Knowledge work automation

13 min read

—

Nov 28, 2024

Casimir Rajnerowicz

Content Creator

Have you ever spent a weekend buried in documents while your family enjoyed Sunday brunch without you?

You might have thought: Isn’t there an AI that could handle this for me?

Here’s the reality: the technical and legal due diligence process hasn’t changed much since “digital” meant using Excel instead of paper. To borrow a phrase, we’re using space-age technology to order coffee but relying on stone-age methods to evaluate billion-dollar deals.

According to Deloitte’s latest research, by the end of 2023, only 10% of private funds had incorporated any kind of AI into their core processes. This isn’t a simple missed opportunity—it highlights the challenge of moving away from well-established practices that have defined the industry for decades.

That said, things are shifting. AI and automation are paving the way for a more efficient due diligence process—faster insights, reduced manual effort, and fewer errors. This is particularly evident in specific parts of the process, such as extracting data from documents.

This article will explore how AI tools are changing the game and why they’re set to become an industry standard in due diligence in the years ahead.

In this article:

Understanding reviews and deal velocity in investment firms

How AI and automation are transforming due diligence

Core technologies, challenges and considerations

Document processing

AI for document processing

Get started today

Due diligence and deal velocity in investment firms

Let’s start by examining the current state of AI implementation among investment firms.

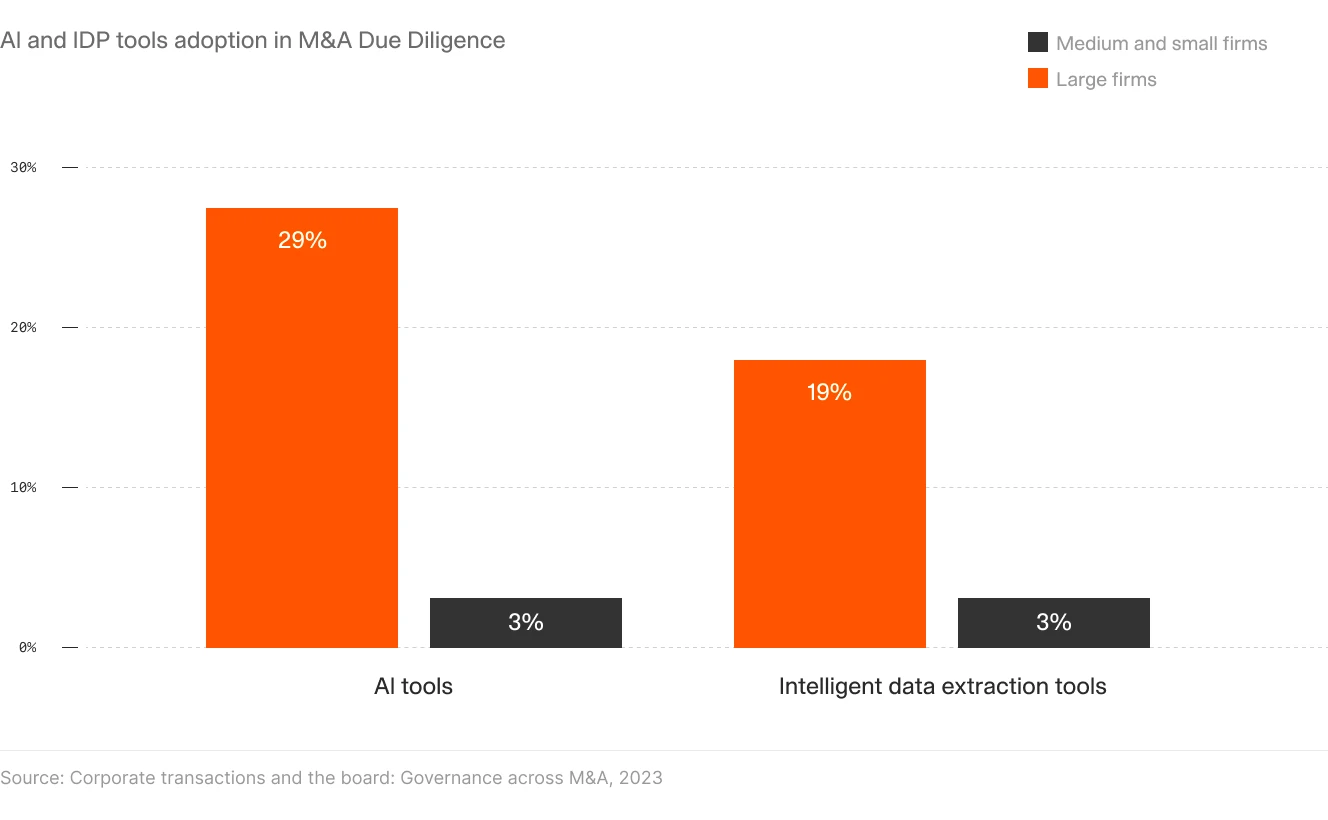

Although overall adoption remains limited, large firms are leading the way. 29% of these firms are actively implementing AI tools to enhance their due diligence processes, while 19% have adopted intelligent data extraction tools to handle document-heavy tasks more efficiently.

In contrast, small and medium-sized firms lag significantly behind, with only 3% adoption for both AI and IDP technologies. This gap highlights the resource and scalability challenges smaller firms face when trying to incorporate cutting-edge tools into their operations.

This stark disparity highlights the resource and expertise gap. But, let’s get back to the core issue at hand.

Due diligence, a cornerstone of mergers and acquisitions (M&A), has long been an exercise in patience, precision, and endurance. Traditionally, the process usually stretches across a minimum of 60 days, demanding a painstaking review of financial statements, contracts, tax records, and regulatory documents. EY points out that many companies still store key documents in physical formats, adding manual effort and delays to what is already a high-stakes exercise.

The costs are equally daunting. With M&A expenses typically ranging between 1% and 4% of the deal size, due diligence alone can rack up millions in fees, reflecting not just the complexity of the work but the inefficiencies inherent in current practices.

But the challenge runs deeper than inefficiency. As Structize explains: due diligence today demands a shift from exhaustive document reviews to strategic inquiry—asking the right questions and uncovering pivotal insights faster. This shift isn’t about cutting corners but rethinking priorities to focus on the factors that can make or break a deal.

The modern M&A landscape also demands analysis beyond financials and legal compliance. Evaluating a target’s technology, cybersecurity, and ESG commitments has become just as critical as reviewing its balance sheet. Research shows that while buyout firms meticulously perform tech due diligence for software companies (representing just 15% of deals), only 9% of general buyouts receive the same scrutiny. This despite the fact that 31% of all buyouts last year involved technology companies.

Companies note that these dimensions are now central to assessing value, making traditional methods increasingly unfit for purpose. The complexity of modern due diligence extends beyond just document review. "Just as the tech function itself has moved out of the back room to become a strategic centerpiece for many companies, the most effective way to evaluate a target's technology capability has had to evolve as well" (Bain & Company). This evolution also demands new tools and approaches that can handle the increasing sophistication of modern business transactions.

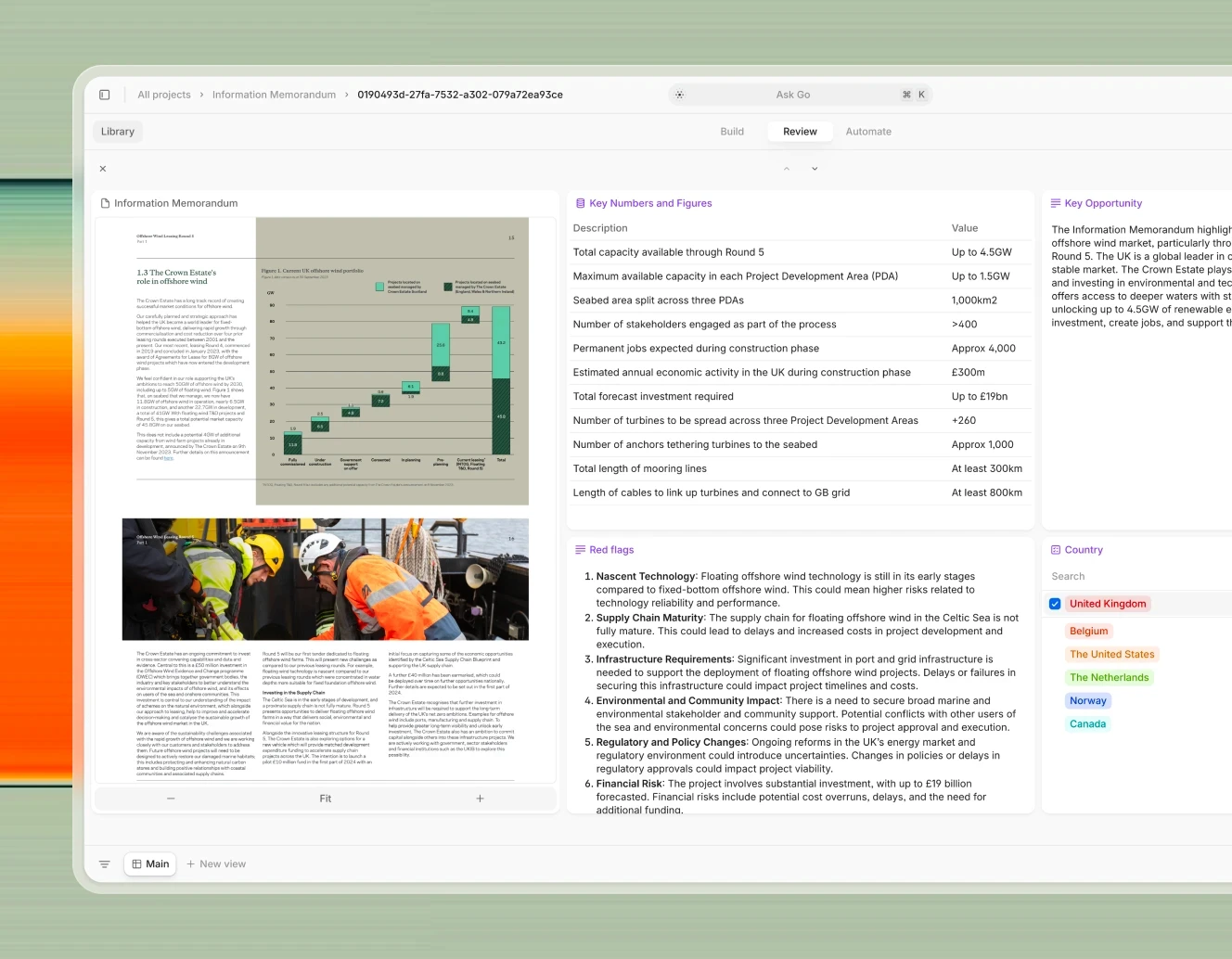

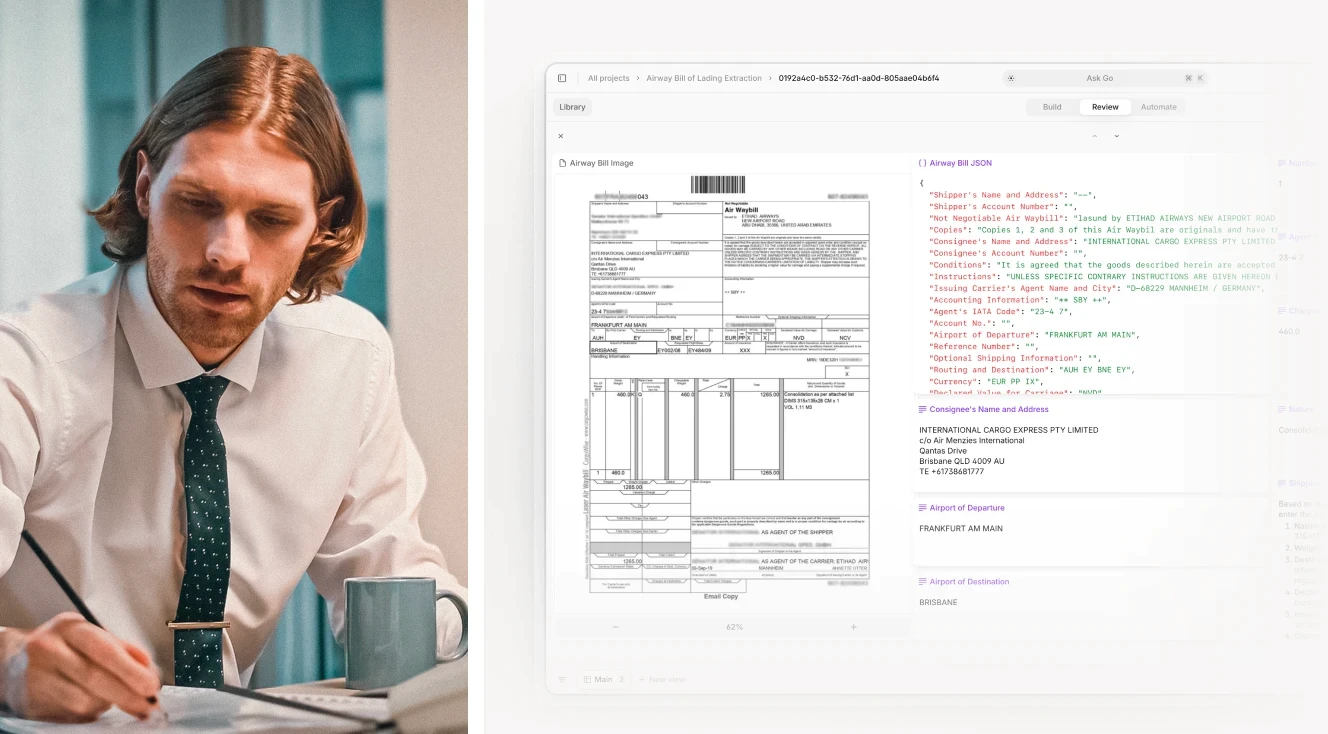

AI extracting data from documents in V7 Go

Here’s where AI enters the picture. Far from being a gimmick, AI addresses the core friction points in due diligence: speed and accuracy. It can perform AI contract reviews, flag risks, and surface anomalies in hours, not weeks, enabling teams to focus their expertise where it counts most. AI has evolved from being experimental to essential.

This is not just a trend but a response to real pressures. In a competitive market where delays can mean lost opportunities, AI provides the edge that firms need to act decisively while maintaining rigor. For firms unwilling to adapt, the cost isn’t just inefficiency—it’s the risk of fading into irrelevance in an accelerating deal-making landscape.

Benefits of using AI to increase deal velocity

Integrating AI into due diligence transforms deal execution by improving speed, accuracy, and scalability while reducing risk. Deloitte research highlights how AI can slash timelines that traditionally exceed 2 months. Centerline is a good example of boosting productivity with AI. By leveraging GenAI tools like V7 Go for data extraction and automated document analysis, the company increased their productivity by 35% in just one month.

AI also enhances accuracy by systematically analyzing vast datasets, spotting risks and anomalies that manual reviews might overlook. It ensures consistency across documents and flags patterns indicative of deeper issues, providing firms with a clearer risk landscape. For complex transactions, AI scales effortlessly, handling cross-border regulatory analysis, multiple deal streams, and diverse document formats, making it indispensable for modern M&A.

Beyond efficiency, AI’s advanced analytics delve into areas like fraud detection, regulatory compliance, and cybersecurity vulnerabilities. By uncovering these risks early, firms not only accelerate their processes but also mitigate potential deal-breaking issues. Together, these advantages make AI a critical asset in executing faster, more informed, and safer deals.

How AI and automation are simplifying due diligence

The transformation from traditional to AI-driven due diligence represents a fundamental shift in how investment firms approach deal evaluation. AI's ability to mine large amounts of documents, contracts, and financial data isn't just about speed – it's about identifying patterns, anomalies, and inconsistencies that might otherwise go unnoticed.

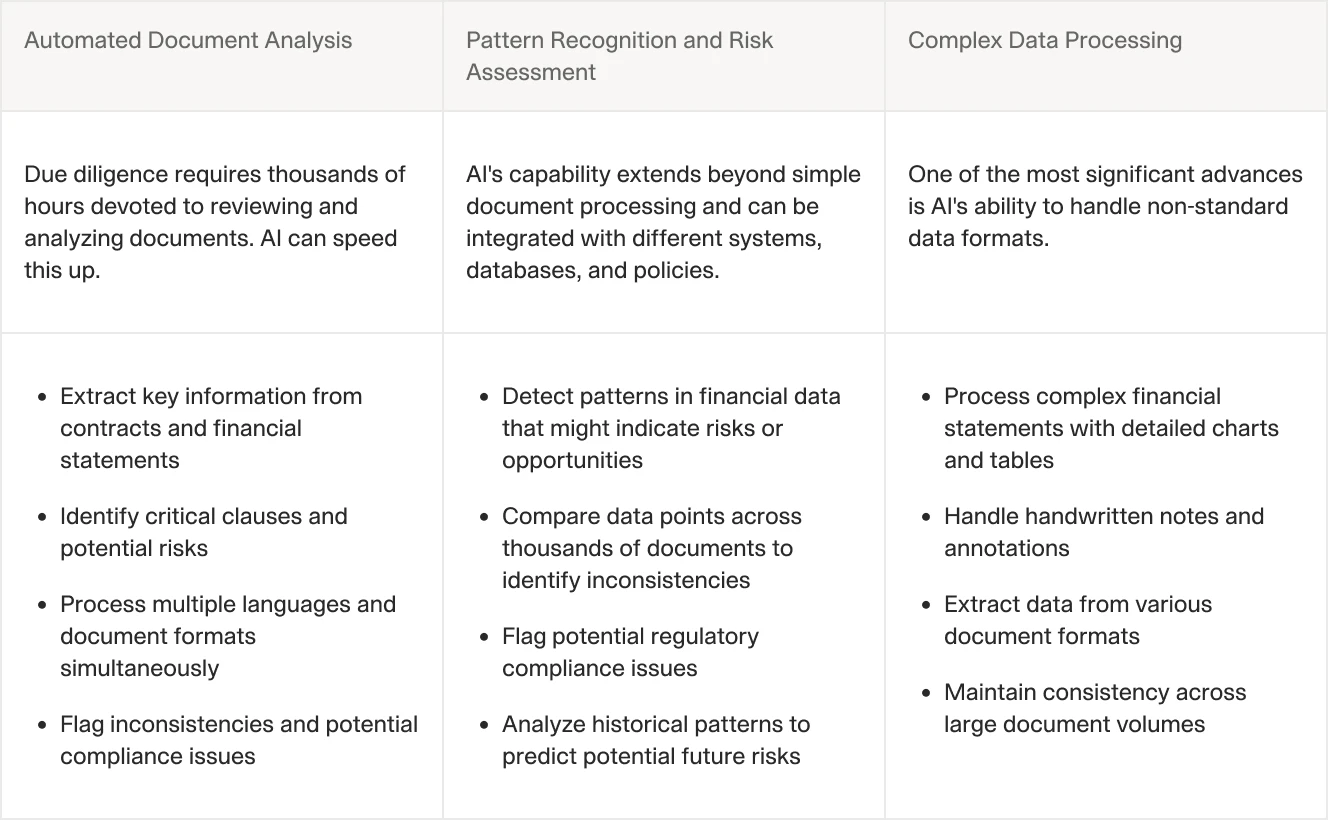

Key AI capabilities in modern due diligence:

The technology has evolved far beyond simple document scanning. As Corporate Compliance Insights reports, modern AI systems can now analyze patterns across various data sources, providing deeper insights into potential risks and opportunities. This comprehensive analysis helps firms make more informed decisions while significantly reducing the time and resources required for thorough due diligence.

Can all of these tasks be fully automated?

To some extent.

Can due diligence be automated with AI?

Let’s take a look at due diligence in a different industry—logistics.

AI plays a pivotal role in modern supply chain due diligence, but its capabilities must be complemented by human expertise. As Samuel Logan explains, while AI efficiently identifies surface-level risks—such as spotting potential "red flags" in vast multinational supply chains—it struggles with interpreting complex relationships and accessing critical local data. For example, understanding the connections between supply chain actors often requires nuanced, contextual insights that AI cannot provide alone. To address these gaps, a hybrid approach is essential. AI streamlines the process by scanning and organizing data, but human investigators bring essential local knowledge, cultural understanding, and on-the-ground access.

Similarly, in M&A and investment due diligence, AI can quickly identify potential risks, such as financial irregularities or regulatory concerns, by analyzing vast datasets. However, interpreting these findings—such as understanding how a flagged financial trend impacts broader investment strategy or uncovering subtleties in market conditions—requires the critical thinking and judgment of experienced professionals.

As you can see, human oversight of the process is as necessary as ever, even if only for the final review:

If traditional due diligence is like trying to find a needle in a haystack, modern AI-powered due diligence is like using a metal detector. The tools make the process much faster and more efficient, but you still need to understand what you're looking for and confirm whether what you’ve found is the right match.

But where do you actually start?

How to automate due diligence with AI

AI isn’t about replacing human judgment. It’s about enhancing it. At its core, AI addresses the fundamental bottlenecks in due diligence: speed, accuracy, and scalability. AI due diligence platforms like V7 Go integrate traditional tools with generative AI technologies—such as Optical Character Recognition (OCR), Large Language Models (LLMs), Python code, and workflow automation—to transform deal evaluation processes.

The platform's AI-powered search and extraction features allow users to instantly locate specific clauses across extensive document repositories. Its understanding of legal language and context ensures that critical provisions are not overlooked, even when exact terms don't match.

Each finding in V7 Go includes source citations and highlighted text for easy verification. The system learns from user feedback, improving its accuracy over time.

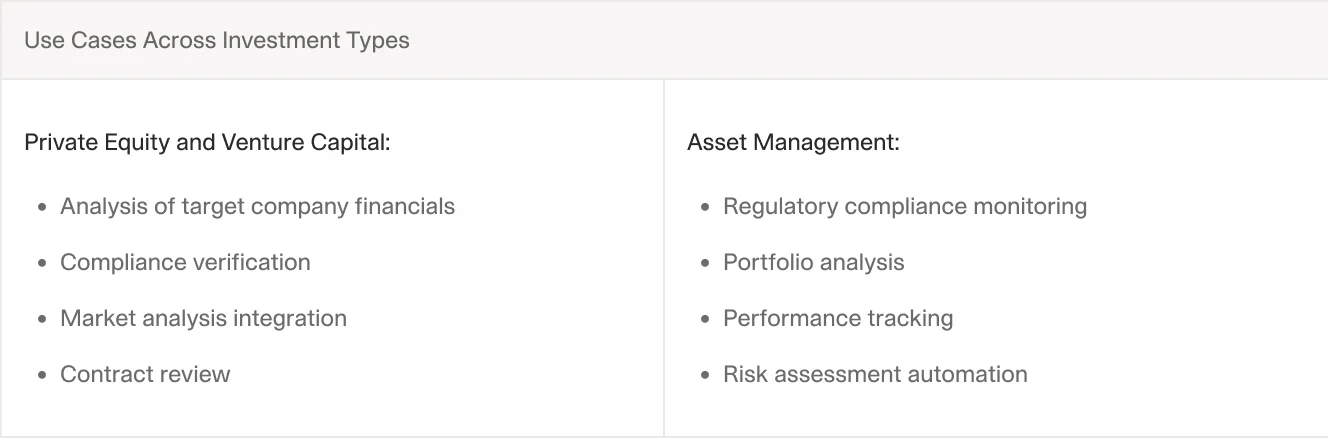

Common due diligence automations include:

10-Q Report Analysis. Automating the extraction of key financial data from quarterly reports to streamline analysis.

Confidential Information Memorandum (CIM) Review. Accelerating the review process by extracting essential financial metrics and market data.

Fund Performance Reporting. Simplifying the analysis of fund performance data to improve reporting accuracy and efficiency.

Pitch Deck Analysis. Extracting key metrics from company pitch decks to facilitate investment comparisons.

Portfolio Data Room Analysis. Automating the extraction of insights from data rooms, including technical documentation and financial models.

Contract Search and Extraction. Reducing review time by extracting key information and enabling instant clause searches.

Patent Processing. Extracting critical information from patent documents with high accuracy for intellectual property evaluations.

Legal Document Review. Automating the identification of critical clauses and ensuring compliance in legal documents.

By automating labor-intensive aspects of contract review, V7 Go enables legal and financial teams to focus on strategic analysis and decision-making, thereby accelerating the M&A due diligence process and enhancing overall deal execution. V7 Go is built to handle large document volumes and integrates seamlessly with existing contract management systems and legal tools, streamlining workflows through robust API access.

To set it up:

Sign up. Create a free V7 Go account to explore its features.

Choose a workflow. Select a pre-built workflow or customize one to fit your needs.

Upload documents. Import contracts, reports, or other relevant files.

Extract data. Use AI to identify and extract key information and generate responses.

Review and refine. Examine the results, adjust prompts as needed.

Automate and integrate. Add properties, notifications, and connect external tools or data sources (like Zapier or Google Sheets).

To learn more about the differences between modern AI tools for due diligence and traditional IDP solutions, read this guide: The Evolution of Document Processing: From OCR to GenAI

Real-world impact of automation in due diligence

The promise of AI-powered due diligence isn’t just theoretical—it’s grounded in real results. Centerline Business Services, a consulting firm specializing in finance and business intelligence, used AI to overhaul its diligence workflows and saw transformative outcomes.

Centerline’s projects often involve processing extensive financial statements and diligence documents. Traditionally, this work required highly skilled professionals to spend countless hours manually sifting through data and populating models in Excel. This tedious approach not only consumed valuable time but also risked delaying insights and decisions for clients.

Centerline implemented V7 Go to build an AI-powered diligence workflow. Using advanced data extraction and automated analysis, the platform could quickly and accurately process complex financial statements and contracts. The result? A significant reduction in manual data entry and analysis time.

Within the first month, Centerline reported a 35% increase in productivity. Key impacts included:

Faster document processing allowed the team to focus on higher-value strategic analysis.

Reduced operational costs by automating repetitive tasks.

Enhanced accuracy through V7 Go’s ability to handle documents with detailed charts and tables.

As Trey Heath, CEO of Centerline, summarized:

"We looked and tried many different AI products, including building our own. The key differentiator with V7 is its ability to understand complex documents with detailed charts and tables. We have seen nothing that compares to the accuracy we get with using V7. When you add this to all of the other features of V7, like multiple models and components, this makes the product invaluable to our team."

Centerline’s success story illustrates how AI can unlock efficiency gains in due diligence without sacrificing accuracy or depth. By automating routine tasks and enabling teams to focus on what matters most, AI can turn due diligence workflows into a strategic advantage.

Challenges in AI adoption for legal and financial frameworks

While the benefits of AI-powered due diligence are undeniable, implementing these tools comes with challenges that organizations must navigate carefully. Addressing these considerations ensures a smoother transition and maximizes the return on investment.

1. Productivity, cost, and resource allocation

The upfront investment for AI platforms like V7 Go can seem significant, especially for smaller firms. Costs include token allowance for leading model providers and integration into existing systems. However, these expenses are quickly offset by the long-term gains in efficiency, accuracy, and scalability. Firms should assess their workflows and identify high-impact areas where automation will generate immediate value.

2. Data privacy and compliance

Handling sensitive information—such as financial records, contracts, and personal data—requires robust safeguards. In highly regulated sectors like finance and law, adhering to privacy regulations such as GDPR or CCPA is non-negotiable. AI tools must prioritize encryption, secure access, and compliance tracking to mitigate risks. EY highlights that addressing data security is not just about compliance; it’s critical to maintaining client trust.

3. Training and change management

Adopting AI tools requires more than just technical implementation—it demands cultural change within an organization. Clear communication about how AI enhances, rather than replaces, human expertise is key. Additionally, firms should invest in training programs to teach teams how to use AI effectively, such as refining prompts or managing workflows.

For insights into designing training strategies, refer to our ultimate guide to AI prompt engineering, which explores how to bridge the gap between human expertise and AI capabilities.

Future trends: AI and the evolution of deal-making

AI is no longer a distant promise—it’s reshaping how businesses process data, evaluate opportunities, and manage risk in real time. The future of AI in due diligence is brimming with potential. This evolution is particularly evident in M&A, where the technology is already transforming how firms handle vast datasets and identify red flags.

As Nicholas Fearn highlights in the Financial Times, businesses are increasingly leveraging AI to streamline time-consuming tasks such as evaluating financial data and even analyzing investment opportunities.

The key trends that we can already start observing are:

Looking ahead, the democratization of AI technology through more accessible platforms and decreasing costs suggests that what is currently a competitive advantage for large firms will soon become an industry standard. The question is no longer whether to adopt AI in due diligence processes, but how to implement it in a way that enhances rather than disrupts existing workflows.

As AI capabilities continue to evolve, firms that view this technology merely as a cost-cutting tool risk missing its true potential as a catalyst for better decision-making. The real value lies not in doing the same things faster, but in asking better questions and uncovering insights that might otherwise remain hidden.

Ready to enhance your due diligence process with AI? Start by identifying one high-impact area where AI could immediately add value to your workflow, and begin your journey with a focused V7 Go project rather than attempting a complete overhaul overnight.

References

FAQ

How can organizations measure the ROI of implementing AI due diligence tools, and what metrics should they track to evaluate success?

The best way to measure ROI is to look at both immediate and long-term impacts on your due diligence process. Start by tracking how much time your team saves on document review and data extraction. Look at how many more deals you can evaluate simultaneously compared to before. Pay attention to the quality of insights - are you catching important details that you might have missed before? Also consider team morale and satisfaction; when people spend less time on repetitive tasks, they can focus on more meaningful analysis. The key is to track these metrics consistently over time to see the real impact.

+

How does AI-powered due diligence compare to traditional methods in terms of accuracy, speed, and cost savings?

Think of AI-powered due diligence as having a tireless assistant who can read through thousands of pages instantly and never misses a detail. While traditional methods rely on teams spending weeks or months reviewing documents manually, AI tools can process the same information in hours or days. They're particularly good at spotting patterns and inconsistencies that humans might miss when dealing with large volumes of data. The real advantage isn't just speed - it's the combination of faster processing with more thorough analysis. As for costs, while there's an initial investment in the technology, you'll typically spend much less per deal since your team can work more efficiently.

+

What is the typical learning curve for teams adopting AI due diligence tools?

Most teams find that getting started with AI due diligence tools is surprisingly straightforward. The basics - like uploading documents and running standard analyses - can be learned in a few days. What takes more time is learning how to make the most of the advanced features and integrating them into your existing workflow. The key is to start with simple projects and gradually take on more complex ones as your team builds confidence.

+

What are the essential technical requirements and infrastructure needed to implement AI due diligence software?

The good news is that most modern AI due diligence tools don't require complex technical infrastructure. If your team can run standard business software and has a reliable internet connection, you're probably already set up for the basics. The main considerations are actually around security and data storage rather than hardware requirements. You'll need to ensure you have proper security protocols in place and enough storage space for your documents. Most solutions are cloud-based these days, which means you won't need to install heavy-duty software or buy specialized equipment.

+

What role do human experts play in AI-powered due diligence, and which aspects of the process cannot be fully automated?

+