Knowledge work automation

22 min read

—

Jan 8, 2025

Will AI replace real estate agents? Read our in-depth analysis to discover the impact of AI on real estate jobs and the future of the industry.

Content Creator

At a recent marketing-slash-tech conference, a guy was talking about a new amazing tool he was building: "It's like ChatGPT for real estate!"

The people in the room exchanged knowing glances—we'd heard this pitch several times that day alone.

OK, I'm colorizing. It wasn't really a room—it was an elevator. Maybe keeping us cornered is what encouraged him.

To add insult to injury, it turned out to be exactly that—another GPT wrapper with no real tech built in. The "for real estate" bit was pure prompt engineering.

And, to be fair, the demand seems to be there, so it's hard to blame the guy. The global AI in the real estate market is expected to reach $731.59 billion in 2028 at a compound annual growth rate of 34.0%.

Everyone in the business seems to be chasing some form of artificial intelligence, from generating property descriptions (often poorly) to creating virtual property tours with AI bots (a solution in desperate search of a problem).

But while the industry chases these new shiny toys, the real AI revolution in real estate is happening in a far less glamorous place: the filing cabinet. Or more precisely, in the digital equivalent of thousands of filing cabinets worth of paperwork that has always been real estate's true operational challenge.

In this article:

How to distinguish between hype and genuine value in real estate AI solutions

Key technologies transforming data processing, extraction, and analysis

Use cases for real estate AI that actually work and are driving value

Practical implementation strategies for real estate firms

How AI will affect real estate for agents and investors

Let's dive into what's really happening beneath all the AI buzzwords and elevator pitches.

The role of artificial intelligence in real estate

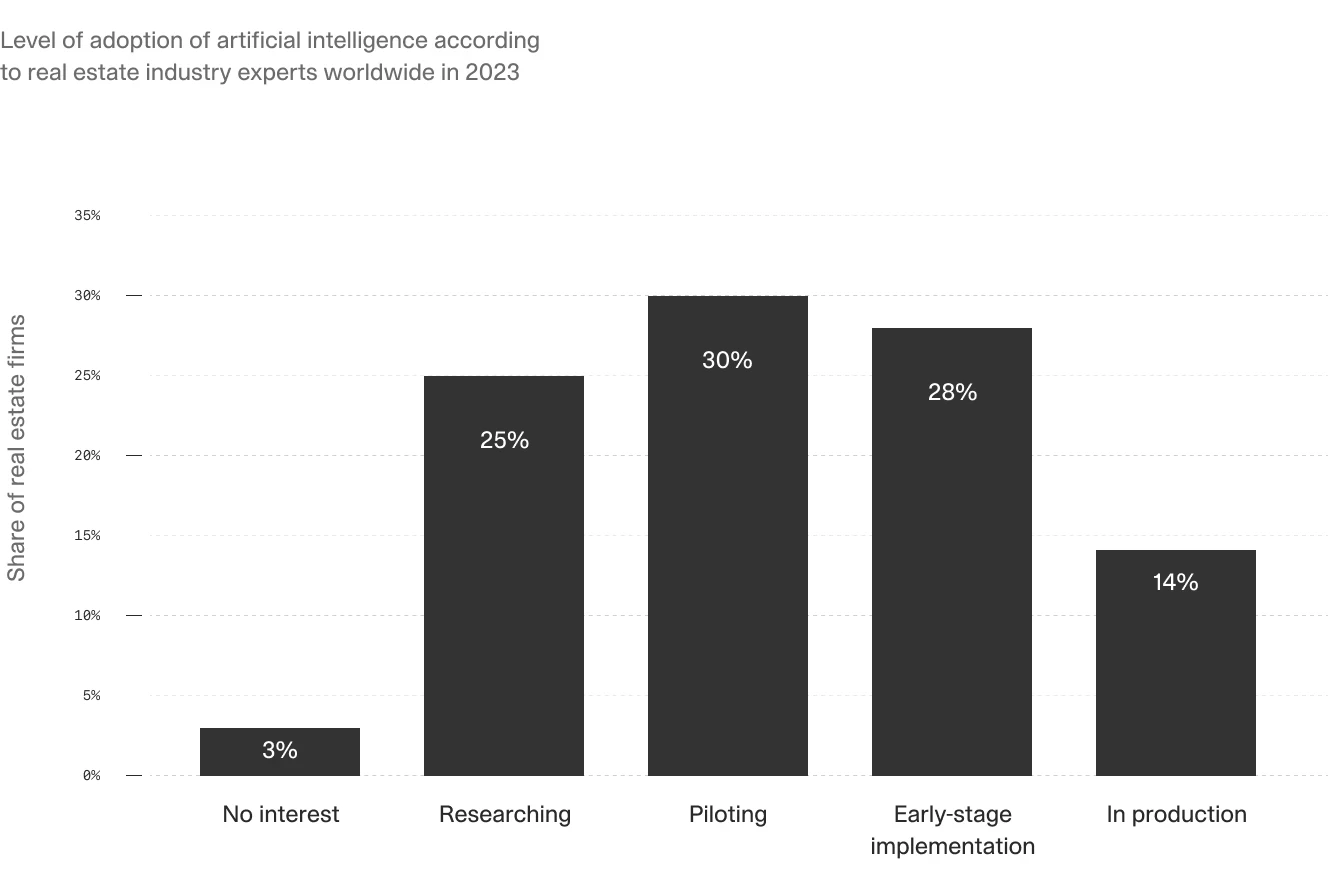

According to a recent survey of 750 CFOs, 14% of real estate firms are actively using AI technologies, with another 28% in early adoption stages and 30% conducting pilot programs. The numbers tell an interesting story about an industry in transition.

But what do these numbers really mean in practice?

For many real estate firms, "using AI" might simply mean that junior team members are writing social media posts with ChatGPT—hardly a technological revolution.

This points to a deeper issue: while basic AI applications are becoming commonplace, few understand how to leverage them effectively. The low-hanging fruit is obvious: ChatGPT and AI productivity tools can speed up daily activities at the ground level. Automated email responses, basic document summarization, and social media content generation are easy wins that can save hours each week.

This surface-level adoption is reflected in a telling statistic: while 82% of surveyed agents report using AI for property descriptions, 60% admit to a poor understanding of how the technology actually works. This knowledge gap creates a ceiling—while individual tasks might be automated, firms struggle to scale these solutions across their operations.

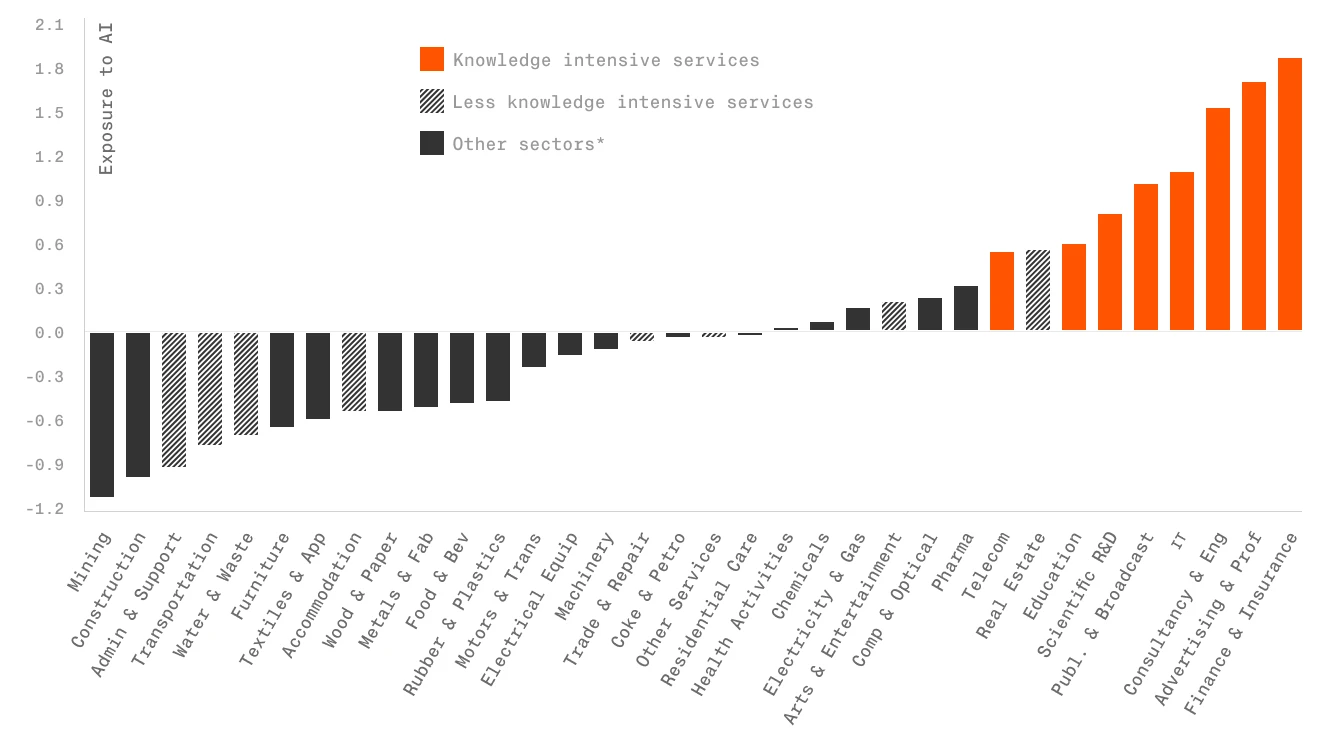

The real estate industry's adoption of AI solutions is significantly lower than in knowledge-intensive fields like finance, insurance, or IT. However, the sector is starting to recognize that workflows already widely adopted in these industries—such as AI for insurance document reviews or financial analysis—can also be applied to tasks like lease agreement processing and property listings.

And here's where the real opportunity lies. Scaling basic applications into enterprise-wide solutions presents a far greater challenge, but also offers exponentially greater returns. While it's one thing to use AI to draft a property description, it's quite another to implement an AI workflow that can reliably process thousands of legal documents or analyze complex market trends across multiple jurisdictions.

This is why the most promising applications are emerging in back-office operations, where AI is perfect for tasks that humans find tedious but crucial. AI contract search and analysis are a good example, but this can expand way beyond just documents. For instance, when analyzing tenant applications in commercial real estate, AI can now assess not just credit scores but broader patterns of business success in similar demographics and locations. Understanding whether a Pret A Manger or a local café would be more successful in a particular Brooklyn neighborhood requires analyzing vast amounts of hyperlocal data—exactly the kind of analysis where AI shines today.

So how are leading firms actually implementing these solutions?

How AI is used in real estate

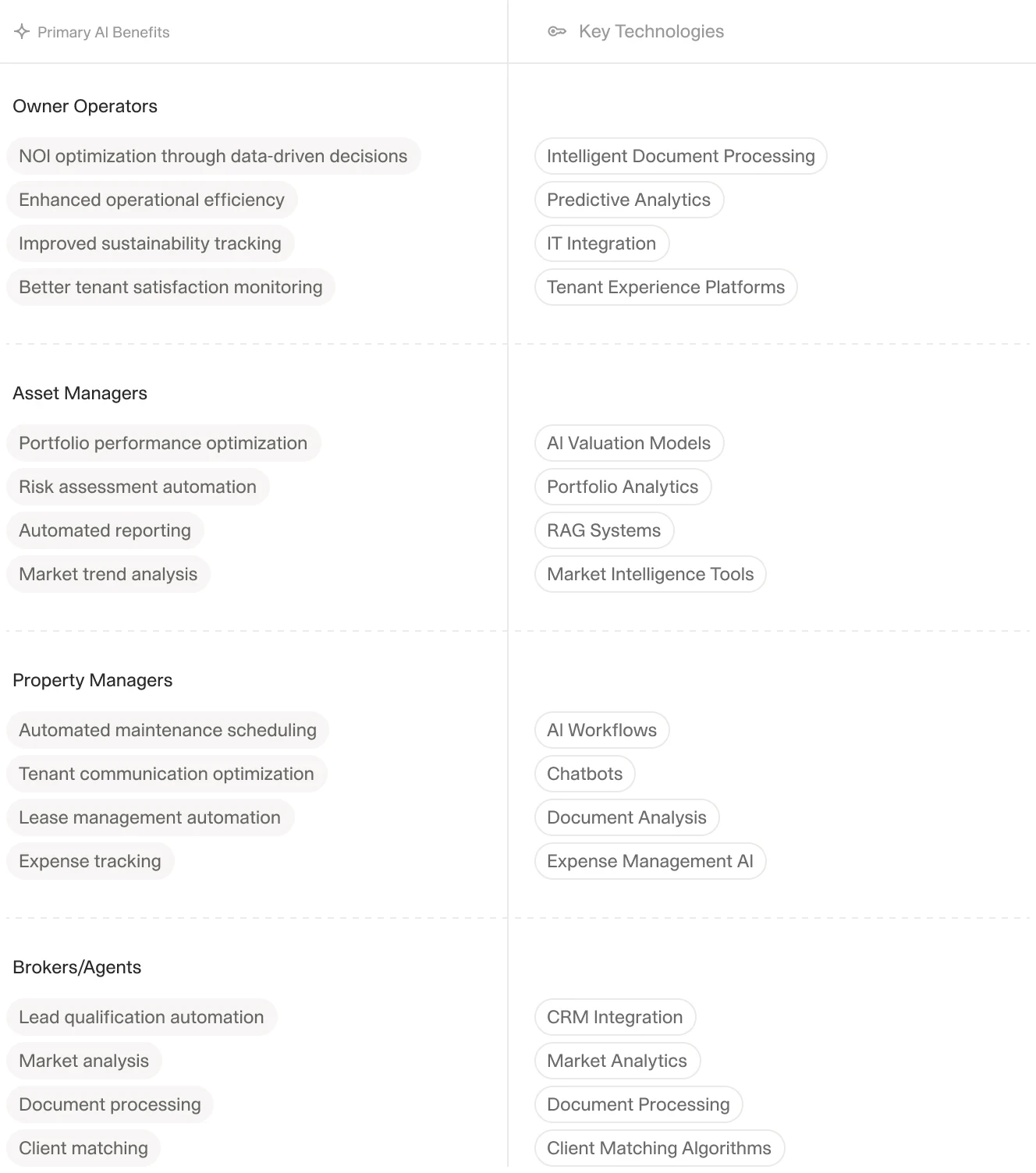

AI in real estate covers diverse use cases, tackling challenges across the entire industry, from residential deals to commercial property management.

Even a cursory glance reveals a common thread running through all these use cases: the centrality of data and document processing. It’s not surprising, given real estate’s reliance on intricate contracts, statements of value, compliance requirements, and the sheer volume of paperwork required for transactions.

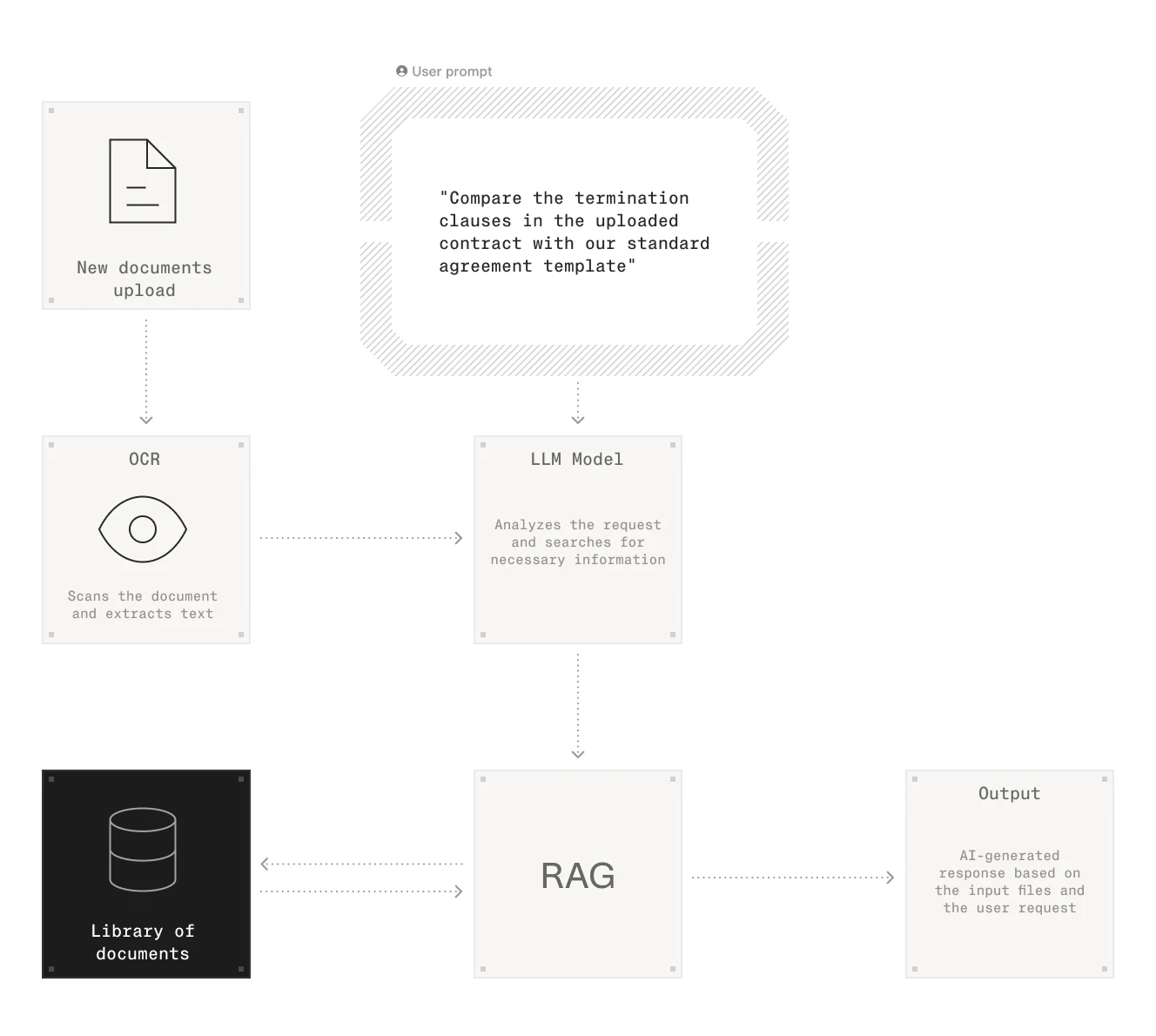

Before diving into specific applications, it's important to understand the key technologies driving this transformation. The landscape has evolved significantly from basic Optical Character Recognition (OCR) and Robotic Process Automation (RPA) to more sophisticated solutions:

Intelligent Document Processing (IDP) combines machine learning with traditional OCR software to understand document context and structure

Retrieval Augmented Generation (RAG) helps AI models access and analyze vast document repositories while maintaining accuracy

Generative AI can create detailed reports, summaries, and analyses while drawing from verified data sources

Modern AI solutions combine all of these functionalities and AI models with proprietary technologies. Now, this can lead to a very diverse range of results and performance levels. A basic GPT wrapper with a nice UI would be at one end of the spectrum, and a tool that builds on top of these technologies and moves it to the next level with IP technologies on the other end.

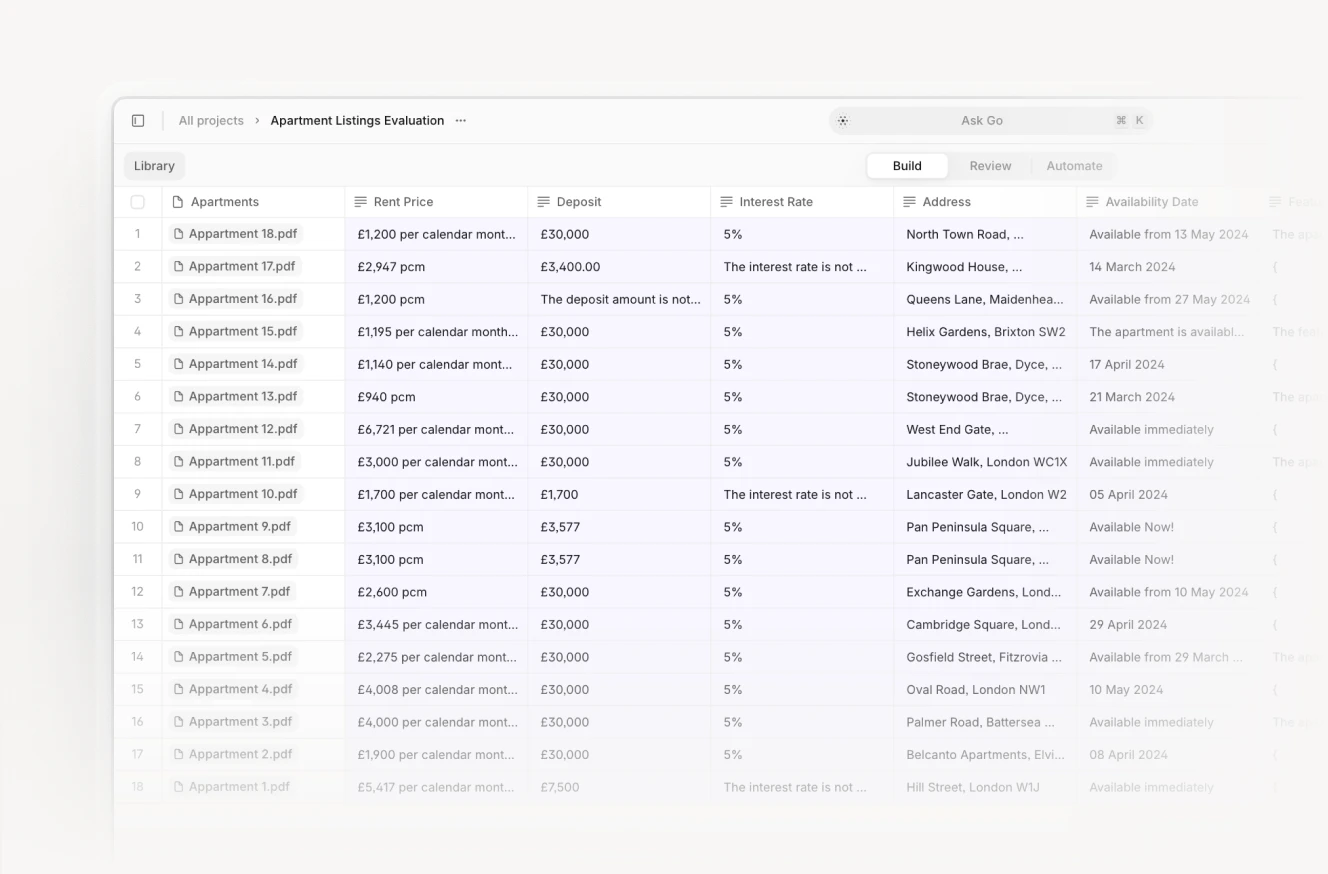

For example basic RAG systems might struggle to locate specific items like termination clauses across thousands of agreements. A state-of-the-art proptech AI for document processing like V7 Go can not only find these clauses but also analyze their implications across entire portfolios. For property management firms handling thousands of leases, this capability alone can save hundreds of hours of analyst time.

Additionally, in real estate, there’s a lot of paperwork all over the place that isn’t centralized in software. This presents a clear opportunity to modernize processes and rethink some of them entirely. With these technological foundations (and constraints) in mind, let's examine how leading firms are applying AI to solve real commercial real estate challenges.

Document reviews

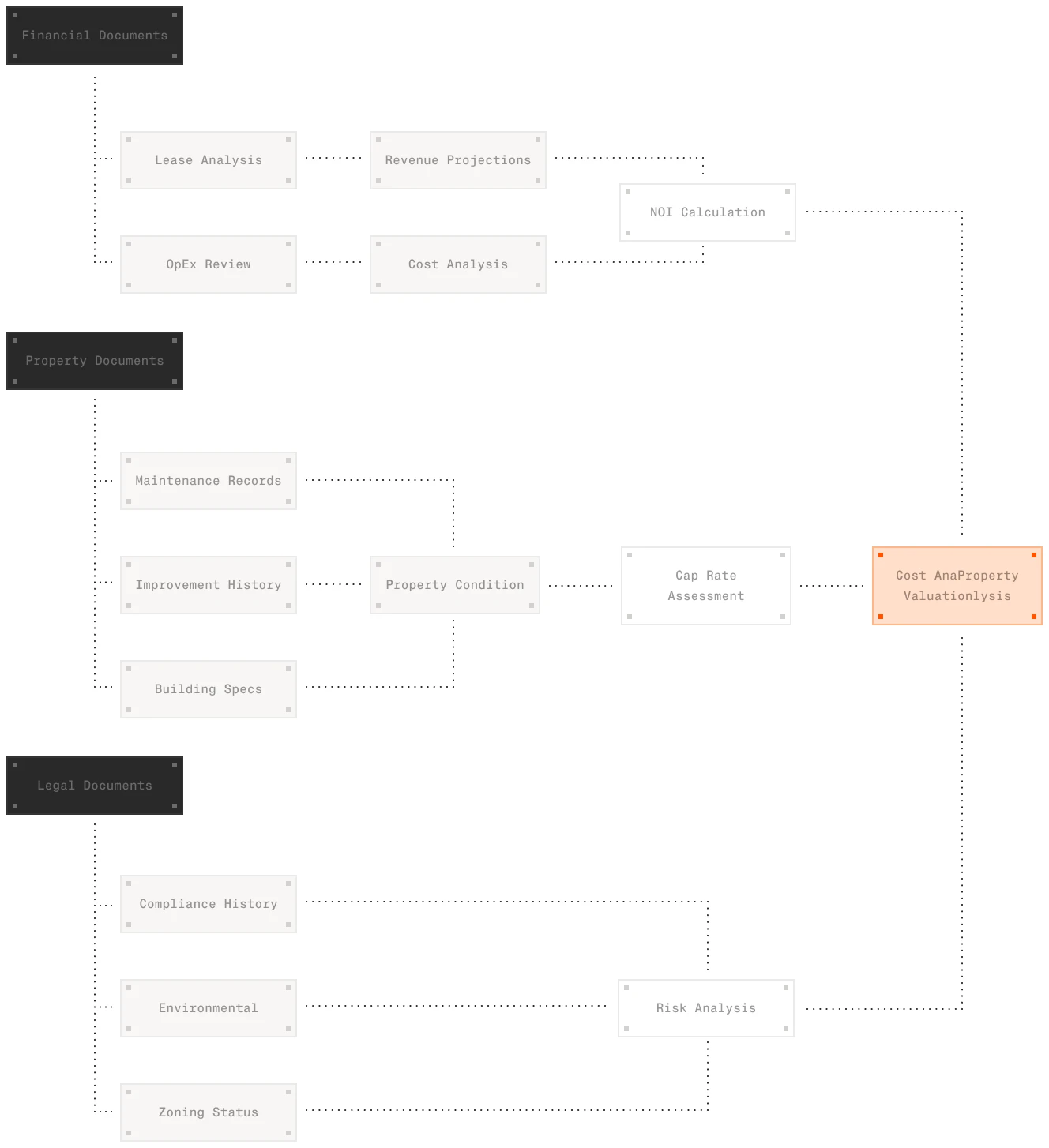

The complexity of commercial real estate documentation isn't just about volume—it's about interconnection. A single property transaction might involve lease agreements referencing multiple amendments, each affecting different clauses within master service agreements, all of which impact the property's NOI calculations and ultimately its valuation.

Traditional document management systems fail here because they treat each document as a separate entity. Modern generative AI tools for real estate approach the problem differently. When analyzing a portfolio acquisition, for instance, the system builds a semantic network of relationships between documents. A change in a lease amendment automatically triggers analysis of its impact on service agreements, operational costs, and compliance requirements.

This capability becomes particularly crucial in mid-market acquisitions. Unlike deals involving large REITs with standardized documentation, mid-market transactions often involve family-owned properties with decades of inconsistent record-keeping. We recently saw a case where an AI system analyzing a seemingly standard retail property portfolio identified a pattern of undocumented sublease arrangements that materially affected the property's value—something that might have been missed in a traditional review process. Artificial intelligence is becoming an essential tool for tasks like analyzing technical documentation and performing AI legal contract reviews.

Copilots and agentic search

Everyone's talking about ChatGPT integrations, but the real innovation in commercial real estate isn't about chatbots answering customer queries—it's about autonomous AI agents that can actively search, understand, and synthesize information from across your organization's data.

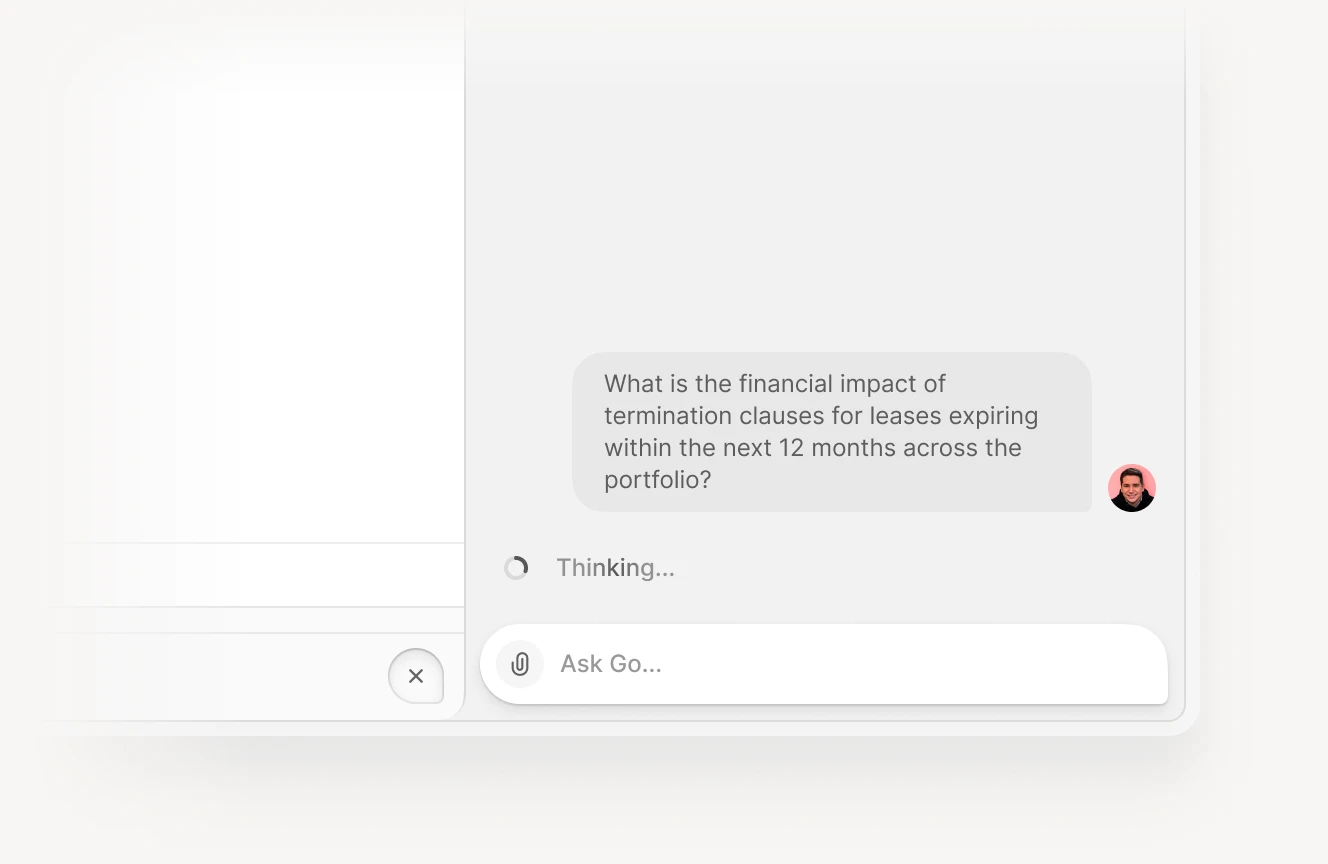

What does this look like in practice? Real estate agents often need to ask their managers about property details—lease terms, pricing, legal requirements—and these managers then have to hunt through internal repositories for answers. AI platforms like V7 Go let you directly query this information across multiple sources: Salesforce, Hubspot, emails, and internal documents. It's not "ChatGPT for real estate"—it's more like Perplexity for your entire organization's knowledge base, with every answer linked back to its source.

On top of that, unlike traditional search systems that simply match keywords or even standard RAG implementations that find relevant documents, agentic search can follow complex reasoning chains. When asked about a specific lease term, it doesn't just locate the relevant clause—it actively explores related documents to understand implications, checks compliance requirements, identifies similar clauses in other agreements, and synthesizes this information into a comprehensive answer.

The difference becomes clear when handling complex queries that require understanding context and relationships. A traditional system might help you find a document containing specific terms. But agentic search can actively reason about the query and provide an accurate answer complete with citations.

Property valuation and due diligence

The real value of AI emerges when dealing with complex commercial property portfolios, where accurate valuation depends heavily on thorough due diligence. Traditional valuation methods often miss critical details hidden in vast document repositories. As one example from the field shows, just reading through a typical commercial property's documentation could take a human 4.6 years at an average pace—and that's before any actual analysis begins.

The challenge isn't just the volume of documents—it's understanding how different factors impact valuation. A single lease amendment might affect not just rental income projections, but also operating costs, compliance requirements, and ultimately, the property's NOI. In traditional approaches, these connections often get missed because nobody can manually cross-reference thousands of pages of documentation.

This becomes particularly crucial in mid-market acquisitions. At the upper end of the market, you're dealing with established firms and professional documentation that follows standardized formats. But try valuing a portfolio of properties owned by a company doing $15-20 million in revenue—you'll likely get a jumble of documents without clear organization. Nobody hands you a neat folder labeled "HR documents" or "supplier contracts," let alone a clear record of how various agreements affect the property's value. It's no surprise that automated due diligence powered by AI is becoming popular.

Computer vision and inventory documentation

OK, let’s address the elephant in the room—yes, AI can do things like this:

As cool as it looks, this isn’t really the best use of AI and computer vision.

In real estate, the true value of computer vision lies in practical, behind-the-scenes applications rather than flashy gimmicks like virtual staging or AI-enhanced visualizations. One of its primary roles is verifying that property listings accurately reflect reality. For example, if a rental listing claims there’s a shower but the uploaded bathroom photos only show a bathtub, AI can automatically detect and flag this inconsistency.

Unlike generative AI, which focuses on enhancing or creating images, computer vision leans on tasks like semantic segmentation and object tracking in videos. These capabilities help tenants visualize space utilization options, assist property managers in monitoring inventory, and support developers in tracking progress on construction sites.

Computer vision also plays a critical role in compliance and maintenance tracking. When property listings are submitted to rental platforms, AI can ensure the images meet platform policies, exclude unauthorized content like copyrighted materials or personal photos, and confirm they align with the property description. By automating these processes, computer vision enhances accuracy, reduces errors, and streamlines operations across the real estate industry.

While understanding the capabilities of AI in real estate is crucial, equally important is knowing which solutions can deliver on these promises. Let's examine the key players in the market and what sets them apart.

AI solutions for real estate

The following platforms stand out for their proven ability to address specific real estate industry challenges with sophisticated technology. Each offers distinct capabilities and pricing models suited to different segments of the market, from buyers, to individual agents, to large commercial operations. Let's examine their key features, use cases, and pricing structures to understand which solutions might best fit your needs.

V7 Go

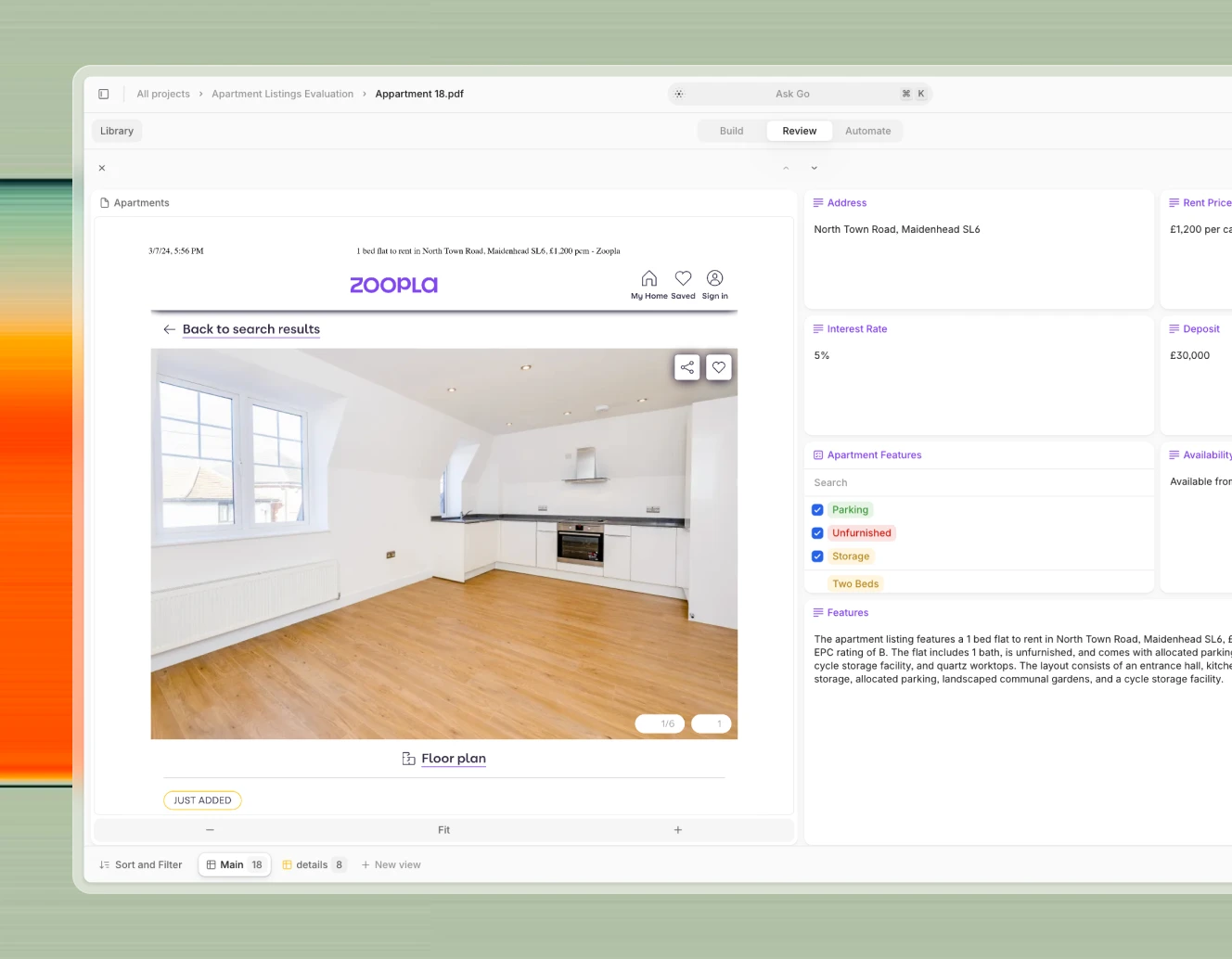

At its core, V7 Go is a document intelligence platform that goes far beyond standard document processing. It combines advanced technologies like chain-of-thought reasoning and multimodal processing to tackle complex commercial real estate workflows that traditional document systems can't handle.

The platform stands out for its ability to not just extract information, but understand context and relationships across documents. For instance, when analyzing lease agreements, it can follow complex reasoning chains to understand how amendments affect master agreements, calculate financial implications, and verify compliance requirements—all while providing clear citations back to source documents.

Best suited for large commercial real estate operations and mid-market acquisitions where document complexity and volume demand sophisticated analysis capabilities. The platform particularly excels at portfolio-level analysis where understanding document relationships is crucial for accurate valuation and risk assessment.

Pricing:

Custom pricing with dedicated support

If you're working on real estate workflows like lease abstraction, contract review, or document intake, book a demo. When the use case is a good fit, we’ll build a free proof of concept using your sample data—typically delivered within a few days.

Zillow AI

Zillow's AI technology started with the famous Zestimate but has evolved into something far more sophisticated. Their machine learning systems now power everything from property valuations to natural language search, processing vast amounts of data from public records, user submissions, and market activity.

The platform's real innovation lies in its predictive capabilities. By analyzing user behavior patterns and property data, Zillow's AI can identify market trends and buyer preferences before they become obvious. Their natural language search allows users to specify complex criteria about layout, location, commute times, and amenities in everyday language, while their recommendation engine delivers surprisingly accurate property suggestions.

While the platform serves both consumers and professionals, its most powerful features target real estate professionals who need deep market insights and advanced property analysis tools. The system is particularly valuable for agents and brokers who want to leverage data-driven insights for better client service.

Pricing:

Core features free for users

Professional services: Custom pricing

Premium features available for agents and brokers (pricing on request)

HouseCanary

HouseCanary has built a comprehensive analytics platform that covers over 136 million single-family properties across the United States. Its AI engine processes vast amounts of property data, market trends, and historical information to provide detailed valuations and market forecasts.

Beyond basic property data, HouseCanary's AI analyzes complex market patterns to predict future trends and property values. The system generates customizable reports and portfolio analyses that help investors and lenders make data-driven decisions about property investments and market opportunities.

The platform is particularly valuable for investors, lenders, and large-scale property managers who need accurate valuations and market forecasts. Its portfolio management capabilities make it especially useful for firms managing multiple properties or evaluating numerous investment opportunities simultaneously.

Pricing:

Basic: $190/year (2 reports/month)

Pro: $790/year (15 reports/month + CanaryAI)

Teams: $1,990/year (40 reports/month, 10 users)

Enterprise: Custom pricing

RealScout

RealScout approaches real estate technology from a collaboration perspective, focusing on enhancing how agents and clients work together during property searches. Their platform combines sophisticated property matching with client behavior analysis to create a more intelligent search experience.

Unlike standard property search tools, RealScout's AI learns from client interactions to understand unstated preferences and requirements. The system monitors market changes in real-time, automatically alerting users to relevant new listings or market shifts that match their refined criteria.

The platform is designed for real estate agencies and brokerages that want to enhance their client relationships with data-driven insights. It's particularly effective for teams that value a more personalized, collaborative approach to property matching.

Pricing:

Agent: $99/month (100 contacts)

Team: $249/month (1,000 contacts, 2 licenses)

Brokerage: From $399/month

Additional contacts: $9.99/month per 500

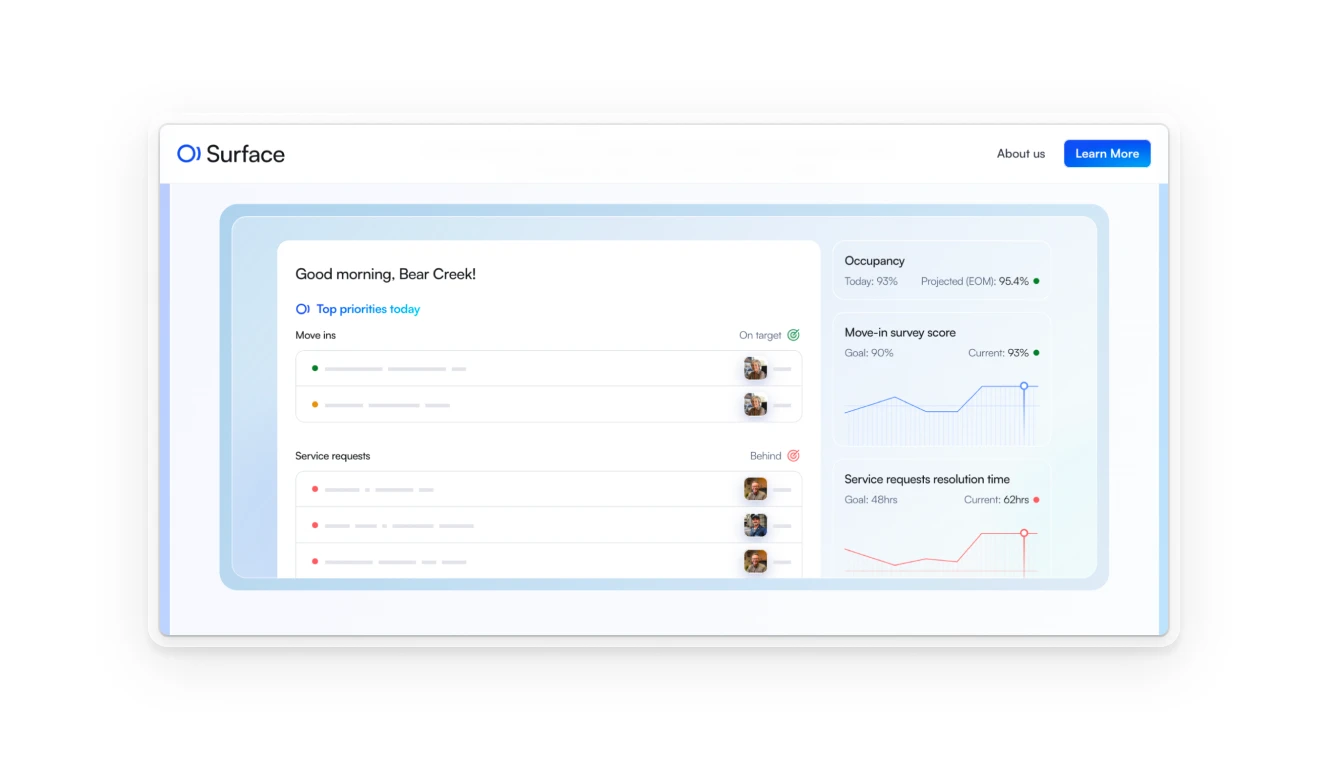

Surface AI

Surface AI is an AI-powered workflow software designed to enhance operations in the multifamily housing sector. By integrating with existing systems, it prioritizes tasks, highlights risks, and streamlines processes to improve efficiency and resident satisfaction.

The platform offers features such as summarizing resident information, drafting policy-compliant communications, and generating insights swiftly. These capabilities aim to boost operational consistency, quality, and speed, leading to increased Net Operating Income (NOI) and more satisfied staff and residents.

Surface AI is particularly beneficial for property management teams seeking to optimize workflows and enhance resident care through AI-driven solutions. Its focus on multifamily housing operations makes it a relevant replacement for the previously mentioned CRE AI in discussions about AI applications in real estate.

Pricing: Custom pricing based on implementation scope and organizational needs

Now—

Having explored both the potential and the tools, a crucial question remains: How do you actually implement AI successfully in a real estate organization? The answer lies in understanding some common patterns—and pitfalls.

AI in real estate: best practices and challenges

Implementation is where the rubber meets the road—and where many AI initiatives in real estate either soar or stumble.

After spending time with dozens of commercial real estate firms implementing AI, patterns emerge that separate successful deployments from expensive experiments. And these patterns might not be what you'd expect.

The process problem

The story typically begins the same way: ambitious plans to modernize operations across the board, usually sparked by a competitor's latest tech announcement or a compelling vendor presentation. Eager executives get excited about AI and decide they're going to automate everything at once.

Three months and several hundred thousand dollars later, they've got a mess of half-working systems and frustrated employees. Meanwhile, the firm down the street started with just lease abstraction, got it working smoothly, and is now gradually expanding to other processes.

Pick one pain point that's costing you real money right now. Maybe it's the fact that your analysts spend 70% of their time just digging through closing documents. Or perhaps it's those quarterly portfolio reviews that take three weeks to compile. Start there.

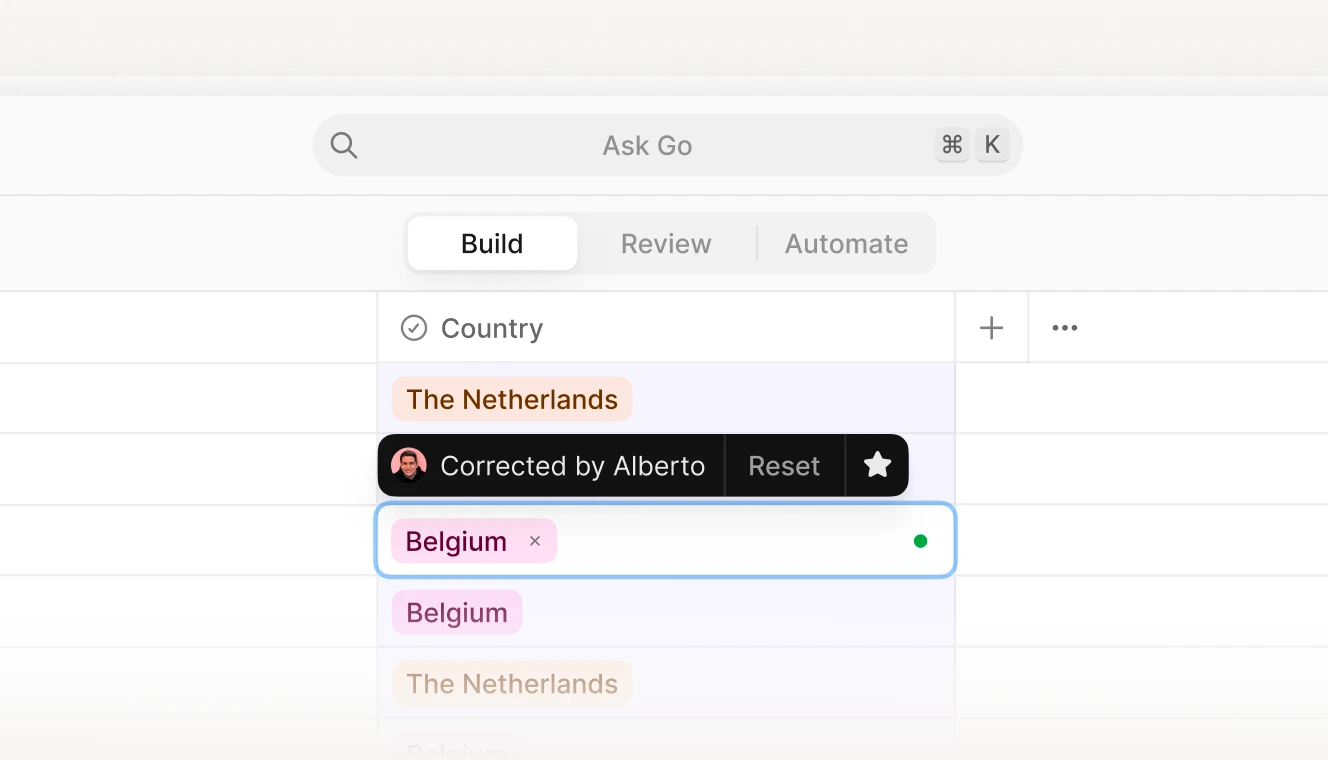

Modern AI platforms are adapting to this reality. For instance, V7 Go's Ask Go feature helps firms start small and scale smartly by picking templates made to address specific use cases in real estate. Instead of requiring technical expertise to set up complex workflows, users can use an existing project from the library. Or, they can explain their goals in natural language, and the system configures the right tools and processes. This approach has helped firms achieve a 35% productivity increase in their first month, focusing on specific processes like due diligence automation.

The integration headache

"Everyone showed us amazing demos. But when we asked how it would work with our existing systems, they got real quiet real fast."

Here's the secret nobody talks about: most AI implementation failures aren't about the AI at all. They're about integration. You've got Salesforce for deals, Microsoft Teams for communication, maybe some ancient property management system that "works just fine, thank you very much." Any new system needs to play nice with all of these.

Vendor demonstrations often look impressive until you ask about integration with existing workflows. The successful implementations all start by mapping out information flows. When an AI system flags an issue in a lease agreement, the key questions aren't about the technology itself but about the business process: Who needs this information? Through what channels? How does it fit into existing workflows? When an AI flags a potential issue in a lease, who needs to know? Does it go to HubSpot as a task? Generate a Slack notification? Both?

Leading AI systems for real estate now offer direct connections to common real estate tools through JSON schemas and API integrations. More importantly, they provide clear audit trails

The human factor

The best AI implementations enhance this rather than trying to replace it. Think of it like giving your analysts superpowers, not replacing them with robots.

Some firms make a show of going "fully automated," but that's usually more about marketing than reality. The smart players understand that AI is best at handling the grunt work—reading through thousands of pages of documents, flagging potential issues, identifying patterns. But you still need experienced professionals to interpret those findings and make judgment calls.

One of the most successful implementations I've seen actually increased human involvement in certain areas. Instead of having analysts spend hours extracting basic information from documents, they now focus on analyzing the insights the AI surfaces. The quality of their work went up, and surprisingly, so did job satisfaction. Turns out people prefer doing actual analysis to copying numbers from PDFs.

The best AI tools for real estate right now address this human versus AI balance through features like visual grounding and human-in-the-loop workflows. When the AI analyzes a document, it doesn't just provide answers—it shows users exactly which parts of the document support its conclusions. This allows experienced professionals to quickly verify AI findings and focus their expertise where it matters most. Some systems even learn from these human interactions, improving their accuracy over time through self-learning capabilities.

The gap between AI hype and reality in real estate is substantial. While vendors promote flashy features like AI-generated virtual tours and chatbots, successful real estate companies focus on practical applications that directly impact their bottom line.

Large brokerages use AI algorithms to analyze data from past transactions, market trends, and client behavior to make better business decisions. Rather than replacing agents with AI assistants, they're using technology to enhance their team's capabilities. When an agent needs to research a property's history or analyze comparable sales, AI proptech tools can compile and present this information in minutes instead of hours.

Lead generation looks different too. Instead of relying solely on AI chatbots, companies use sophisticated algorithms to analyze prospect behavior across multiple channels. This helps identify serious buyers and suggests the best time and way to reach out to them.

The most successful implementations often start small. A commercial real estate company might begin by using AI to extract key terms from lease agreements, then gradually expand to more complex tasks like portfolio analysis or risk assessment. This measured approach helps teams make informed decisions about technology adoption while delivering immediate value.

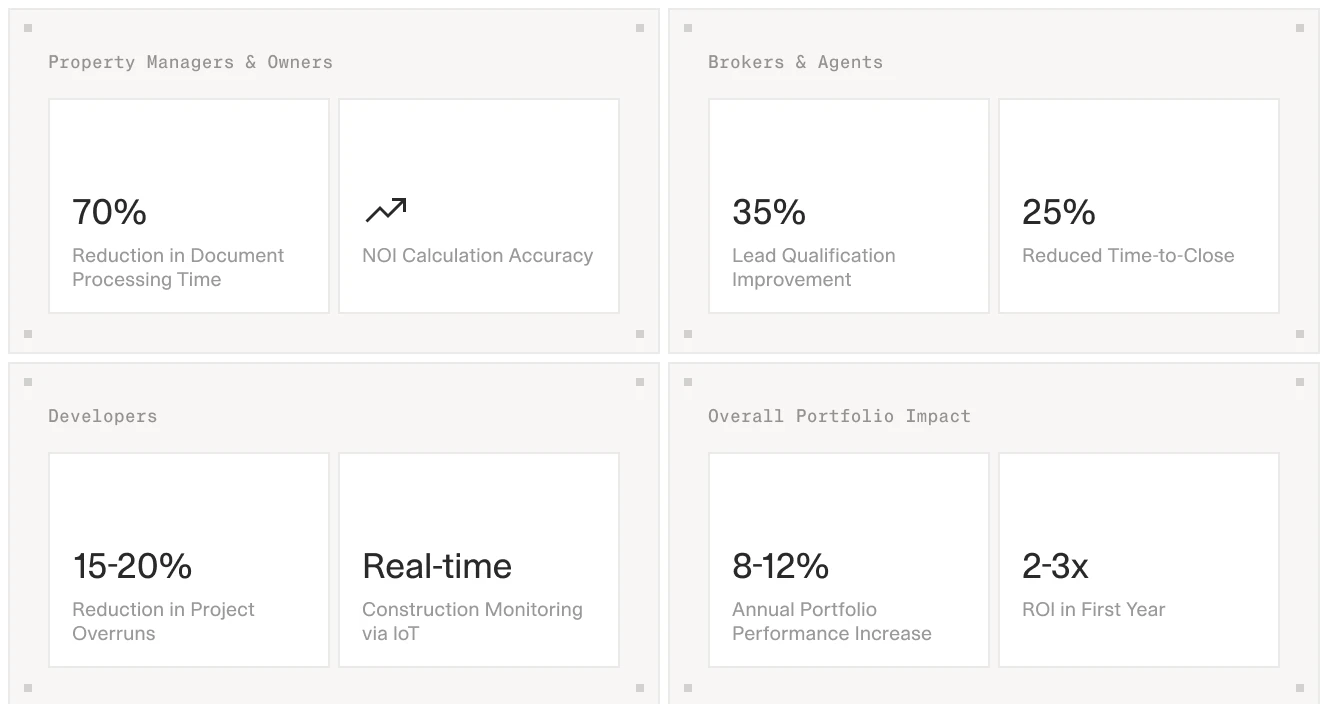

Understanding ROI: AI investment returns in real estate operations

The return on investment for AI document processing platforms in real estate varies significantly across different stakeholders, with returns manifesting both in direct cost savings and operational efficiencies. For property managers and owners, the most immediate returns come from automated valuation models (AVMs) and lease abstraction, where AI can reduce processing time by up to 70% while increasing accuracy in Net Operating Income calculations.

Asset managers implementing AI platforms typically see returns through three primary channels. First, through enhanced property valuations that combine traditional cap rate analyses with deep learning algorithms processing both proprietary and third-party data. Second, via improved property risk analytics that factor in market dynamics and tenant creditworthiness. Third, through optimization of property research and analytics that directly impact investment decisions.

For developers, ROI materializes through construction site selections and dynamic pricing models. By leveraging neural networks trained on historical property data, construction timelines, and market conditions, developers can better predict project viability and optimize development schedules. Internet of Things sensors integrated with AI platforms provide real-time construction monitoring, potentially reducing project overruns by 15-20%.

Brokerages and agents find value in customer experience automations and AI-assisted forecasts. Advanced client engagement platforms utilizing foundational models can automatically generate interactive showcase listings and personalized home recommendations. These systems typically deliver a 30-40% improvement in lead qualification accuracy and a 25% reduction in time-to-close for transactions.

Commercial real estate firms investing in comprehensive AI platforms often see compound returns through integrated mortgage origination solutions and property advertising optimization. TestFit and similar decision assist tools help optimize space utilization and tenant mix, while conversational chatbots handle routine inquiries, freeing up human capital for high-value activities.

Residential real estate investing platforms demonstrate how AI can transform property listing descriptions and customized user experience delivery. By leveraging generative AI tools and intellectual properties developed specifically for real estate applications, these platforms typically deliver 2-3x ROI within the first year of implementation.

Perhaps most significantly, property research and analytics powered by AI have begun to show remarkable accuracy in predicting market movements. When combined with digital marketing platforms and AI lead generation tools, these systems create a comprehensive ecosystem that can increase portfolio performance by 8-12% annually through better-informed investment decisions and improved asset management.

For institutional investors, the ROI calculation must consider not just cost savings but also risk mitigation. Advanced property risk analytics powered by deep learning algorithms can identify potential issues in lease agreements or market conditions that might be missed in traditional analysis, potentially preventing millions in losses through early intervention.

The key to maximizing ROI lies in selecting platforms that integrate seamlessly with existing workflows while providing scalability for future growth. While initial implementation costs may seem substantial, the long-term returns through improved operational efficiency, reduced human error, and enhanced decision-making capabilities typically justify the investment within 12-24 months of deployment.

Looking ahead: the future of AI in real estate

The real estate industry's relationship with AI is reaching a critical inflection point. While many firms are still experimenting with surface-level applications like property description generation, forward-thinking organizations are focusing on the less glamorous but far more valuable back-office operations.

The distinction becomes particularly clear in commercial real estate. For large brokerage firms managing complex portfolios, the ability to automate document processing, enhance due diligence, and streamline compliance monitoring isn't just about efficiency—it's about competitive advantage. The technology has matured enough to handle sophisticated tasks like analyzing lease amendments, tracking maintenance patterns, and even predicting tenant success rates.

However, successful implementation requires more than just choosing the right technology. As Dave Conroy from the National Association of Realtors warns, "You need to know that the results of ChatGPT-created text are generally 80% to 90% accurate, but the danger is that the output sounds confident, even on the inaccurate parts." This underscores the importance of human oversight and the need for systems that provide clear citations and verifiable results.

The real estate industry may be traditionally slow to adopt new technology, but the potential impact of AI on commercial real estate operations is too significant to ignore. The question isn't whether to implement AI, but how to do so in a way that creates lasting value while maintaining the human relationships that have always been at the heart of real estate.

Dealing with a specific challenge? We can set up a focused demo around your use case. And yes, we'll show you exactly how it integrates with your existing systems. Book a demo and let's discuss how to make AI work for your real estate operations. No "revolutionary AI” pitches, we promise—just practical solutions to real challenges.