be buried in a footnote or in the Management’s Discussion and Analysis (MD&A) section – and if the analyst happens to miss it, the resulting investment decision could be flawed. For example, subtle warnings about revenue recognition changes or pending legal liabilities might be glossed over in a cursory read. The volume of data is simply overwhelming. Companies have been disclosing more and more information in financial reports due to regulatory pressures and complexity. In fact, the average 10-K report length has roughly doubled between early 2000s and late 2010s.

Inconsistent formats

Beyond the sheer length of reports, inconsistency in format adds another layer of inefficiency. One company’s annual report might present data in a completely different layout or wording than another’s. Analysts must familiarize themselves with each firm’s style, terminology, and accounting policies from scratch, which slows down comparison and analysis. And while databases exist for quantitative financial data (allowing analysts to download, say, revenue and profit figures quickly), the qualitative insights – the explanations, the caveats, the “story” behind the numbers – remain locked in paragraphs of text. Traditionally, making use of that unstructured text required a human brain to read and interpret it.

Now, with all these issues in mind, let’s take a look at what happens when these operations meet AI.

Recent advances in AI, and large language models in particular, are tackling these inefficiencies head-on. Large language models (LLMs)—such as GPT-4 and domain-specific models—understand natural language and can be trained or prompted to extract structured information from unstructured text. In the context of financial statements, that means an LLM can read an entire SEC filing or earnings release, pull out the pieces that matter, and even interpret them if instructed with specific guidelines. Tasks that once took an analyst days can now be done in minutes, if not seconds.

More importantly, some AI platforms prioritize the verifiability of outputs produced by generative AI models. This means that AI will not only answer questions about a balance sheet or confidential information memorandum but will also highlight specific areas inside the analyzed documents and describe the sources used to ensure full transparency.

While all of this sounds very promising, most financial institutions and firms are very cautious about implementation. There is a huge knowledge gap between what AI can do today and how to implement it successfully in daily operations.

So, let's get more specific about our current state of AI implementation for financial analysis.

AI Adoption in Financial Statement Analysis Over Recent Years

Discussions about AI often lump multiple technologies into the same category, leading to broad oversimplifications. However, there are critical distinctions between different types of AI. Training machine learning models for predictive analytics, using OCR for text extraction, and leveraging generative AI for document summarization are fundamentally different approaches.

To make things even more complex, there’s a degree of overlap between these methods, and many tasks can be solved in multiple ways—all branded under the umbrella of "AI." Take document classification as an example:

Traditional machine learning involves training a classification model on labeled datasets. If you want to categorize financial documents (e.g., balance sheets, income statements, and earnings reports), you would collect a dataset of examples, train a model, and use it to predict document types with assigned probabilities. This was the default approach for specialized AI tasks in the 2010s and earlier.

Generative AI, on the other hand, removes the need for extensive training. Instead of building a custom classifier, you can use a pre-trained foundation model like GPT-4o or Claude, prompting it to recognize and categorize documents based on context. This shifts the effort from model training to problem decomposition—breaking down tasks into steps that a general-purpose AI can handle without specialized fine-tuning.

Over time, foundation models are becoming more versatile, reducing the need for bespoke ML models. Instead of creating one-purpose AI solutions, businesses are increasingly using multi-use generative models and even chaining them together.

A prime example of this shift is when Bloomberg trained an in-house AI model designed specifically for finance. While trained for domain-specific tasks, it turned out to be less powerful than the latest iteration of a general-purpose model like GPT-4.

This highlights an unexpected trend: training highly specialized AI models can sometimes backfire, as general foundation models—which were never explicitly designed for finance—have ended up being more effective in specialized applications. The reasoning is simple: general AI models are trained on a broader and more diverse dataset, which allows them to generalize better even for niche tasks.

Models from OpenAI and Anthropic are increasingly effective at financial problem-solving, which reduces the need for domain-specific fine-tuning

In other words, what was once considered a disadvantage—being too broad—has turned out to be an asset. General AI models can often match or even exceed the performance of domain-specific models, simply because they have absorbed a much larger base of knowledge. This is why financial firms are now reconsidering the cost and effort of training in-house models when commercially available alternatives may be just as good, if not better.

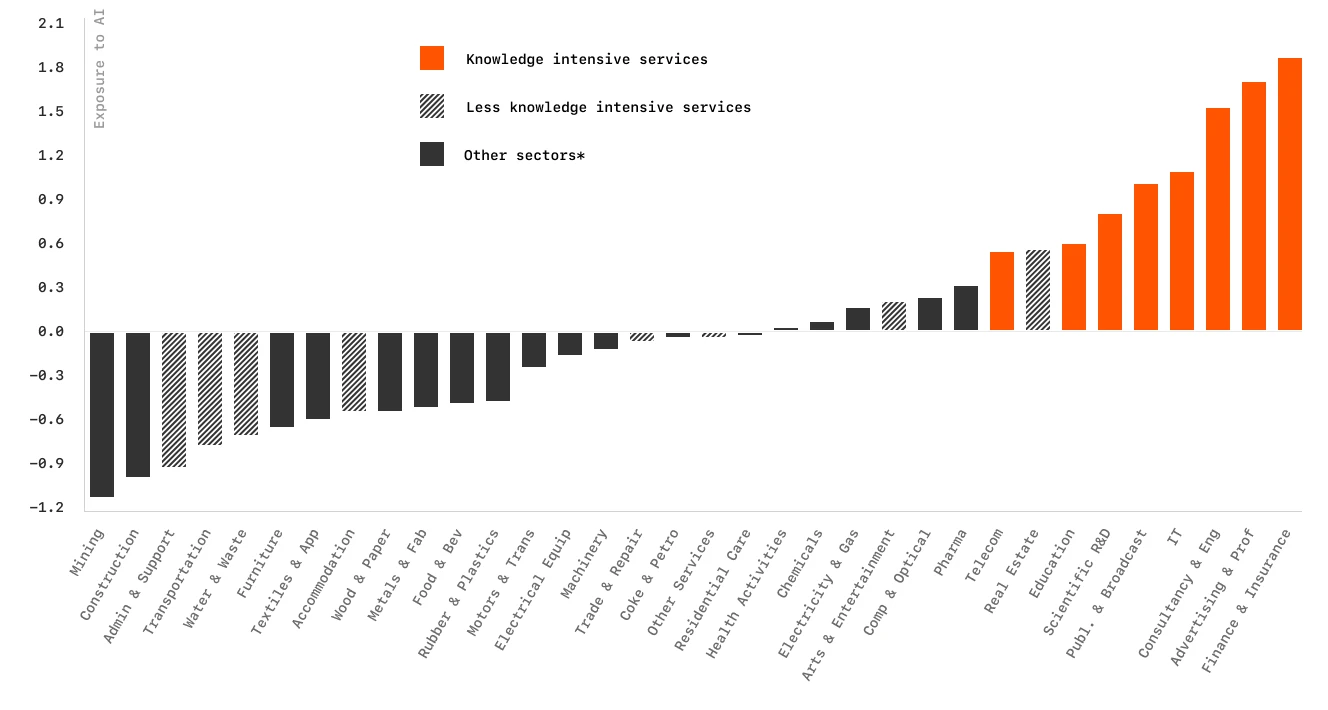

Finance and insurance professionals are at the forefront of adopting generative AI to automate knowledge work. Generative AI is now being widely used in insurance underwriting, finance workflow automation, and due diligence, with applications ranging from one-off interactions to task assistance and end-to-end automations.

The final piece of the puzzle is AI agents. They can automatically determine which tools to use and how to solve a given task. So, instead of using only a specialized ML model for forecasting, or only an optical character recognition model for raw text extraction, or only a GPT model, you can let the AI decide and combine aspects of all the best frameworks. AI agents can autonomously decide how to solve problems, integrating multiple tools and data sources, instead of merely responding to prompts. This introduces new transparency challenges—verifying AI outputs and understanding reasoning steps—but it also opens the door for highly sophisticated financial analysis without extensive manual oversight.

Here is a comprehensive list of tools and frameworks for AI-driven financial analysis, covering both cutting-edge and well-established technologies:

While AI agents are still an emerging technology, they have the potential to orchestrate these systems with varying degrees of autonomy, supported by guardrails such as human oversight and built-in safety mechanisms.

From Theory to Practice: How AI Is Used for Financial Statement Analysis

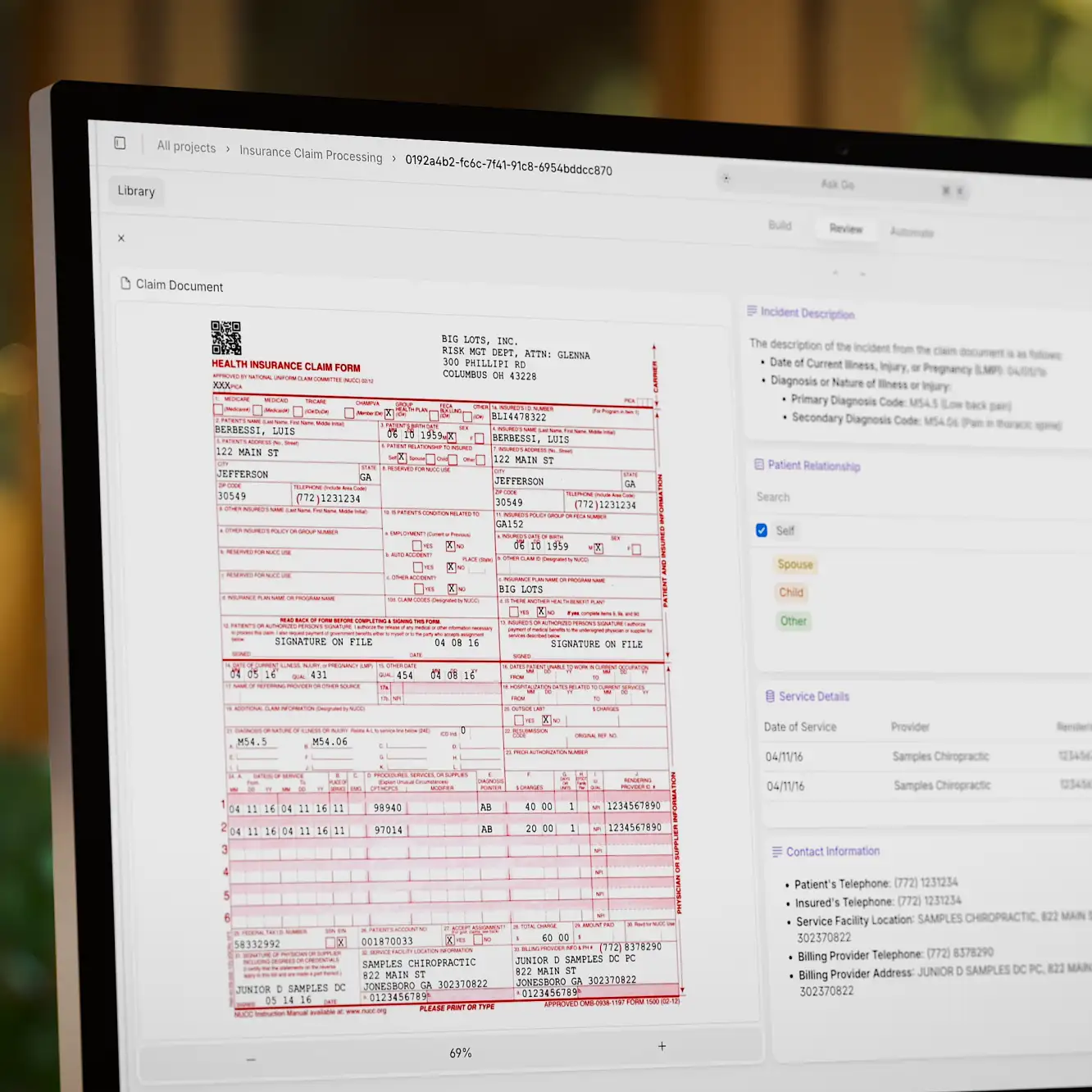

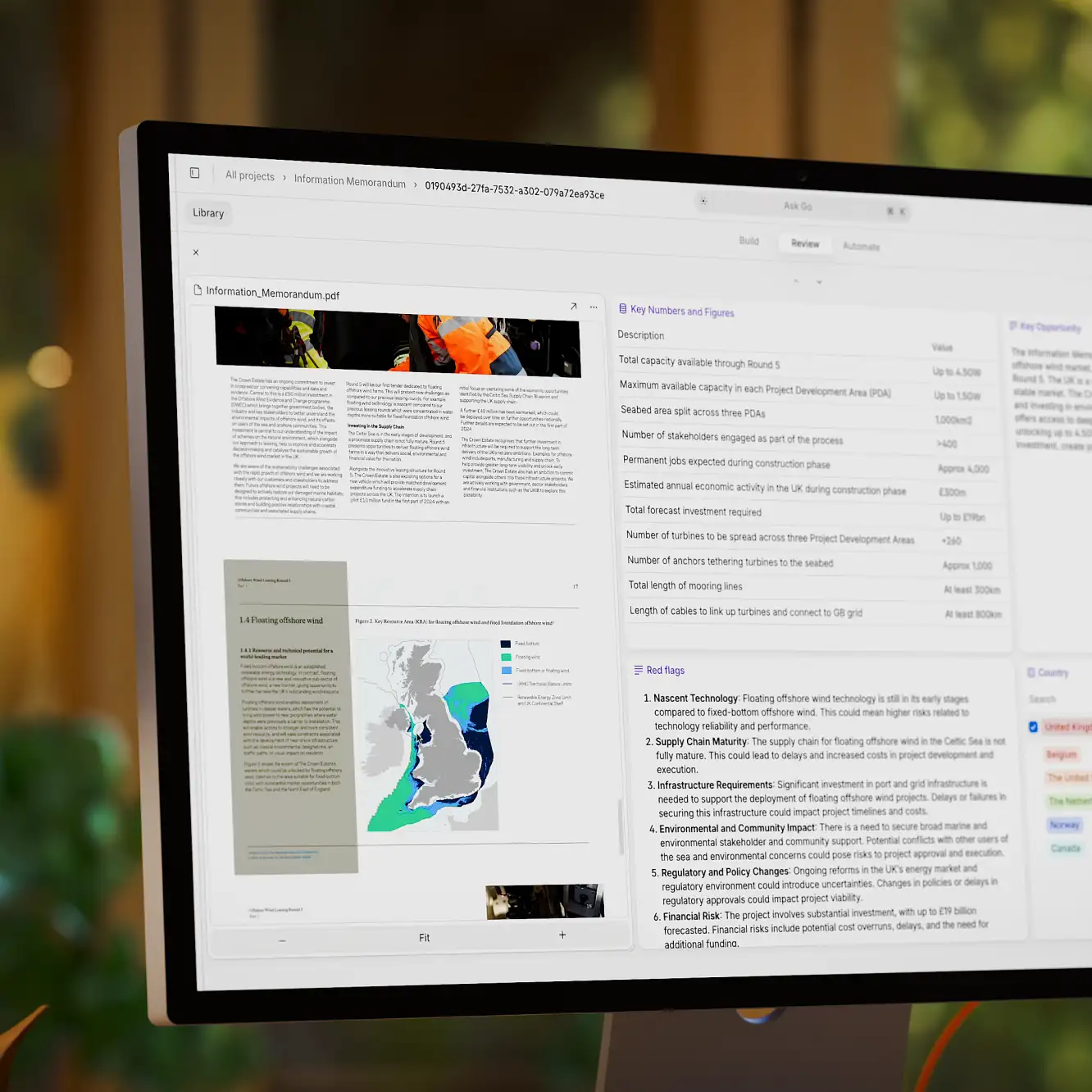

AI technologies discussed above are increasingly automating labor-intensive financial workflows, like analyzing confidential information memorandums (CIMs), prospectuses, commercial loan agreements, and due diligence documents. AI-powered document processing and agentic AI platforms (such as V7 Go and similar tools) can ingest thousands of pages in seconds, extracting key data and even interpreting complex financial tables automatically.

AI for document ingestion

Analysts can feed a year’s worth of PDF reports into an AI-powered system and quickly receive a structured dataset or table with all the important numbers. The AI will read through each document’s text and tables, extracting entries such as total sales, net income, EBITDA, or growth rates, and it can even capture contextual data like the reporting period or currency. This document automation eliminates the need to re-key data into Excel, saving hours of manual effort and greatly reducing transcription errors. It also enables near real-time analysis.

As soon as a new report or statement is available, AI can ingest it and update the data repositories or dashboards used for decision-making. Moreover, AI extraction isn’t limited to the primary financials. It can delve into footnotes and annexes to grab details about debt covenants, lease obligations, or contingent liabilities, which are often buried in text. By transforming unstructured financial documents into clean, analysis-ready data, AI empowers financial teams to be more agile and data-driven.

Financial due diligence

Likewise, private equity firms are adopting AI for due diligence automation. Investcorp reported that its portfolio funds saved hundreds of hours by using an AI platform to review contracts, credit agreements, and private placement memorandums that were previously labor-intensive. These operational enhancements translate to faster deal cycles and fewer human errors, which is critical in high-stakes M&A transactions where speed and accuracy confer a competitive edge.

AI can help with many due diligence workflows, from analyzing quarterly financial reports to scanning entire data rooms. Modern AI platforms offer ready-made templates for tasks like 10-Q report analysis, CIM summarization, and contract clause extraction. This means an M&A team can upload a stack of financial statements, legal agreements, and due diligence questionnaires into an AI system and have it swiftly output structured findings: key financial ratios, outlier transactions, compliance issues, and more.

Data extracted with V7 Go from an uploaded financial report based on predefined fields

By automating repetitive review tasks, AI allows deal teams to focus their expertise where it matters most—interpreting findings and strategizing on deal implications, rather than hunting for information. Firms that have embraced AI-driven due diligence report substantial productivity gains. For instance, one consulting firm saw a 35% increase in productivity within the first month of deploying generative AI for data extraction and document analysis.

Deal sourcing

AI-driven workflow automation is not limited to document review. Deal sourcing is another area seeing efficiency gains. Rather than relying solely on personal networks and manual research, firms now deploy AI to scan vast datasets (financial filings, news, even social media) for promising acquisition targets. Industry analysis suggests AI-powered screening can cut the time to identify targets by up to 30% while improving prediction accuracy by over 20%.

By automating initial filtering, deal teams can focus their efforts on the most viable opportunities. Even in mid-process workflows, natural language processing algorithms and LLMs can flag risks or unusual clauses across thousands of pages of legal and financial documents, ensuring nothing critical is overlooked.

Learn more: 5 Applications of AI in Venture Capital and Private Equity

Risk management

In risk management, banks are deploying AI to enhance credit scoring and portfolio risk assessments by evaluating a wider array of variables (including macroeconomic indicators and alternative data) faster than traditional models. Generative AI is further pushing boundaries by synthesizing insights across disparate sources: bankers can prompt an AI to summarize the key financial ratios and red flags in a 100-page annual report, or to draft a preliminary financial model based on management’s projections, saving considerable analyst time.

Learn more: De-risking Asset Management with AI: A Strategic Guide for Investment Firms

AI Integration into Financial Workflows: Best Practices & Challenges

While the benefits of generative AI for financial statement analysis are clear, successful implementation requires thoughtful integration into existing workflows. Unlike traditional ML models that require extensive training on financial data, modern LLM-powered solutions focus on operational efficiency—automating document review, extracting key metrics, and providing verifiable insights with minimal disruption. However, this still poses multiple challenges.

Ensuring transparency and verifiability

One of the greatest challenges in AI-powered financial analysis is maintaining traceability and trust. Financial professionals need to verify that AI-generated insights accurately reflect the source documents. This is where platforms like V7 Go provide improved transparency through source citation features.

When V7 Go extracts financial metrics or summarizes a CIM section, it links each insight directly to the source location in the original document. This visual grounding means that when the AI reports "Company X's EBITDA increased 15% year-over-year," you can click to see exactly where this information appears in the financial statement. This citation capability addresses a critical concern in finance: the need to verify every data point.

Additionally, LLMs are not necessary for every part of the workflow. Sometimes it's beneficial to use Python scripts and specialized libraries for certain workflow components. For example, an AI search engine could gather results, then a Python script could parse the output to control the extracted information.

Financial teams using V7 Go can trace the AI's logic and sources without hunting through hundreds of pages manually. This transparency feature is particularly valuable during investor presentations or audits, where teams must defend their analysis and demonstrate thorough review of all materials.

Human-in-the-loop oversight

Best practices for implementing AI in financial workflows emphasize human oversight rather than full automation. The most effective setups maintain what's called a "human-in-the-loop" approach, where AI handles the initial heavy lifting of document processing, but financial experts review, verify, and interpret the results.

In practice, this looks like an AI assistant that flags unusual items in financial statements for human review. For example, V7 Go might flag a significant change in accounting policy buried in a footnote and bring it to an analyst's attention, but the analyst still evaluates the significance of this change for the overall financial health assessment.

This balanced approach accomplishes two objectives: it dramatically reduces the time spent on manual document review while maintaining the judgment and accountability that financial analysis requires. Most importantly, it positions AI as an enhancer of human capabilities rather than a replacement—analysts spend less time on data gathering and more time on strategic interpretation.

Balancing Automation with Judgment. Financial analysis often requires contextual understanding and professional judgment that goes beyond data extraction. The most successful implementations maintain clear boundaries: AI can process large volumes of information and spot patterns, while humans provide judgment about strategic implications and final decisions.

Integration with existing tools and systems

Successful AI implementation in financial workflows doesn't require a complete system overhaul. Modern platforms like V7 Go offer flexible integration options that complement existing tools:

API connections: Financial data extracted by V7 Go can flow directly into Excel, data visualization tools, or internal databases via APIs, eliminating manual data transfer.

Native integrations: V7 Go connects seamlessly with your databases and knowledge hubs such as Google Drive or SharePoint.

Exportable outputs: AI-extracted metrics and insights can be exported in structured formats, such as JSON, compatible with financial modeling tools.

Workflow automation: Multi-step processes like quarterly report analysis can be automated end-to-end or configured to include human checkpoints at critical junctures.

The ideal integration approach is modular and gradual. Financial teams might start by automating document classification and data extraction, then gradually expand to more complex workflows like anomaly detection or summarization as confidence in the AI system grows.

Compliance and security considerations

Financial institutions operate in highly regulated environments, making compliance and data security paramount in any AI implementation. The ideal AI solution for financial statement analysis should address these concerns through:

Role-based access controls: Limiting who can access sensitive financial documents and what actions can be performed.

Audit trails: Recording all AI interactions and human reviews for compliance and tracking.

Data privacy protections: Ensuring confidential financial information remains secure during processing.

V7 Go addresses these requirements through enterprise-grade security features and compliance-friendly architecture. For example, firms can maintain control of sensitive financial data through secure deployment options, while still leveraging powerful AI capabilities.

Some organizations choose to start with less sensitive use cases (like public financial statement analysis) before moving to more confidential workflows, allowing time to validate security and accuracy. This phased approach builds confidence in the AI system while minimizing risk.

The Future of AI in Financial Statement Analysis: Opportunities and Considerations

The adoption of AI for financial statement analysis has created a dramatic shift in how analysts interact with complex financial documents. As this article has shown, large language models, AI agents, and workflow automation tools allow financial professionals to extract data from financial statements with greater speed and accuracy.

As the field advances, several important trends are emerging. Financial teams will see specialized solutions designed specifically for extracting metrics from balance sheets, identifying questionable footnote disclosures, and spotting accounting policy changes. Future AI systems will better understand the connections between structured tables, charts, and explanatory text in financial statements, recognizing how a footnote might modify the interpretation of a revenue or expense figure.

AI agents will handle routine extraction and standardization tasks, which frees financial analysts to concentrate on interpretation and strategic decision-making rather than data preparation. The most effective implementations will keep humans in oversight roles for critical judgments. AI will also begin to analyze patterns across different reports, detecting inconsistencies between income statements and cash flows or monitoring accounting practice changes across reporting periods.

Organizations looking to implement AI for financial statement analysis should begin with specific, high-value applications—automating regular calculations across reports, finding off-balance-sheet obligations hidden in footnotes, or standardizing metrics across competitor companies. Choose solutions that clearly explain how they extract data and that work with your existing financial models. Remember that AI enhances your financial analysts' capabilities rather than replacing them. The best implementations handle tedious data extraction, allowing human experts to apply their judgment to what the numbers mean for business strategy and investment.

When thoughtfully integrated into financial statement analysis, AI allows organizations to process more documents faster, find insights buried in dense reports, and make better-informed financial decisions while maintaining the accuracy that stakeholders expect.

If you're interested in implementing AI-powered financial statement analysis for your organization, request a demo to see how V7 Go can automate your document processing workflows and enhance your analytical capabilities.