Turn complex SOVs into actionable risk insights

Turn complex SOVs into actionable risk insights

Process more insurance documents with AI

Process more insurance documents with AI

Challenge

Challenge

Challenge

SOVs are critical documents for insurance companies, especially for tracking property values, vehicle inventories, and liability exposures. However, statements of value require extensive normalization before insurers can effectively use the data. Traditional methods struggle with varied formats and complex data relationships.

SOVs are critical documents for insurance companies, especially for tracking property values, vehicle inventories, and liability exposures. However, statements of value require extensive normalization before insurers can effectively use the data. Traditional methods struggle with varied formats and complex data relationships.

V7 Go simplifies SOV processing with AI that understands complex insurance contexts, extracts essential metrics, and standardizes data for comprehensive risk assessment.

V7 Go simplifies SOV processing with AI that understands complex insurance contexts, extracts essential metrics, and standardizes data for comprehensive risk assessment.

Why V7 Go

Why V7 Go

Why V7 Go

Long document support

Process hundreds of SOVs simultaneously regardless of format or complexity. Handle multi-line data across property, liability, and specialty risks with consistent accuracy.

Long document support

Process hundreds of SOVs simultaneously regardless of format or complexity. Handle multi-line data across property, liability, and specialty risks with consistent accuracy.

Long document support

Process hundreds of SOVs simultaneously regardless of format or complexity. Handle multi-line data across property, liability, and specialty risks with consistent accuracy.

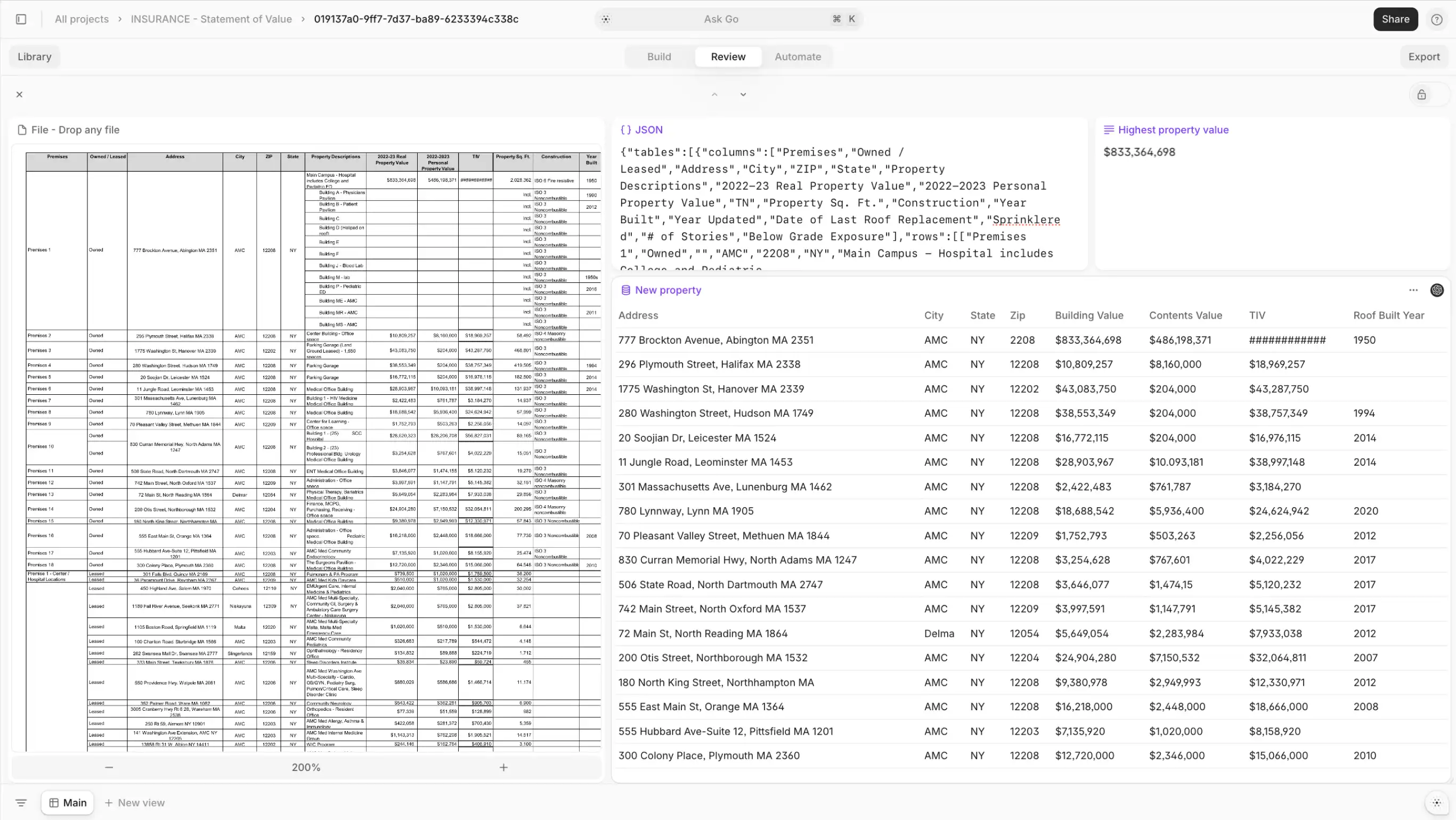

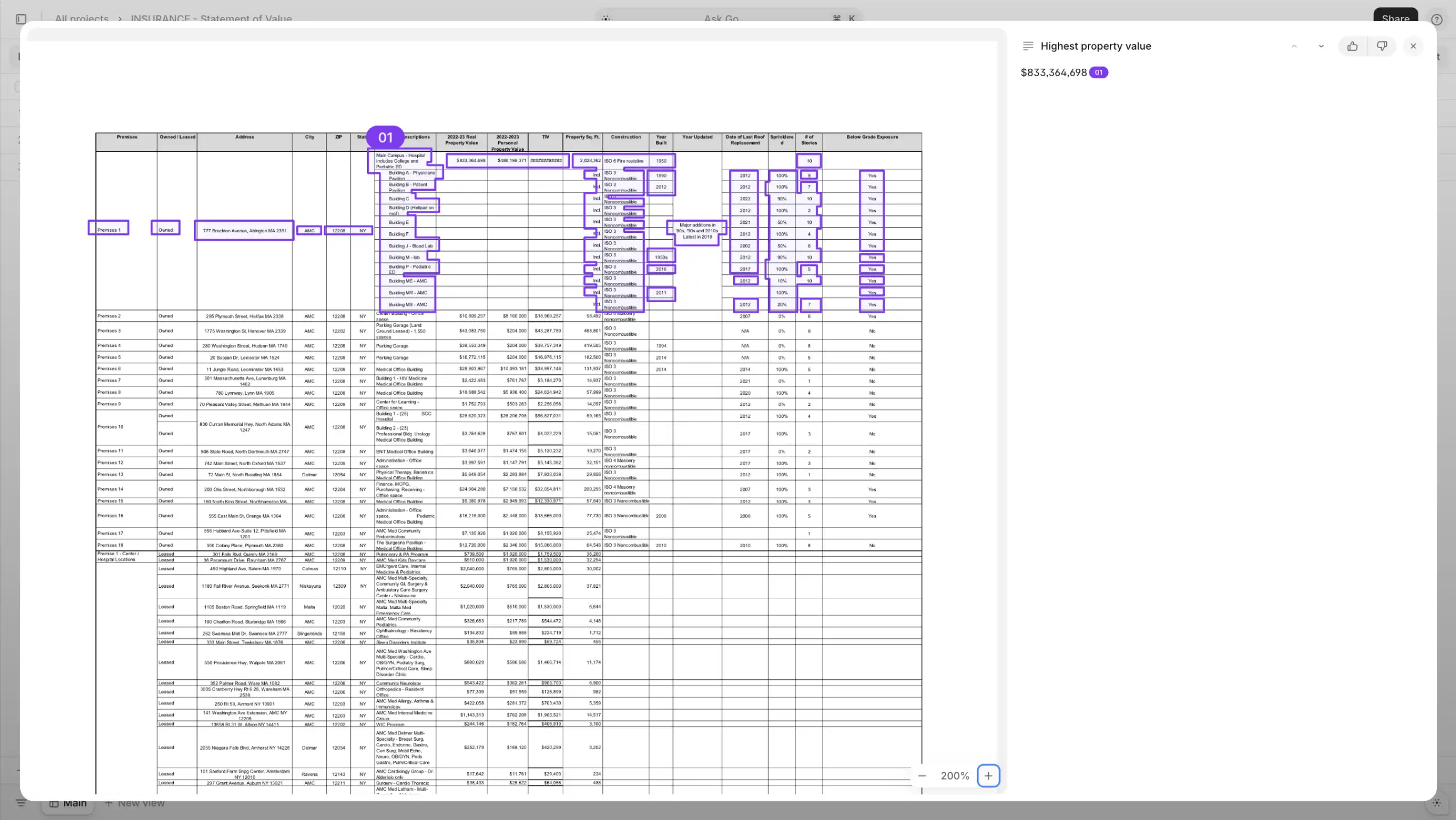

AI citations

Verify every extracted value with highlighted source text. Each data point links back to its original location in the statement of value documents for easy validation.

AI citations

Verify every extracted value with highlighted source text. Each data point links back to its original location in the statement of value documents for easy validation.

AI citations

Verify every extracted value with highlighted source text. Each data point links back to its original location in the statement of value documents for easy validation.

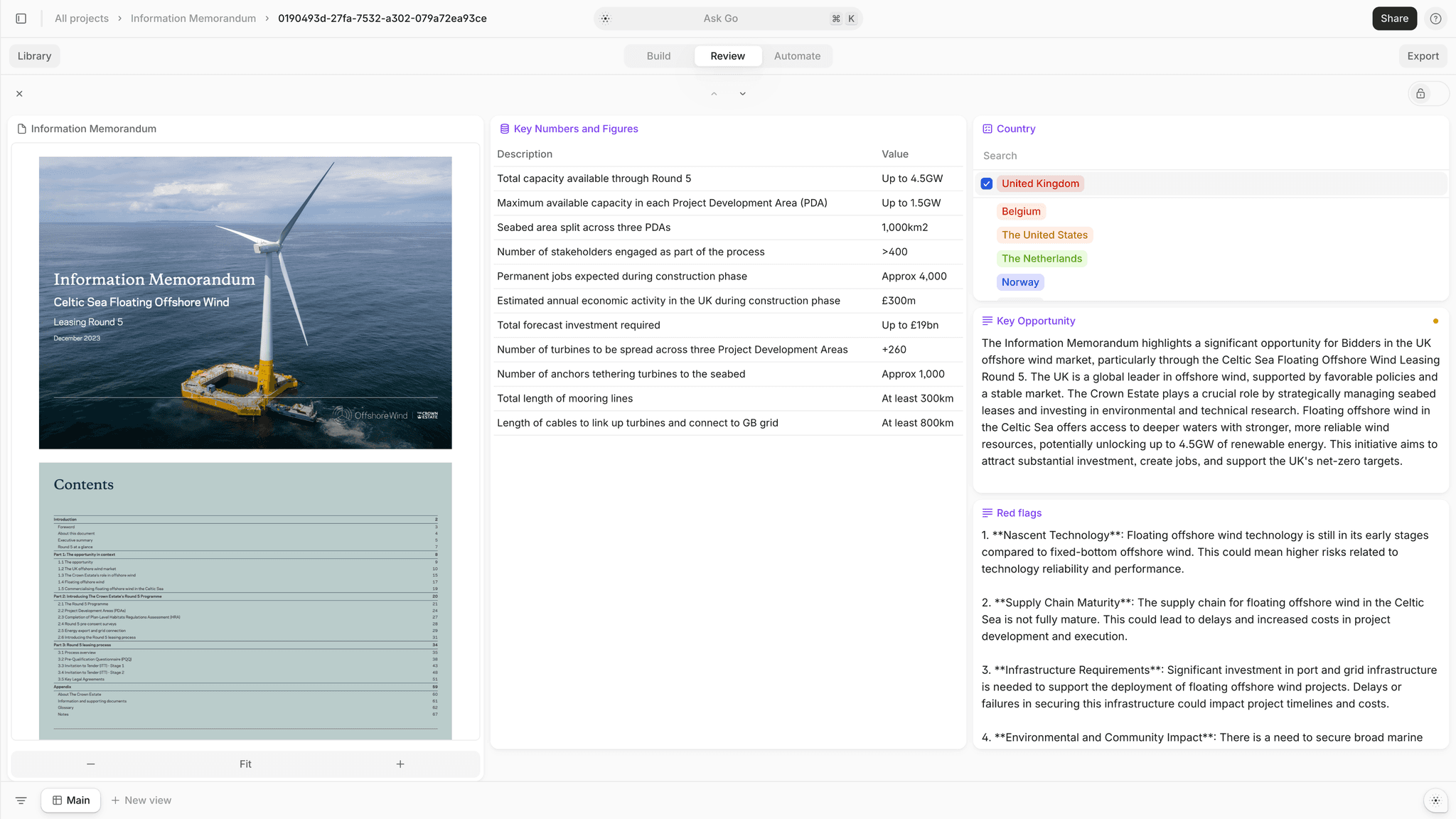

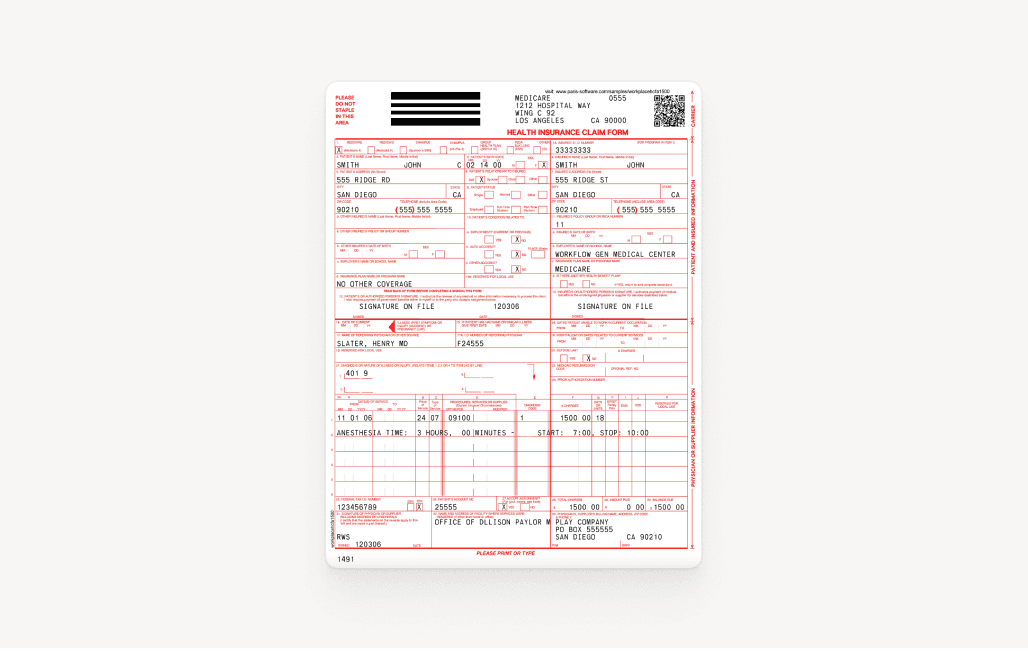

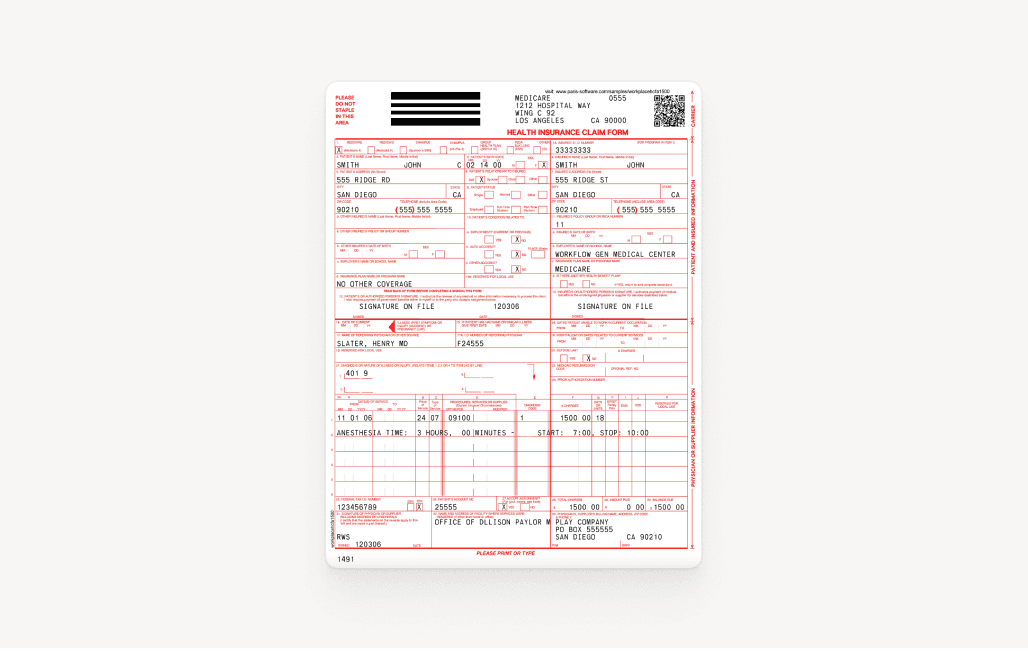

Table & graph analysis

Extract structured data from complex exposure tables. Automatically process property schedules, vehicle lists, and liability matrices while preserving the structure of columns, rows, and tables as needed. Parse data to meet new requirements and adapt it to different document templates.

Table & graph analysis

Extract structured data from complex exposure tables. Automatically process property schedules, vehicle lists, and liability matrices while preserving the structure of columns, rows, and tables as needed. Parse data to meet new requirements and adapt it to different document templates.

Table & graph analysis

Extract structured data from complex exposure tables. Automatically process property schedules, vehicle lists, and liability matrices while preserving the structure of columns, rows, and tables as needed. Parse data to meet new requirements and adapt it to different document templates.

Security & compliance

Protect sensitive data with enterprise-grade security features and compliance with insurance industry standards.

Security & compliance

Protect sensitive data with enterprise-grade security features and compliance with insurance industry standards.

Security & compliance

Protect sensitive data with enterprise-grade security features and compliance with insurance industry standards.

Permission levels

Control access across underwriting teams with customizable user roles, project-level permissions, and collaboration tools. Manage complex insurance operations and global projects with configurable views and tailored access settings.

Permission levels

Control access across underwriting teams with customizable user roles, project-level permissions, and collaboration tools. Manage complex insurance operations and global projects with configurable views and tailored access settings.

Permission levels

Control access across underwriting teams with customizable user roles, project-level permissions, and collaboration tools. Manage complex insurance operations and global projects with configurable views and tailored access settings.

Easy integration

Connect V7 Go to your policy admin systems and exposure management platforms through API access. Implement in under a week with minimal configuration needed.

Easy integration

Connect V7 Go to your policy admin systems and exposure management platforms through API access. Implement in under a week with minimal configuration needed.

Easy integration

Connect V7 Go to your policy admin systems and exposure management platforms through API access. Implement in under a week with minimal configuration needed.

ROI

ROI

ROI

50% faster SOV processing

Leading insurers accelerate their operations with V7 Go. By automating SOV analysis across lines of business, underwriting teams can process more submissions while maintaining accurate risk assessment.

How does V7 Go improve SOV data accuracy?

V7 Go achieves higher accuracy through AI that understands insurance context and document structure. The system validates values against expected ranges, flags outliers, and provides source citations for easy verification.

+

How does V7 Go improve SOV data accuracy?

V7 Go achieves higher accuracy through AI that understands insurance context and document structure. The system validates values against expected ranges, flags outliers, and provides source citations for easy verification.

+

How does V7 Go improve SOV data accuracy?

V7 Go achieves higher accuracy through AI that understands insurance context and document structure. The system validates values against expected ranges, flags outliers, and provides source citations for easy verification.

+

Can V7 Go handle SOVs from different sources?

Yes, V7 Go processes SOVs from any broker or source. The AI adapts to different formats while maintaining consistent data extraction and normalization standards.

+

Can V7 Go handle SOVs from different sources?

Yes, V7 Go processes SOVs from any broker or source. The AI adapts to different formats while maintaining consistent data extraction and normalization standards.

+

Can V7 Go handle SOVs from different sources?

Yes, V7 Go processes SOVs from any broker or source. The AI adapts to different formats while maintaining consistent data extraction and normalization standards.

+

What security measures does V7 Go implement?

V7 Go provides enterprise-grade security including SOC2 Type 2 compliance and ISO 27001 certification. All data is encrypted, with granular access controls to protect sensitive information.

+

What security measures does V7 Go implement?

V7 Go provides enterprise-grade security including SOC2 Type 2 compliance and ISO 27001 certification. All data is encrypted, with granular access controls to protect sensitive information.

+

What security measures does V7 Go implement?

V7 Go provides enterprise-grade security including SOC2 Type 2 compliance and ISO 27001 certification. All data is encrypted, with granular access controls to protect sensitive information.

+

Can V7 Go identify potential coverage gaps or mismatches?

Yes, V7 Go can compare SOV values against policy limits and sublimits to identify potential coverage gaps. AI tools included in the platform can also flag unusual coverage combinations or missing essential information.

+

Can V7 Go identify potential coverage gaps or mismatches?

Yes, V7 Go can compare SOV values against policy limits and sublimits to identify potential coverage gaps. AI tools included in the platform can also flag unusual coverage combinations or missing essential information.

+

Can V7 Go identify potential coverage gaps or mismatches?

Yes, V7 Go can compare SOV values against policy limits and sublimits to identify potential coverage gaps. AI tools included in the platform can also flag unusual coverage combinations or missing essential information.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing their custom SOVs with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to try out instantly. While these templates may require additional tweaks and customizations, adjustments can easily be made through an intuitive graphical user interface.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing their custom SOVs with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to try out instantly. While these templates may require additional tweaks and customizations, adjustments can easily be made through an intuitive graphical user interface.

+

How quickly can insurance teams implement V7 Go?

Teams can start processing their custom SOVs with V7 Go in less than a week. The platform includes pre-built insurance workflow templates that are ready to try out instantly. While these templates may require additional tweaks and customizations, adjustments can easily be made through an intuitive graphical user interface.

+

Can V7 Go process SOVs for multinational insurance programs?

Yes, V7 Go handles international exposures with support for multiple currencies, address formats, and measurement units. The system can normalize values to a common formats for global program administration.

+

Can V7 Go process SOVs for multinational insurance programs?

Yes, V7 Go handles international exposures with support for multiple currencies, address formats, and measurement units. The system can normalize values to a common formats for global program administration.

+

Can V7 Go process SOVs for multinational insurance programs?

Yes, V7 Go handles international exposures with support for multiple currencies, address formats, and measurement units. The system can normalize values to a common formats for global program administration.

+

Other automations

More automations

Transform your business

with other AI Agents

More agents

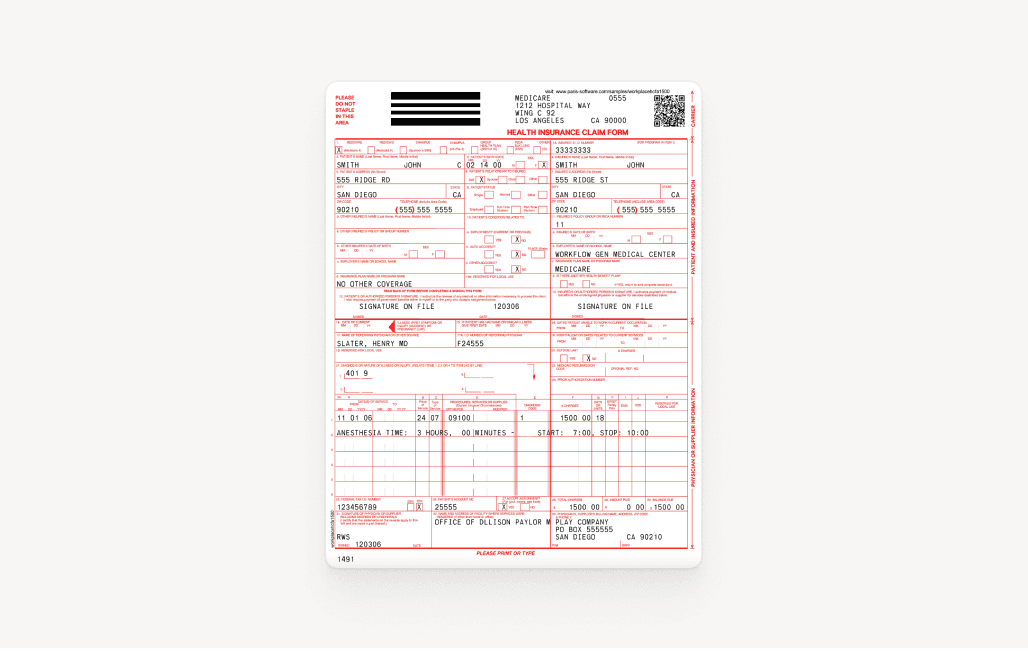

Claims Processing

Open automation

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Claims Processing

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Claims Processing

Open automation

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Policy Application Processing

Open automation

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Policy Application Processing

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Policy Application Processing

Open automation

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Next steps

Automate your SOV analysis workflows.

Let's talk

You’ll hear back in less than 24 hours

Next steps

Automate your SOV analysis workflows.

Let's talk

Next steps

Automate your SOV analysis workflows.

Let's talk

You’ll hear back in less than 24 hours