Automate risk engineering report analysis

Automate risk engineering report analysis

Built for property and specialty insurance

Built for property and specialty insurance

Challenge

Challenge

Challenge

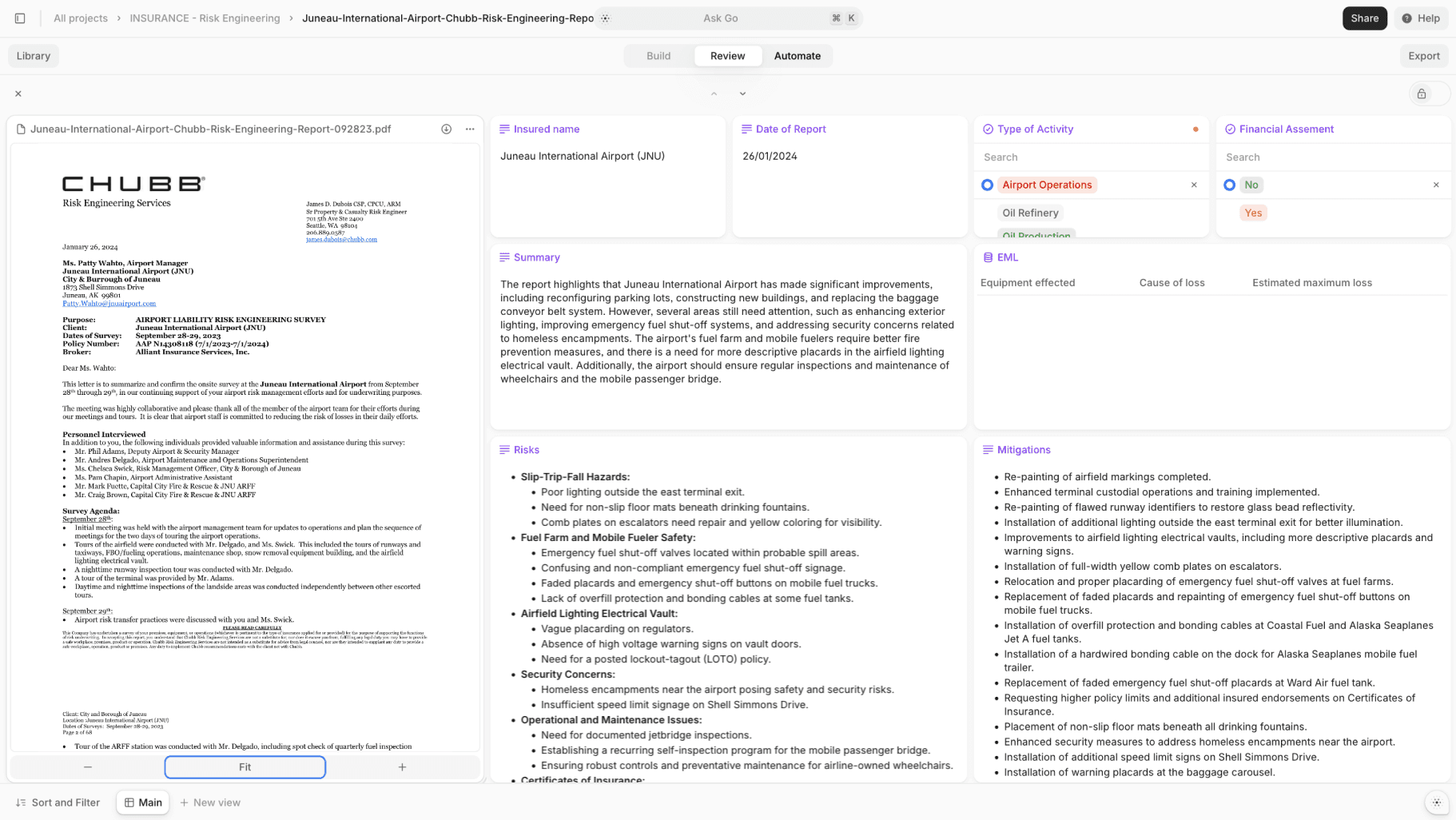

Risk engineering reports contain hundreds of pages of technical specifications, compliance checks, and risk assessments. With multiple global providers using different methodologies and formats, standardizing and extracting key insights manually creates significant bottlenecks in the underwriting process.

Risk engineering reports contain hundreds of pages of technical specifications, compliance checks, and risk assessments. With multiple global providers using different methodologies and formats, standardizing and extracting key insights manually creates significant bottlenecks in the underwriting process.

V7 Go speeds up the extraction and normalization of critical risk data across different document formats. It ensures no report goes unread and every risk factor is properly evaluated for optimal decisions.

V7 Go speeds up the extraction and normalization of critical risk data across different document formats. It ensures no report goes unread and every risk factor is properly evaluated for optimal decisions.

Why V7 Go

Why V7 Go

Why V7 Go

Long document support

Handle 200-page+ reports from multiple risk engineering providers. Extract and normalize risk grades and technical specifications regardless of methodology or layout.

Long document support

Handle 200-page+ reports from multiple risk engineering providers. Extract and normalize risk grades and technical specifications regardless of methodology or layout.

Long document support

Handle 200-page+ reports from multiple risk engineering providers. Extract and normalize risk grades and technical specifications regardless of methodology or layout.

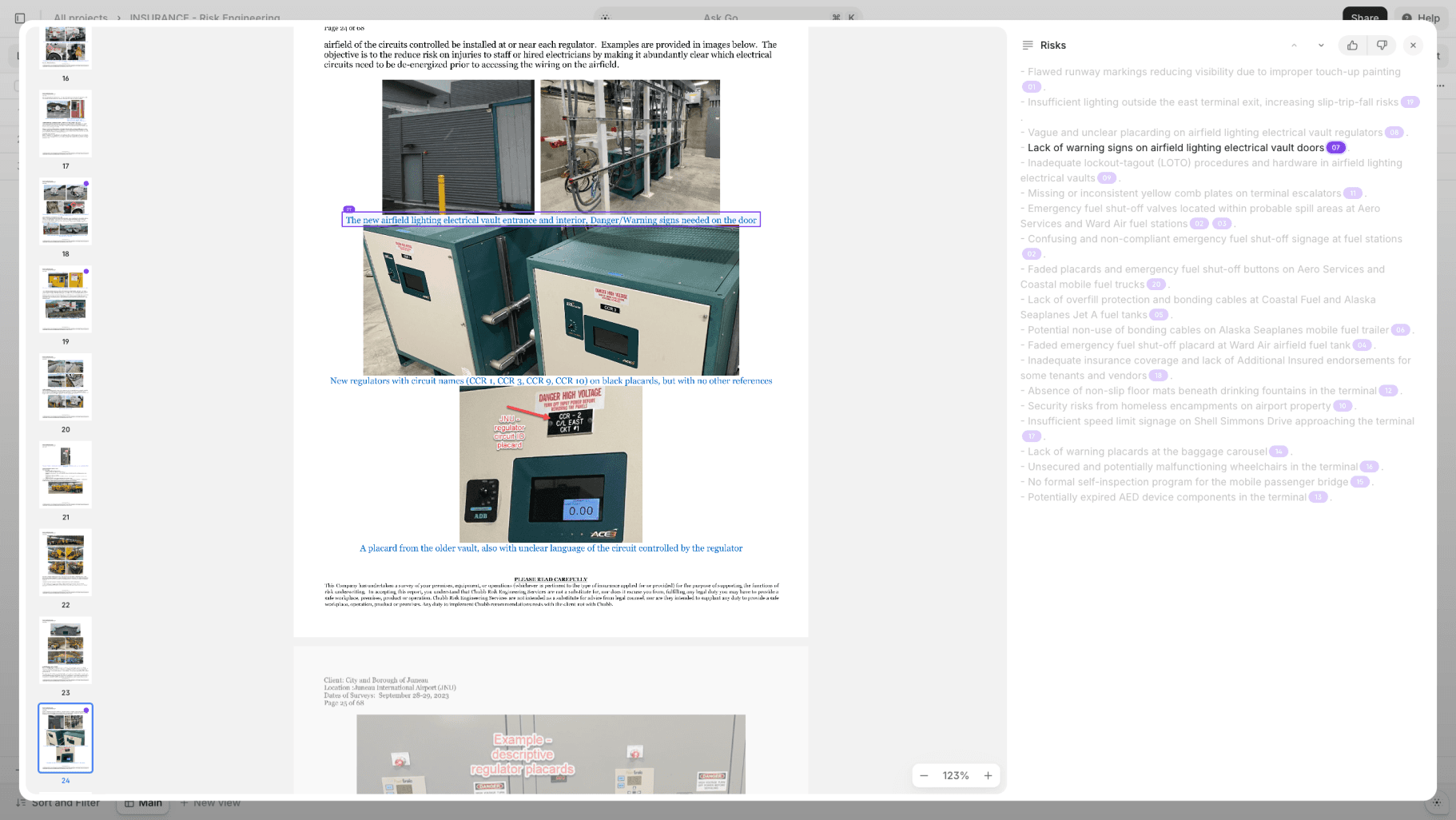

AI citations

Verify every extracted insight instantly with highlighted source text. Track risk factors back to original assessments for confident underwriting decisions.

AI citations

Verify every extracted insight instantly with highlighted source text. Track risk factors back to original assessments for confident underwriting decisions.

AI citations

Verify every extracted insight instantly with highlighted source text. Track risk factors back to original assessments for confident underwriting decisions.

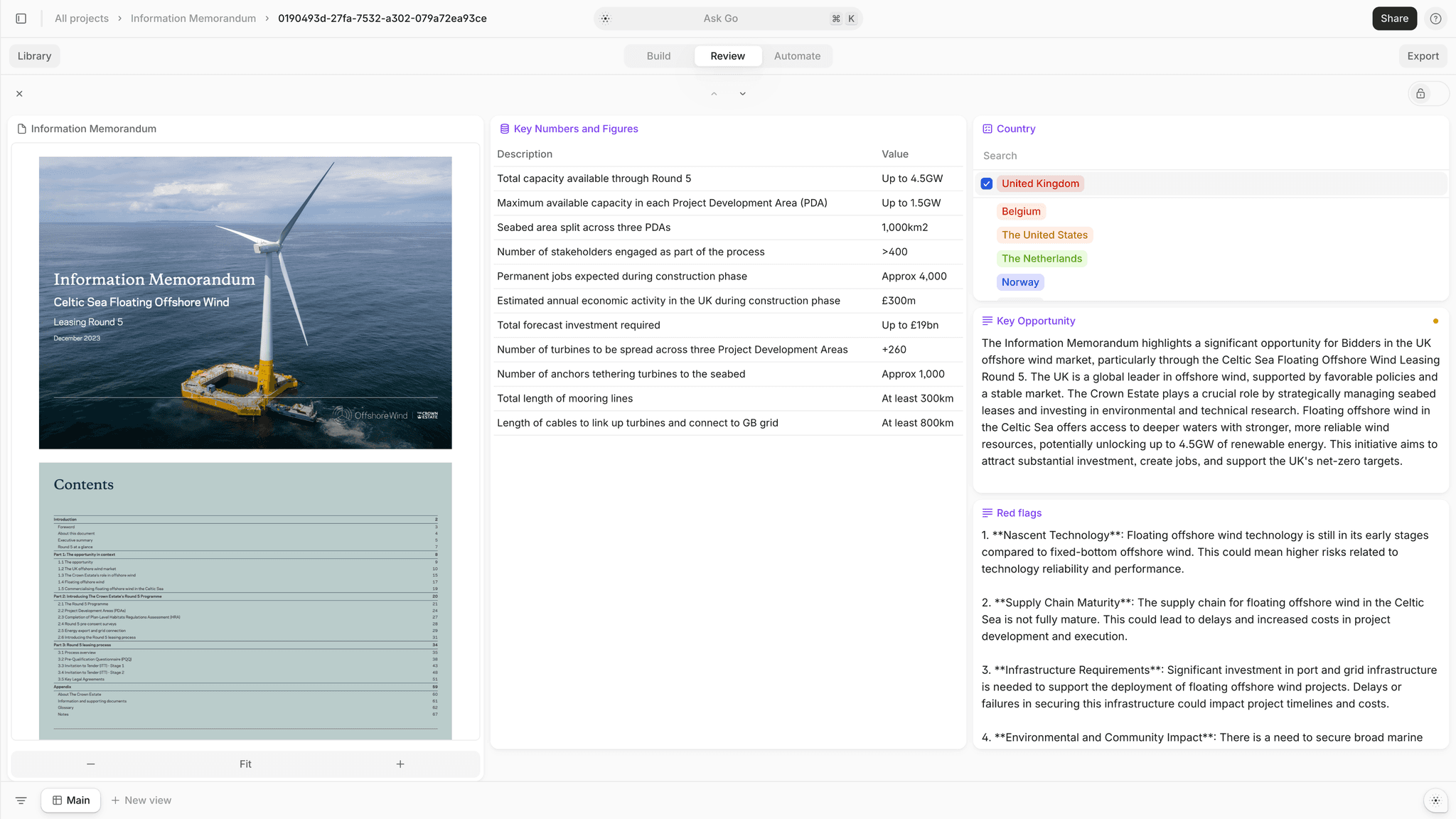

Table & graph analysis support

Extract data from complex technical diagrams, floor plans, equipment specifications, and performance charts. Convert visual risk information into structured data automatically.

Table & graph analysis support

Extract data from complex technical diagrams, floor plans, equipment specifications, and performance charts. Convert visual risk information into structured data automatically.

Table & graph analysis support

Extract data from complex technical diagrams, floor plans, equipment specifications, and performance charts. Convert visual risk information into structured data automatically.

Security & compliance

Protect sensitive risk assessment data with enterprise-grade security features that meet international insurance compliance standards.

Security & compliance

Protect sensitive risk assessment data with enterprise-grade security features that meet international insurance compliance standards.

Security & compliance

Protect sensitive risk assessment data with enterprise-grade security features that meet international insurance compliance standards.

Permission levels

Control access across underwriting teams with customizable user roles and project-level permissions. Perfect for managing large insurance operations across multiple regions.

Permission levels

Control access across underwriting teams with customizable user roles and project-level permissions. Perfect for managing large insurance operations across multiple regions.

Permission levels

Control access across underwriting teams with customizable user roles and project-level permissions. Perfect for managing large insurance operations across multiple regions.

Easy integration

V7 Go to your existing underwriting platforms and risk management systems through API access. Implement in days with minimal IT overhead.

Easy integration

V7 Go to your existing underwriting platforms and risk management systems through API access. Implement in days with minimal IT overhead.

Easy integration

V7 Go to your existing underwriting platforms and risk management systems through API access. Implement in days with minimal IT overhead.

ROI

ROI

ROI

"The system analyzes supporting documentation and returns structured data. It saves us hours on each report."

Leading global insurers and risk assesment professionals accelerate their operations with V7 Go. By automating risk engineering report analysis, underwriting teams can process more submissions while maintaining thorough risk evaluation.

Can V7 Go identify critical risk factors automatically?

Yes, V7 Go can identify and flag critical risk factors, compliance issues, and potential hazards across lengthy technical reports. The system can be configured to notify relevant team members when specific risk thresholds are exceeded.

+

Can V7 Go identify critical risk factors automatically?

Yes, V7 Go can identify and flag critical risk factors, compliance issues, and potential hazards across lengthy technical reports. The system can be configured to notify relevant team members when specific risk thresholds are exceeded.

+

Can V7 Go identify critical risk factors automatically?

Yes, V7 Go can identify and flag critical risk factors, compliance issues, and potential hazards across lengthy technical reports. The system can be configured to notify relevant team members when specific risk thresholds are exceeded.

+

How does V7 Go improve underwriting decisions?

By ensuring all risk engineering reports are thoroughly analyzed and standardized, V7 Go helps underwriters make more informed pricing decisions. The system highlights key risk factors and provides quick access to supporting technical details.

+

How does V7 Go improve underwriting decisions?

By ensuring all risk engineering reports are thoroughly analyzed and standardized, V7 Go helps underwriters make more informed pricing decisions. The system highlights key risk factors and provides quick access to supporting technical details.

+

How does V7 Go improve underwriting decisions?

By ensuring all risk engineering reports are thoroughly analyzed and standardized, V7 Go helps underwriters make more informed pricing decisions. The system highlights key risk factors and provides quick access to supporting technical details.

+

Can V7 Go handle multi-language risk engineering reports?

Yes, V7 Go processes risk engineering reports in multiple languages, making it ideal for global insurance operations. The system maintains high accuracy across different languages while standardizing risk assessments.

+

Can V7 Go handle multi-language risk engineering reports?

Yes, V7 Go processes risk engineering reports in multiple languages, making it ideal for global insurance operations. The system maintains high accuracy across different languages while standardizing risk assessments.

+

Can V7 Go handle multi-language risk engineering reports?

Yes, V7 Go processes risk engineering reports in multiple languages, making it ideal for global insurance operations. The system maintains high accuracy across different languages while standardizing risk assessments.

+

How does V7 Go handle technical diagrams and floor plans?

The advanced image-processing capabilities of V7 Go allow it to analyze technical diagrams, floor plans, and equipment specifications. The system extracts crucial information from these visual elements, converting them into structured data that complements the textual analysis of risk factors. For highly specialized, niche applications, you can also train custom computer vision models using our other platform: V7 Darwin.

+

How does V7 Go handle technical diagrams and floor plans?

The advanced image-processing capabilities of V7 Go allow it to analyze technical diagrams, floor plans, and equipment specifications. The system extracts crucial information from these visual elements, converting them into structured data that complements the textual analysis of risk factors. For highly specialized, niche applications, you can also train custom computer vision models using our other platform: V7 Darwin.

+

How does V7 Go handle technical diagrams and floor plans?

The advanced image-processing capabilities of V7 Go allow it to analyze technical diagrams, floor plans, and equipment specifications. The system extracts crucial information from these visual elements, converting them into structured data that complements the textual analysis of risk factors. For highly specialized, niche applications, you can also train custom computer vision models using our other platform: V7 Darwin.

+

How does V7 Go support compliance verification?

You can upload your custom documentation libraries and integrate them into V7 Go's knowledge base for future reference. This allows the AI to cross-reference information and check for compliance with various standards and regulations mentioned in risk engineering reports, as well as your existing policies, guidelines, or other data. It can verify whether properties meet specific code requirements, industry standards, or insurance policy conditions, flagging any gaps or concerns for underwriter review.

+

How does V7 Go support compliance verification?

You can upload your custom documentation libraries and integrate them into V7 Go's knowledge base for future reference. This allows the AI to cross-reference information and check for compliance with various standards and regulations mentioned in risk engineering reports, as well as your existing policies, guidelines, or other data. It can verify whether properties meet specific code requirements, industry standards, or insurance policy conditions, flagging any gaps or concerns for underwriter review.

+

How does V7 Go support compliance verification?

You can upload your custom documentation libraries and integrate them into V7 Go's knowledge base for future reference. This allows the AI to cross-reference information and check for compliance with various standards and regulations mentioned in risk engineering reports, as well as your existing policies, guidelines, or other data. It can verify whether properties meet specific code requirements, industry standards, or insurance policy conditions, flagging any gaps or concerns for underwriter review.

+

What training is required for underwriting teams?

The intuitive interface of V7 Go requires minimal training. Most underwriters can start processing risk engineering reports after a single 2-hour orientation session. We provide comprehensive documentation, best practices guides, and ongoing support to ensure your team maximizes the platform's capabilities.

+

What training is required for underwriting teams?

The intuitive interface of V7 Go requires minimal training. Most underwriters can start processing risk engineering reports after a single 2-hour orientation session. We provide comprehensive documentation, best practices guides, and ongoing support to ensure your team maximizes the platform's capabilities.

+

What training is required for underwriting teams?

The intuitive interface of V7 Go requires minimal training. Most underwriters can start processing risk engineering reports after a single 2-hour orientation session. We provide comprehensive documentation, best practices guides, and ongoing support to ensure your team maximizes the platform's capabilities.

+

Other automations

More automations

Transform your business

with other AI Agents

More agents

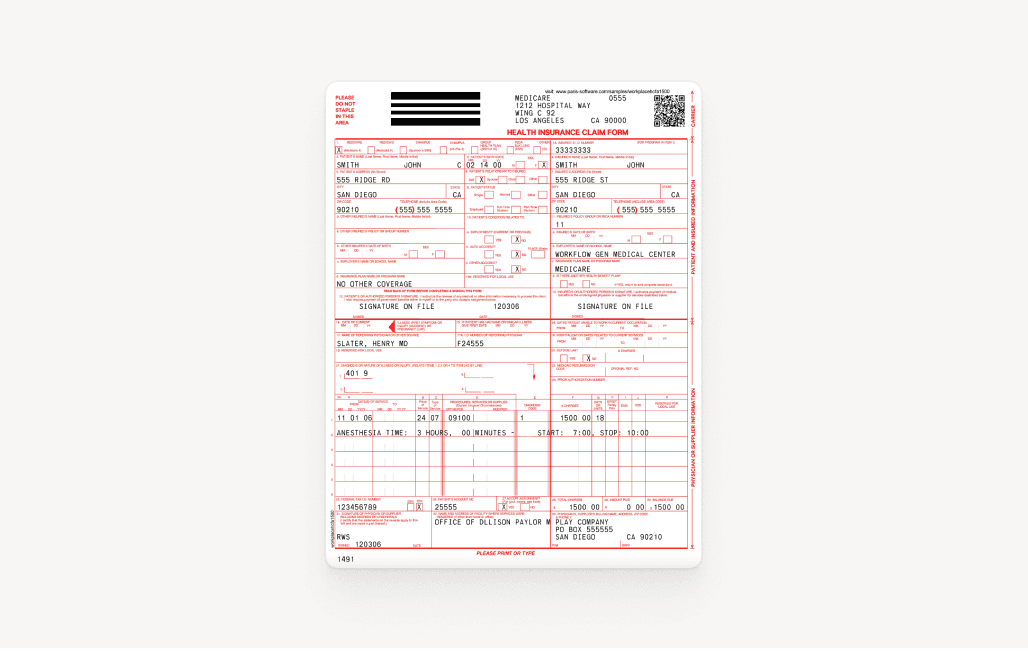

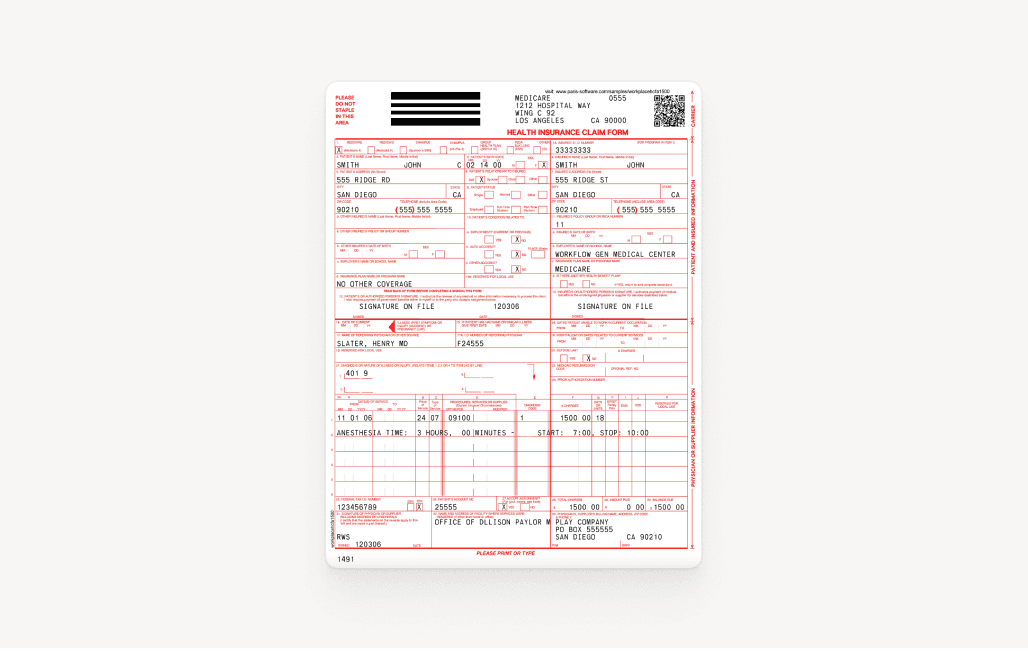

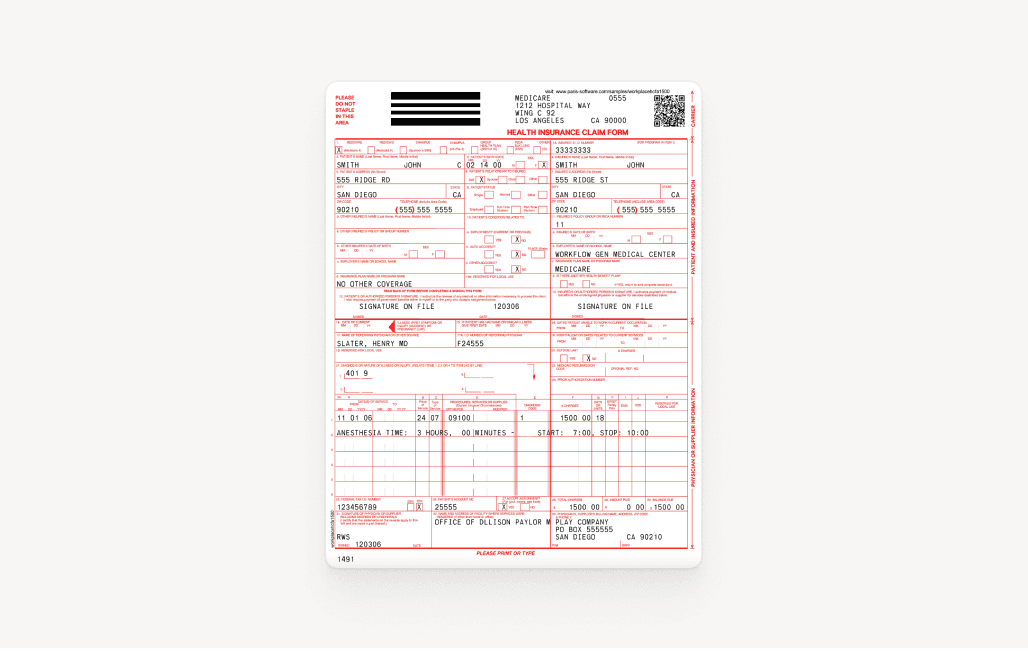

Claims Processing

Open automation

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Claims Processing

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Claims Processing

Open automation

Extract data from forms, medical reports, and adjustor notes with top accuracy. Built for insurance teams processing over 1,000 claims per month.

Policy Application Processing

Open automation

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Policy Application Processing

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Policy Application Processing

Open automation

V7 Go automates policy application processing by extracting and verifying applicant data, enabling faster and more accurate decisions.

Next steps

Determine risk factors and normalise risk grading with AI.

Let's talk

You’ll hear back in less than 24 hours

Next steps

Determine risk factors and normalise risk grading with AI.

Let's talk

Next steps

Determine risk factors and normalise risk grading with AI.

Let's talk

You’ll hear back in less than 24 hours